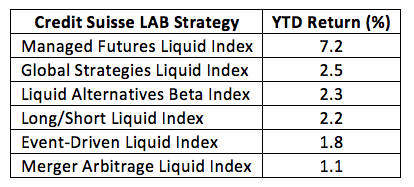

According to Credit Suisse, 2018’s best alternative investment (read: hedge fund) strategy is managed futures. Futures didn’t just edge out other strategies in the Swiss bank’s Liquid Alternative Beta series, futures crushed ‘em. Just take a look at the year-to-date performance table:

What accounts for futures’ outsized gains? Well, active management for one thing. That’s the “managed” in managed futures. Remember, futures can be sold short as easily as they can be bought, so futures portfolio runners have a shot at scooping up profits from bull and bear moves. Underlying the managers’ commodity selection and timing, of course, are the trends in a diverse mix of futures contracts.

In January, a trader’s best bets on the long side would have been crude oil, grains, cocoa and industrial metals such as nickel and lead. Winning trades on the short side would have been found in copper and sugar.

Did you notice that there were more winning opportunities on the long side than on the short side? That’s telling. There’s been a quickening uptick in inflationary expectations over the past six months, evidenced by an 85 basis point (0.85 percent) rise in the bellwether 10-year break even inflation rate.

Futures start to ping on investor radars during inflationary periods.

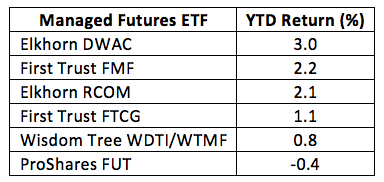

If you want to access the commodities markets through managed futures hedge funds, though, you better be well-heeled. It takes a big buy-in and a hefty net worth to play that game. Hedge funds, too, are opaque and illiquid. For the hoi polloi, there are a growing number of managed futures exchange traded funds offering instant liquidity and transparency. We dived into a half-dozen of them last year as the commodity bounce back started to take hold. Here’s how they’re faring in 2018:

Managed futures ETF returns seem pale compared to the LAB futures index, don’t they? The reason? Well, none of these funds is truly discretionary. They’re all strategic, or “smart” beta products. Futures selection and timing are determined by index methodologies and subject to regular rebalancing schedules. That said, these funds don’t have the nimbleness of portfolios run by opportunistic managers. Sometimes that’s a good thing, sometimes not.

Still, January was, for five of the six ETFs, a profitable month. And, for most, January’s results add to a lengthening winning streak.

It’s early days yet for the managed futures turnaround. While January’s returns may seem smallish compared to the parabolic ascent of equities, it’s important to remember that they’re uncorrelated. Having futures on board provides portfolio risk diversification. And that’s not a bad thing.

Brad Zigler is WealthManagement’s Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange’s (now NYSE Arca) option market and the iShares complex of exchange traded funds.