As Thanksgiving Day approached, we took the measure of the markets in hopes of finding something for which we could give thanks. Lemme tell ya, folks: Pickin’s are pretty slim. No matter how you slice the equity market—domestic or international, growth or value, utilities or industrials—it seems that all sectors are in the red for the year. The fixed income market isn’t much better, though there is a segment that clearly stands out for generating positive returns while others faltered. That’s the senior loan market.

Senior loans, otherwise known as bank loans or leveraged loans, are syndicated credit facilities with variable coupons. Senior loans are typically medium-term, most often with original maturities of seven years. Commonly, interest rates are pegged to three-month Libor and reset every 90 days, bestowing them with minimal interest rate risk.

These credits earn their “senior” designation because of their position in a company’s debt structure. Because they’re typically collateralized by a specific corporate asset, bank loans are prioritized above a company’s unsecured bonds and preferred stock. While this mitigates some default risk, senior notes are generally rated as “junk.”

Investors are now giving thanks for the floating rate feature of these notes. As Libor has ticked up this year, so too have senior loan coupons. The Libor reference rate started the year at 1.44 percent. At last look, Libor had climbed to 2.65 percent. Now that may not sound like much of an uptick, but you have to realize that senior loan covenants specify a “spread” over Libor for coupon payments. For example, a loan syndicated with a spread of 250 basis points over Libor and due for reset today would now pay 515 basis points or 5.15 percent.

Better still, there’s often a “floor” built into bank loan agreements, stipulating a minimum reference rate. If our note had a 100-point floor and Libor had fallen to, say 90 basis points today, the spread would be applied to the 100-point floor rather than the prevailing Libor rate, making the new coupon 350 basis points. Pass the cranberry sauce, please.

There are a handful of exchange traded portfolios made up of senior loans:

With assets exceeding $6.6 billion, one of every two dollars invested senior loan exchange traded funds is on the books of the Invesco Senior Loan Portfolio (NYSE Arca: BKLN). BKLN tracks the market cap-weighted S&P/LSTA U.S. Leverage Loan Index. At last count, the BKLN portfolio held 118 loans with an average coupon of 5.25 percent and a weighted mean maturity of 5.3 years. BKLN’s annual holding cost is 65 basis points.

Actively managed SPDR Blackstone/GSO Senior Loan ETF (NYSE Arca: SRLN) goes global by investing in leveraged loans made to both U.S. and non-U.S. corporations. SRLN’s portfolio currently holds 321 issues with an average maturity of 5.7 years. The fund’s average weighted coupon is 5.95 percent. SRLN carries an annual expense ratio of 70 basis points.

Another actively managed portfolio, the First Trust Senior Loan Fund (Nasdaq: FTSL), also seeks out targets globally, but isn’t necessarily limited to investing in bank credits. Fixed-rate, high-yield bonds and equities can also be added to its 325-issue portfolio. FTSL’s average weighted coupon is 5.23 percent with a maturity of 5.2 years. Shareholders pay 88 basis points a year to own this fund.

The Markit iBoxx Liquid Leveraged Loan Index is tracked by the Highland/iBoxx Senior Loan ETF (Nasdaq: SNLN), a portfolio holding about 100 credits with an average maturity of 3.8 years. Coupons currently average 5 percent. The fund carries a 55 basis point expense ratio.

The smallest fund in the sector—with just $29 million in assets—is the actively managed AdvisorShares Pacific Asset Enhanced Floating Rate ETF (NYSE Arca: FLRT). The fund’s managers make use of an index swap to ratchet bank loan market exposure up or down in response to prevailing conditions. When last surveyed, the FLRT portfolio contained 92 issues with a weighted average coupon of 5.45 percent and cost investors 114 basis points annually to hold.

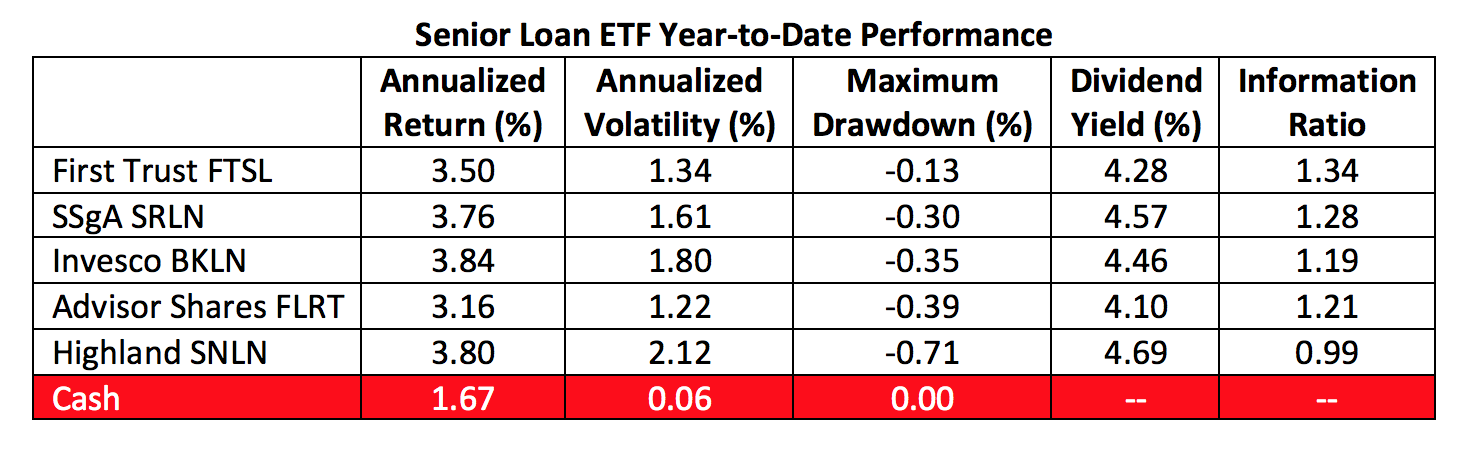

Looking back over 2018, the five funds produced both capital appreciation and dividend yields with little apparent downside risk as evidenced in the table below:

How will these loan ETFs fare in the future? Should investors go for the highest dividend yield? The lowest volatility?

Well, if the past is prologue, the sweet spot’s to be found in the information ratio. The higher the ratio, the more consistent the fund’s performance. This year, the First Trust FTSL portfolio takes top honors but looking further back in time—over one-, two- and three-year spans—the SSgA SRLN fund earned the highest information ratios.

These ratios, mind you, were chalked up during an economic recovery. Going forward, bank loan ETF performance will largely depend on the likelihood of a recession and the trajectory of interest rates. If the economy nosedives, default risk will spike. A slate of quick interest rate hikes, too, could make it harder for issuers to service their debt, adding yet more default risk.

Presently, the probability of a recession, though rising, is still low. And so far, interest rate rises haven’t been jet-propelled. This, of course, can change. But for now, we can all dig into our Thanksgiving repasts with a sense of gratitude for small favors bestowed. And for pumpkin pie.

Brad Zigler is WealthManagement’s Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange’s (now NYSE Arca) option market and the iShares complex of exchange traded funds.