The Covid-19 related sell-off shrunk the asset base on thematic ETFs, but not equally. Thematic ETFs provide investors the opportunity to own a broad group of publicly traded companies positioned to benefit from a medium- or long-term investment thesis, driven by forces such as disruptive technologies or changing demographics and consumer behavior.

At the end of the first quarter of 2020, there were 125 thematic ETFs, as classified by Global X Management, an ETF provider that tracks this type of fund, up from 121 three months earlier. Franklin Templeton launched three thematic ETFs in February. Yet, due largely to weakness in the underlying equities inside, the asset base shrunk by 9.9% to $25 billion. Most mega-theme—such as robotics and new consumer trends—had much smaller asset bases three months later, hurt by the impact of Covid-19, even as connectivity- and digital content-focused ETFs benefited from renewed investor interest.

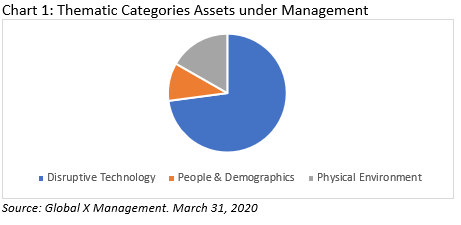

Global X classifies the 125 ETFs into ten different mega-themes that fall further under three categories. Connectivity (5G, Internet of things, etc.), Digital Content (social media, video games, etc.) and Robotics are part of the $18 billion Disruptive Technology category (73% of thematic ETF assets), while New Consumer (Cannabis, Emerging Markets Consumer, Millennials, etc.) and Health (emerging markets health care, genomics, etc.) are part of the $2.6 billion People & Demographics (10%) category. Physical Environment themed ETFs, including Climate Change and Infrastructure Development, form the third $4.2 billion (17%) category.

Investors hit refresh on connectivity themed ETFs to start 2020. Within the disruptive technology category, there were both asset-growing and asset-declining mega-themes. For example, connectivity focused ETFs swelled in size to $4.0 billion at the end of March 2020, up from $3.6 billion at the end of 2019.

Defiance Next Gen Connectivity (FIVG) and First Trust Indxx NextG ETF (NXTG) each had first-quarter net inflows despite declining in value. Both FIVG and NXTG invest in global companies engaged in the research and development or commercialization of systems and materials used in 5G communications. The broad adoption of 5G technology is expected to transform work practices and daily life by providing faster speeds, better functionality, and lower latency.

FIVG launched in March 2019 and gathered more than $100 million of new money in the first three months of 2020, driving its asset base to greater than $220 million. Meanwhile, NXTG rolled out in May 2019 and, due to an $83 million net inflow in the first quarter of 2020, increased its asset base to more than $290 million. While there are more holdings in NXTG, the fund’s top 10 holdings comprised 21% of assets, compared to 40% for FIVG.

FIVG’s top positions include global information technology companies Ericsson (ERIC), Nokia (NOK), NXP Semiconductors (NXPI), and Qualcomm (QCOM), all rated as “buys” by CFRA. Meanwhile, NXTG’s top positions are more focused on specialty REITs, including American Tower (AMT), ranked as a “hold” by CFRA, Crown Castle International (CCI), CyrusOne (CONE), Digital Realty Trust (DLR), and SBA Communications (SBAC). CFRA has a higher rating on FIVG based on our forward-looking assessment of its costs, risk, and reward factors. CFRA rates approximately 1,500 equity ETFs leveraging our proprietary holdings-level analysis.

Robotics funds shrunk in size, even as the investment case strengthened. During the first quarter, assets in robotics ETFs declined to $2.4 billion, from $3.2 billion, with the two leading products particularly under pressure. Global X Robotics & Artificial Intelligence (BOTZ) shrunk to $1.1 billion in assets, from $1.5 billion, hurt in part by $170 million of net outflows, while ROBO Global Robotics and Automation Index ETF (ROBO) narrowed to $922 million, from $1.3 billion, with $111 million of redemptions. Yet, the investment case for robotics and artificial intelligence is enhanced as a result of Covid-19 as companies rethink their supply-chain strategies. Reshoring manufacturing to home countries and diversifying supply chains are now priorities as firms look to maintain greater control and avoid costly interruptions. Robotics and automation technologies can help control expenses.

BOTZ is the more concentrated fund, with nearly 60% of assets in its top-10 holdings, more than triple what ROBO owns of its largest positions. For example, NVIDIA (NVDA), which CFRA rates as a “buy”, was BOTZ’s largest holding, at 11% of assets, while it represented approximately 2% of ROBO’s assets. The stock was joined in BOTZ’s top-10 by CFRA Buy-recommended ABB (ABB) and Hold-recommended Intuitive Surgical (ISRG). Meanwhile, more moderately sized Cognex Corp (CGNX) and iRobot (IRBT) were part of ROBO’s top-10. CFRA has a higher overall rating on BOTZ as the fund earns stronger reward potential and risk mitigation scores. BOTZ also has a lower expense ratio.

While the array of thematic ETFs further expanded in early 2020, assets shrunk due to the emergence of a bear market. Investors in these funds should have long time horizons but understand the Covid-19 potential impact. CFRA sees connectivity and artificial intelligence & robotics as just two of the themes likely to gain traction during 2020. Yet, for those interested in the more popular funds tied to these themes, it is important to look inside at the securities. While they may play on the same themes, there are notable differences between them all.