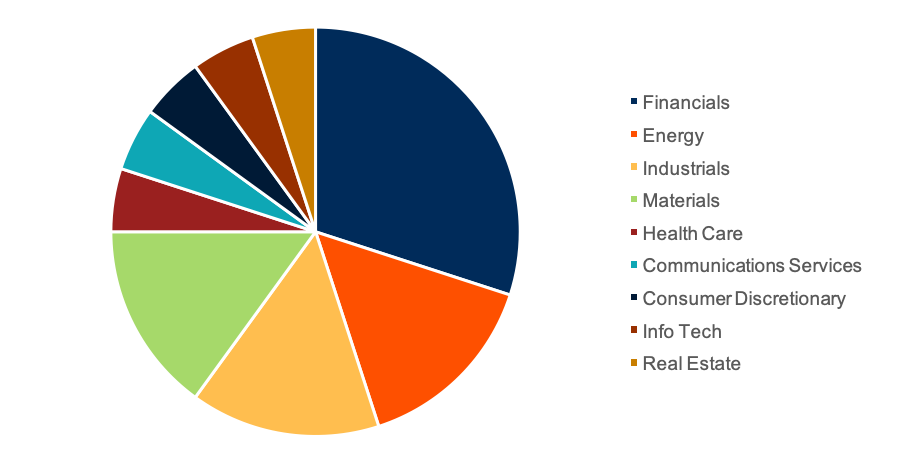

U.S. sector/industry-focused equity ETFs pulled in $35 billion this year. While the U.S. broad market equity ETFs such as Vanguard S&P 500 ETF (VOO) and Vanguard Total Stock Market ETF (VTI) continue to gather significant assets in 2021, investors have also increasingly used ETFs to tactically target certain sectors or industries. Indeed, while all but two GICS sectors were represented in the 20 ETFs with the largest net inflows year-to-date through May 5 as shown in Figure 1, nine of the 20 most popular sector ETFs were either in the value-oriented Energy or Financials sectors. Meanwhile, Industrials and Materials sectors each had three. Only the defensive Consumer Staples and Utilities sectors were not represented.

Figure 1: Percentage of ETFs among the Top-20 Sector ETFs Per GICS Sector

CFRA’s ETF Database. As of May 5, 2021.

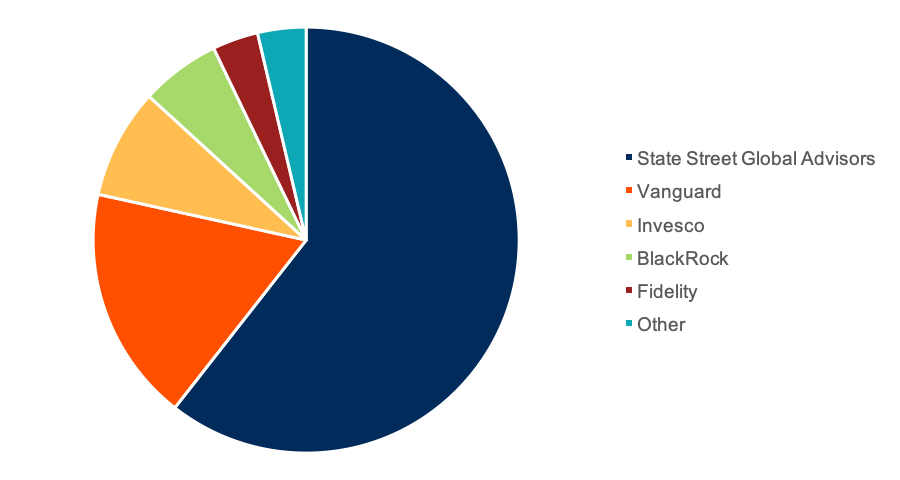

State Street Global Advisors has dominated the sub-category inflows in 2021. The third largest manager for U.S.-listed ETFs pulled in $21 billion of net money into its sector/industry ETFs this year, equal to 61% share of the overall net inflows. The four most popular ETFs and six of the top-10 were run by State Street. Meanwhile, Vanguard gathered the second most new money into these sector products thus far, equal to an 18% share, followed by Invesco (8.4%), BlackRock (6.1%), and Fidelity (3.5%). A handful of other providers shared the remainder of the net inflows.

Figure 2: Market Share for U.S. Sector/Industry ETFs 2021 Net Inflows (%)

CFRA’s ETF Database. As of May 5, 2021.

