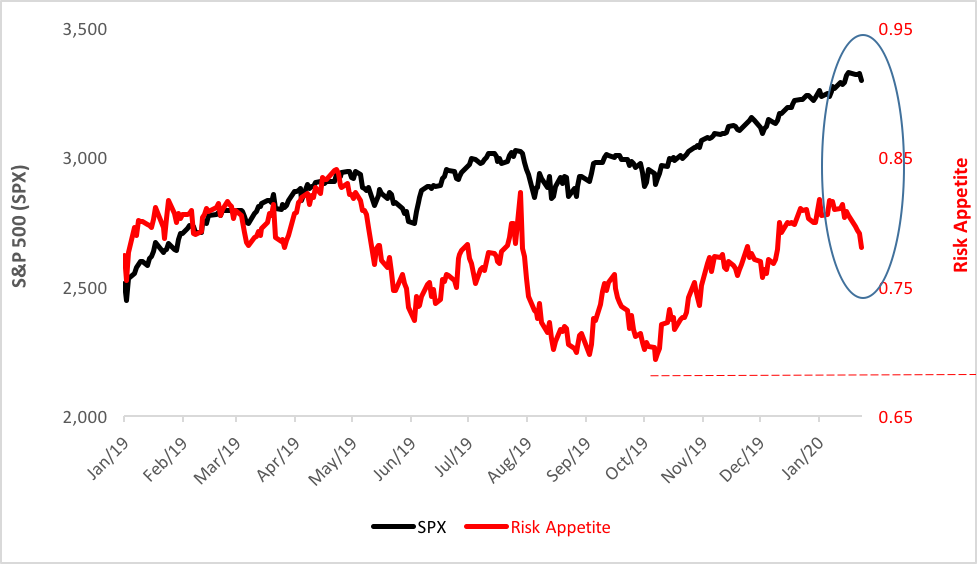

Last week was a very interesting one. For one thing, new highs were attained in the S&P 500. For another, it was a risk-off week.

What? Aren’t those two situations mutually exclusive? Well, yes and no. For the most part, investors’ thirst for high beta coincides with a rising equity market. But most recently, investors’ appetite for risk fell precipitously as the market climbed.

Risk Appetite’s Recent Slump

You can see this depicted in the chart above. Look to the area scribed by the blue oval. Risk appetite, as measured by the SPHB/SPLV price ratio, is slumping. The Invesco S&P 500 High Beta ETF (NYSE Arca: SPHB) tracks a 100-stock index of the S&P’s most volatile components while the Invesco S&P 500 Low Volatility ETF (NYSE Arca: SPLV) takes the opposite tack. The ratio falls when the price of the low-vol ETF rises faster (or falls slower) than that of the high-beta product. Moreover, net fund flows have recently favored SPLV, indicating greater investor interest in SPLV, regardless of price.

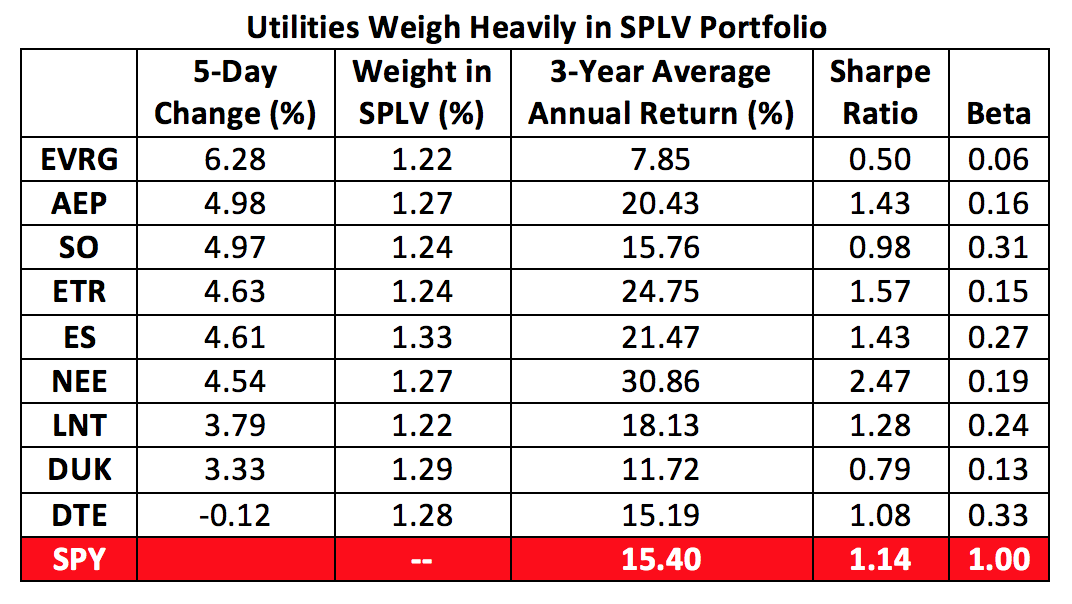

Peek into SPLV’s portfolio and you’ll see what’s compelling investors. Utilities. Of the fund’s 10 largest constituents, nine are utilities and eight of those made substantial price gains—averaging more than 4%—last week.

Last week wasn’t an anomaly, though. In the aggregate, these utilities have been outperforming the market for the past three years. Equally weighted, these stocks’ average annual return has been 1.5 percentage points higher than the S&P 500’s, earning the collective a 14.68 alpha coefficient.

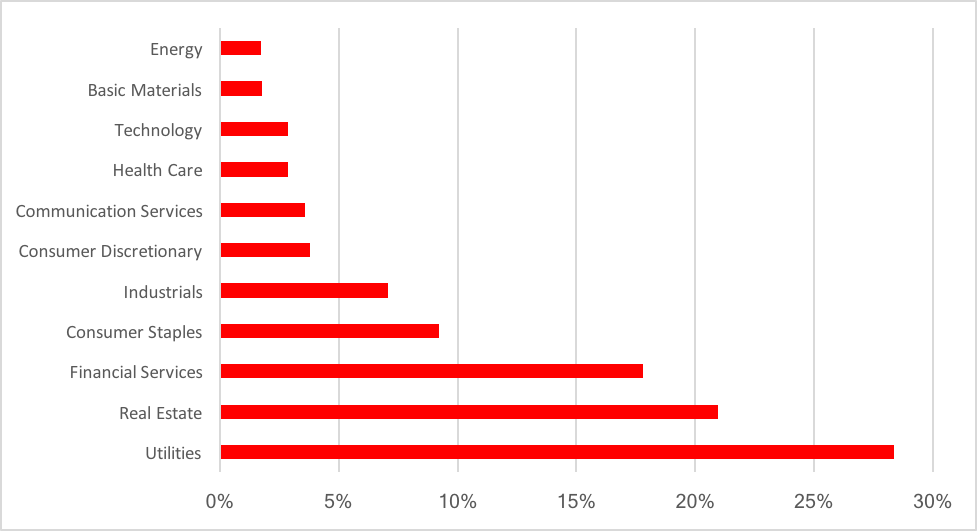

Utilities aren’t the only stocks held in the SPLV portfolio, but they represent the weightiest element in the SPLV portfolio, followed by real estate and financial services issues.

SPLV Sector Exposures

If we apply some technical analysis to the SPHB/SPLV ratio, there seems enough gravity to draw the indicator to a test of the low reached in October 2019. Translated, that means the low-vol side has the potential to outperform the S&P’s high-beta stocks by better than 13% on a cumulative basis.

With that in mind, low-beta plays like utilities might just be what’s needed to energize and insulate investors’ portfolios.

Brad Zigler is WealthManagement's alternative investments editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.