By Rachel Evans, Carolina Wilson and Julie Verhage

(Bloomberg) --Vanguard Group Inc. is entering the latest game in exchange-traded funds, but with a very Vanguard twist.

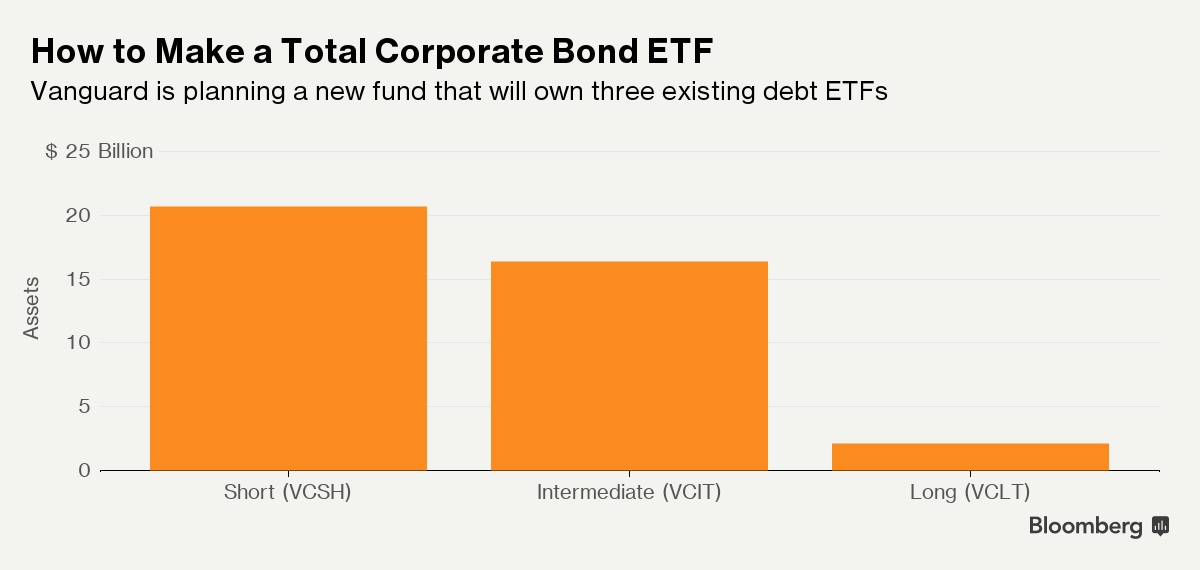

The $4.4 trillion asset manager is seeking approval for a Total Corporate Bond ETF, which would use the “ETF-of-ETFs” structure to buy other debt funds sold by the company, rather than individual bonds, according to regulatory filings. The new ETF, which would be the first from Vanguard to use this construction, would wrap the company’s short-term, intermediate term and longer-dated corporate bond funds into one product, the filings show.

“The use of its very, very liquid bond ETFs will help it tap into the corporate bond market very easily,” said Todd Rosenbluth, director of ETF and mutual funds at CFRA Research. “It’s a novel approach that will work well for not only investors, but also for Vanguard in its ability to launch a low-cost product that will trade with tight spreads and build its asset base relatively quickly.”

By owning its own bond ETFs, Vanguard can keep down both the management fees and trading costs of its new fund because ETFs are easier to buy and sell than the underlying bonds. The firm estimates the fund will have an expense ratio of 0.07 percent and expects to launch it in the fourth quarter, it said in a press release.

“The ETF-of-ETFs approach benefits from $39 billion in scale from the underlying funds,” said Freddy Martino, a spokesman for Malvern, Pennsylvania-based Vanguard. “This would be our first ETF of ETFs in the U.S. but we have many mutual fund funds-of-funds.”

The First Trust Dorsey Wright Focus 5 ETF is currently the largest ETF of ETFs at $2.4 billion, and invests in sector and industry funds deemed likely to outperform. It rebalances periodically.

“Vanguard hasn’t launched a lot of products, so whenever they do it’s a big deal,” said Eric Balchunas, an analyst at Bloomberg Intelligence. “They’re probably hearing from clients and advisers that they want something that is the easy button.”

To contact the reporters on this story: Rachel Evans in New York at [email protected] ;Carolina Wilson in New York City at [email protected] ;Julie Verhage in New York at [email protected] To contact the editors responsible for this story: Nikolaj Gammeltoft at [email protected] Eric J. Weiner