There’s a word often used in Ireland to describe a social gathering’s level of conviviality: craic. It’s pronounced “crack.” More craic, more fun.

Crack—in the English spelling—is also used in the petroleum industry. The level of fun represented by the crack depends on whether you’re buying it or selling it. And when.

Oil refiners are in the business of cracking crude oil into distillates and residual products. At the top of the distillate pyramid are such ubiquitous commodities as gasoline and fuel oils. The refiner’s model is simple: pay as low a price for input crude as can be obtained and attempt to command as high a price as practicable for distillate sales. A refiner aims for a wide “crack spread.” The wider the spread between input and output prices, the fatter a refiner’s gross profit margin.

Not surprisingly, crack spreads vary seasonally. In large part, the variance is driven by product demand. In the summer, demand for gasoline outstrips that for heating oil, but the situation tends to flip in the winter. If the crack spread is too thin, product prices will generally rise as refiners curtail production. When the crack spread is wide, refiners tend to step up production, which ultimately lowers distillate prices.

Cyclically, crack spreads are usually fattest between October and the following February. Over the past 14 cycles, in fact, the average increase in the 3-2-1 crack spread (three barrels of crude converted to two barrels of gasoline and one barrel of fuel oil) was $6.62 per barrel, representing a mean 10.7% hike in refining margins.

So, now should be a good time for refiners. It certainly is for Valero Energy Corp. (VLO). The San Antonio-based independent forecast favorable market conditions for the current quarter when it announced better-than-expected profits on Thursday. The company’s stock has been on a tear this year, up better than 13%, due in part to its ready access to cheap domestic crude. With lower anticipated product inventories, VLO’s management is looking for continuing improvement in its crack spreads.

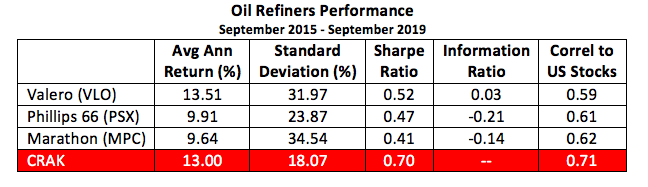

As dramatic as Valero’s price trajectory is, its stock is also quite volatile. That’s to be expected, really. Other domestic refiners’ stocks are volatile, too. The table below details the four-year track records of the largest U.S. oil refiners that are components of the VanEck Vectors Oil Refiners ETF (CRAK). CRAK tracks an index of 25 global stocks issued by firms deriving at least half of their revenue from refining operations.

If you’re tempted to play the seasonal crack spread through Valero, you might want to consider using the VanEck ETF instead. Why? Well, if history’s any guide, you might be able to snag a VLO-like return for only half its volatility.

More CRAK, more fun.

Brad Zigler is WealthManagement's alternative investments editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.