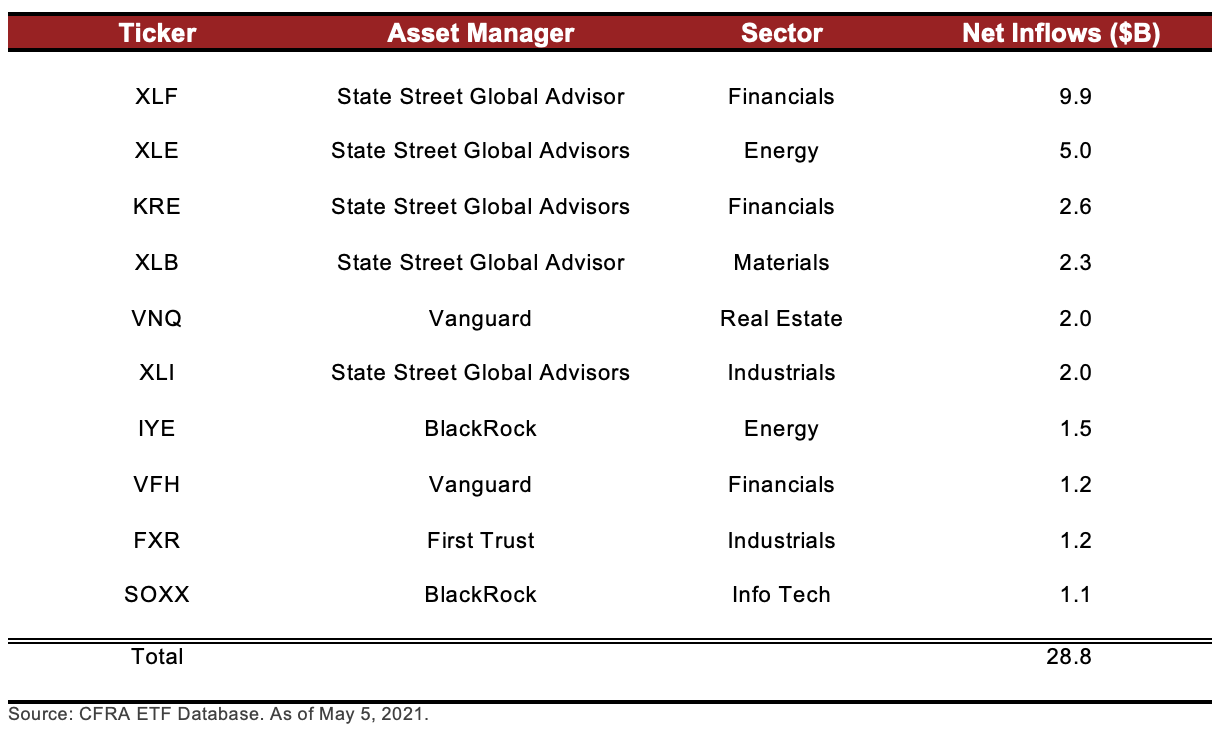

There were six Financials ETFs in the top-20 asset gatherers in 2021. With approximately $10 billion of net inflows, Financial Select Sector SPDR Fund (XLF) has been the overall sector fund leader in 2021. The State Street Global Advisors’ offering provides exposure to the market-cap weighted S&P 500 Financials sector and is diversified across banks (39% of assets), capital markets (25%), insurance (17%), and diversified financial services (13%). However, investors also favored the equally weighted SPDR S&P Regional Banking ETF (KRE), which only holds banks like Citizens Financial. Companies inside XLF and KRE stand to benefit from higher interest rates and a stronger U.S. economy in 2021. Vanguard Financials ETF (VFH) and iShares US Financials ETF (IYF), which are more like XLF at the industry level, pulled in $1.2 billion and approximately $600 million, respectively.

Energy remains a small slice of the broader market, but investors have chosen to augment with Energy Select Sector SPDR Fund (XLE) and peers. XLE tracks the S&P 500 Energy-based ETF and is heavily weighted toward Chevron and Exxon Mobil. The ETF pulled in $5 billion of new money, second most behind XLF. This ETF and iShares U.S. Energy ETF (IYE), which gathered $1.5 billion to start the year, are benefitting from higher oil prices and global economic growth. Meanwhile, more narrowly focused SPDR S&P Oil & Gas Exploration & Production ETF (XOP) added an additional $800 million this year. CFRA finds the three funds to be relatively unappealing on a risk/reward basis and less likely than the previously mentioned Financials ETFs to outperform the broader sector ETF category over the next nine months.

CFRA favors some of the more popular Materials sector ETFs. Materials Select Sector SPDR ETF (XLB), which tracks the S&P 500 Materials sector, gathered $2.3 billion year-to-date through May 5. CFRA finds the risk/reward profile of XLB attractive aided by our Buy or Strong Buy recommendations on seven of its top-10 recent positions. The ETF is dominated by chemicals (68% of assets) companies, with just 14% in metals & mining. Containers and packaging (13%) and construction materials (5%) comprise the remainder of the assets.

SPDR S&P Metals & Mining ETF (XME), which gathered approximately $920 million of new money this year, is a strong alternative for those investors wanting a more targeted industry approach. Steel (49% of assets), aluminum (16%), and gold (13%) are the largest sub-industries in this equally weighted five-star rated ETF.

Figure 3: Top-10 Largest Inflows for U.S. Sector/Industry ETFs in 2021

Conclusion

Investors have embraced the security-level diversification and ease of use sector and industry ETFs provide relative to owning stocks directly. While a few sectors, namely Energy, Financials, and Materials, have been particularly popular thus far in 2021, ETF investors are likely to rotate to others as sentiment shifts. The top ETF providers offer a wide range of choices, some that CFRA finds to be appealing going forward.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.