Last week, investors were reminded that ETFs are traded on an exchange at a market price, often intra-day, unlike mutual funds that are purchased or sold at the end of the day at net asset value (NAV).

As such, the price of an ETF is often a slight premium or discount to the fund's NAV. In times of unexpectedly high volume and uncertainty, however, the differential can widen—creating an important cost factor. This certainly occurred on Thursday, March 12, for fixed income ETFs when they collectively traded $51 billion, more than four times their average daily volume, according to iShares.

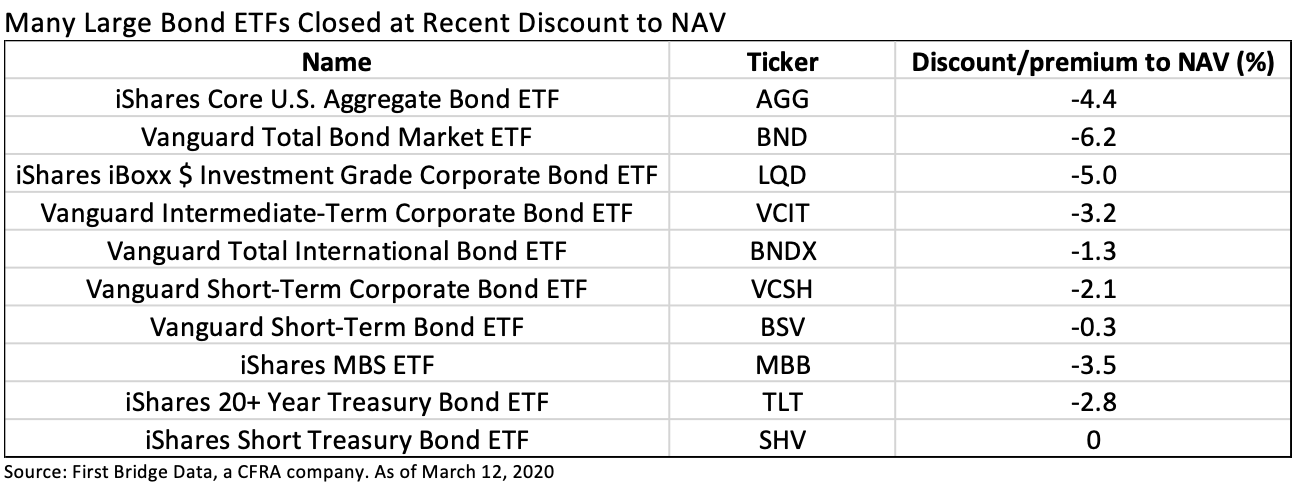

Many popular fixed income ETFs that typically trade close to their NAV ended Thursday at much wider-than-normal discounts. Before we get to some examples, a quick comment on why this occurs.

Authorized participants (APs) support the ETF ecosystem by periodically taking the other side of the trade when investors want to sell (or buy) and enabling redemptions (and creations). Large price differentials like Thursday tend to be fleeting and in the below examples the gap shrunk sharply on Friday. To keep the ETF price near the NAV, the APs collectively must believe the NAV is accurate based on the underlying holdings or only offer to trade for less. During times of market stress, the NAV can be stale since not all bonds inside the fixed income ETF trade every day. The ETF’s price can be a leading indicator of NAV.

While the expense ratio gets much more attention in the total cost of ownership discussion, CFRA focuses on the price-to-NAV differential to support our rating of approximately 400 fixed income ETFs. We combine this key cost metric with holdings-level analysis tied to the yield and duration of the portfolio as well as performance and sentiment metrics. CFRA rates all fixed income ETFs relative to one another rather than seek out the historically best-performing fund in a narrow peer group.

On Thursday, the $30 billion iShares iBoxx $ Investment Grade Corporate Bond (LQD) closed at a 5.0% discount to its NAV, meaning that people who sold got 95 cents of what the stated value of the portfolio closed at. How rare was the sizable discount on Thursday? According to iShares website, in 2018 and 2019, LQD never closed at more than a 1% discount or premium to its NAV. In the fourth quarter of 2019, the ETF closed at a modest premium on 58 days and a modest discount on five days, with the highest differential just 0.39%. Not surprisingly, on Friday, March 13, 2020, the discount to NAV shrunk to just 0.19% as bond prices better aligned with investor demand than the prior day.

The SEC’s ETF rule was implemented at the end of 2019 to provide consistent regulations across all traditional ETFs. One of the many benefits to investors was that the rule required all asset managers to publish historical price/NAV differences on their websites to transparently support investor education about costs. Investors in LQD should take comfort that Thursday was an anomaly.

The unusual Thursday discount on a corporate bond ETF was not unique to iShares, as State Street Global Advisors and Vanguard investment-grade corporate bond peer ETFs also closed well off their NAVs, before largely recovering the next day.

The $28 billion Vanguard Intermediate Term Corporate Bond ETF (VCIT) ended Thursday at a 3.2% discount to its NAV (approximately 97 cents for every dollar of bond value). According to Vanguard’s website, VCIT traded at both its largest 2019 discount (-1.21%) and largest premium (0.56%) nine days apart in mid-June. However, 62% of the time, the ETF traded between a 0.25% discount and premium. On Friday, March 13, VCIT’s discount narrowed to a more reasonable 0.48% difference relative to its NAV.

LQD’s CFRA five-star rating is driven more by its reward and risk attributes, with costs offering a slightly negative input. CFRA has a four-star rating on VCIT with positive risk and reward metrics, but the costs are a negative input to CFRA’s rating. Relative to LQD, VCIT incurs less average duration (six years versus nine years), which impacts its relative rating.

Meanwhile, $5 billion SPDR Portfolio Intermediate Term Corporate Bond ETF (SPIB) closed at a 3.1% discount to its NAV on Thursday. During 2019, SPIB never closed at a premium higher than 0.5% or a discount lower than 0.5%, according to State Street Global Advisors’ website. On Friday, the discount narrowed to 1.5% relative to NAV.

CFRA has a three-star rating on SPIB. Despite a less expensive cost factor, the ETF has only slightly positive risk and reward rating inputs. SPIB has an average duration of four years.

In contrast, iShares Edge High Yield Defensive Bond ETF (HYDB) closed at a 1.3% discount to its NAV on Thursday and a 2.1% premium to its NAV on Friday. In the fourth quarter of 2019, the small $36 million ETF consistently traded at a premium or discount between 0.51% and 1.0% of its NAV more than half of the days. Given the ETF’s history and typically limited trading volume, investors should expect this five-star ETF to trade further off its NAV and weigh this cost relative to other fund-specific and portfolio-specific factors.

Most importantly, while a discounted price can be appealing to those buyers of ETFs and discouraging to those sellers, they are usually temporary. Investors and advisors should remember that they can always chose not to trade if they do not feel they have clarity on whether they are getting a fair price. The above examples of getting 95 or 97 cents worth of the bonds. impacted only those who executed a sell order. Longer-term fixed income ETF investors were not impacted.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here