Thematic ETF assets swelled in size by 42% to $59 billion in the three months ended September 2020. Asset manager Global X characterizes thematic ETFs as following long-term, growth-focused strategies; unconstrained by arbitrary geographic and sector definitions; and having "relatable concepts." Global X grouped the 135 available thematic ETFs into three categories, 10 mega-themes, and approximately three dozen themes. These themes include cloud computing—part of the disruptive technology category, clean energy—part of the physical environment category, and cannabis—part of the people & demographics category. CFRA thinks thematic ETFs provide targeted exposure and the benefits of diversification as not all companies connected to powerful, disruptive macro-level trends will succeed as winning investments.

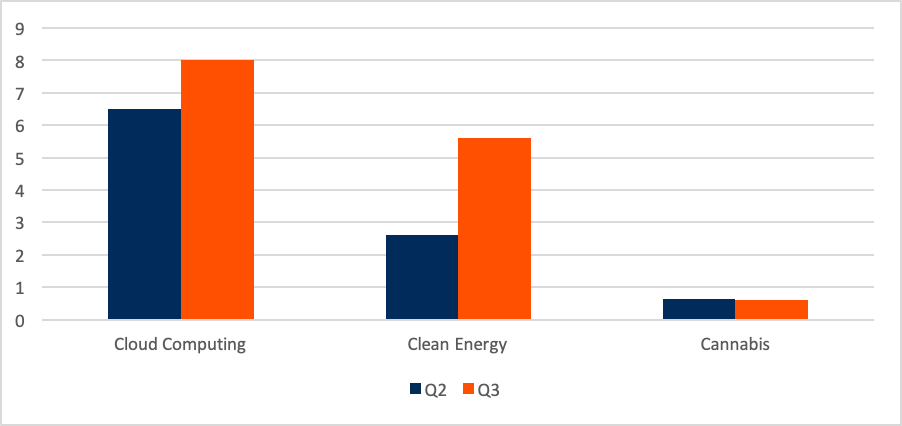

Cloud computing is the most popular theme for ETF investors. Driven by $1.2 billion of net inflows and strong performance during the third quarter, cloud computing ETFs held $8 billion in assets at the end of September, the most of any of the themes identified by Global X. First Trust Cloud Computing ETF (SKYY) was the largest of these funds with $5 billion in assets aided by $292 million of net inflows, but more moderately sized and younger peers gathered even more assets in recent months. The $1.2 billion Global X Cloud Computing ETF (CLOU) and the $795 million WisdomTree Cloud Computing Fund (WCLD) pulled in $336 million and $313 million in the third quarter, respectively, despite launching only in 2019.

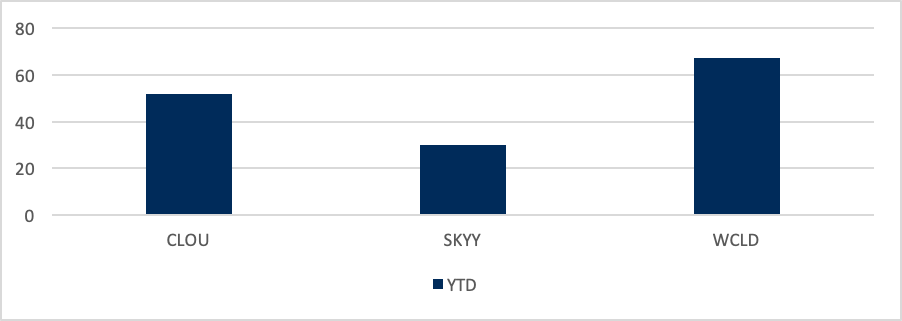

Chart 1: 2020 Total Returns for Leading Cloud Computing ETFs (%)

CFRA’s First Bridge ETF database. As of September 30, 2020.

There’s a wide range of performance for cloud ETFs. Although SKYY, CLOU, and WCLD sound the same, there has been wide disparity between their performance records in 2020. WCLD was up 67% year-to-date through September, ahead of the 52% gain for CLOU and more than double the 30% return for SKYY.

While the trio outperformed the largest Information Technology ETFs, Vanguard Information Technology ETF (VGT) and Technology Select Sector SPDR (XLK), the differential highlights they are not constructed the same. Based on our risk, reward, and cost analysis, they are also not rated the same. CFRA’s quantitative and forward-looking star rating likes CLOU best of the three due to its low risks and cost attributes.

Clean Energy ETF assets more than doubled in the third quarter to $5.6 billion. Investors have also recently embraced funds that provide both narrow and more diversified investment approaches for alternative energy. Invesco Solar ETF (TAN) swelled to $1.6 billion in assets as of September, from approximately $630 million three months earlier, by offering exposure to solar energy through a combination of primarily Information Technology (57% of assets), Utilities (27%), and Industrials (12%) stocks. TAN gathered $370 million in assets, second only in the theme to the $406 million gathered by $1.5 billion iShares Global Clean Energy ETF (ICLN). ICLN owns companies exposed to solar, wind, hydroelectric, and other renewable energies. Both have less than half of ETF assets in the U.S., providing exposure to Canada, China, Germany, and other markets.

Chart 2: Asset Growth of Select Investment Themes ($B)

Global X Thematic ETF Report- Q3 2020.

Cannabis was the rare ETF theme to experience a decline in third-quarter assets. Despite being one of the more crowded thematic groups with seven products, cannabis ETFs collectively held approximately $615 million in assets. This was down from approximately $650 million at the end of the second quarter, even as AdvisorShares Pure US Cannabis ETF (MSOS) was one of six new thematic ETFs industrywide to launch in the quarter. The cannabis theme remains dominated by ETFMG Alternative Harvest ETF (MJ), which ended the quarter with just under $500 million in assets. While MJ had just over $50 million of net inflows, the asset base was 11% lower than three months earlier. Year-to-date through September, MJ declined 36%, significantly lagging the broader global equity markets.

As governments around the world look to re-ignite economic growth in wake of the Covid-19 pandemic, concerns remain around how to return to offices, schools, and stores safely and responsibly. In the new normal, certain industries will play a key role to overcome these challenges and we think thematic ETFs can provide targeted exposure. Register to join us for a webinar on thematic ETF investing on Oct 14.

Conclusion

Some investors think of thematic ETFs in general, and funds within a theme, as driven by the same long-term return seeking objectives. While as a group, they are collectively experiencing sharp demand and growing supply, there are notable distinctions between these funds that warrant scrutiny. Our research provides a forward-looking, holdings based approach to sorting through the choices.