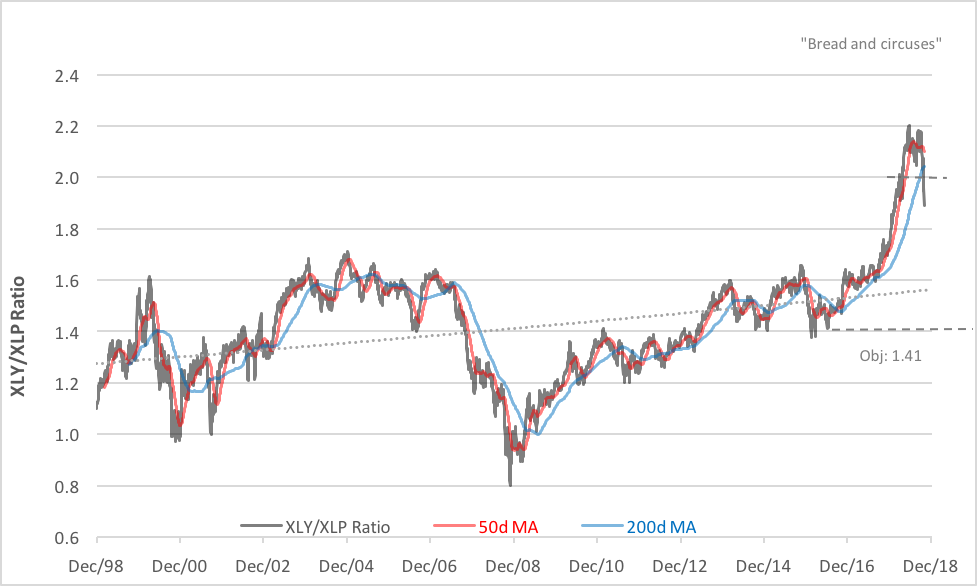

By now, readers of this column have seen this chart more than a few times during the development of the recent top in the XLY/XLP ratio:

For those unfamiliar with the ratio, it’s the quotient of two exchange traded fund prices. The numerator’s the Consumer Discretionary Select Sector SPDR (NYSE Arca: XLY) and the denominator’s the Consumer Staples Select Sector SPDR (NYSE Arca: XLP). The ratio’s a barometer of investor confidence, rising when economic prospects are bright and falling as fears take hold.

After Wednesday’s equity nosedive, we’ve set a downside objective of 1.41 for the ratio—a level last visited in July 2016. So, what does this mean for everyday investors? Nobody’s listed an inverse XLY/XLP fund yet so a direct investment isn’t an option.

One could simply buy the XLP fund instead. Technically, it’s set to ultimately test the $59 level. That’s nearly 24 percent higher than Wednesday’s close. Alternatively, an investor could look inside the XLP portfolio to see if there are individual stocks offering better potential returns.

XLP holds 34 stocks but concentrates half of its market capitalization in its top five positions. Among these, only one—Proctor & Gamble Company—has the technical set-up necessary to outperform the XLP portfolio as a whole.

Is it worth taking on single-stock risk in the hope of an incremental 6 percent gain? That’s a question investors must ponder for themselves.

Here’s a little background that may help. If we look back over the past 15 years, XLP’s expected returns have been 9.8 percent versus 8.3 percent for PG. Volatility-wise, XLP has outdone PG as well. The fund’s standard deviation has been 10.6 percent, while PG’s been clocked at 14.5 percent. Statistically, the XLP portfolio has a better than 80 percent probability of outperforming the broader market in a downturn.

That’s a pretty compelling case for making room for XLP in an equity portfolio now.

Brad Zigler is WealthManagement’s Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange’s (now NYSE Arca) option market and the iShares complex of exchange traded funds.