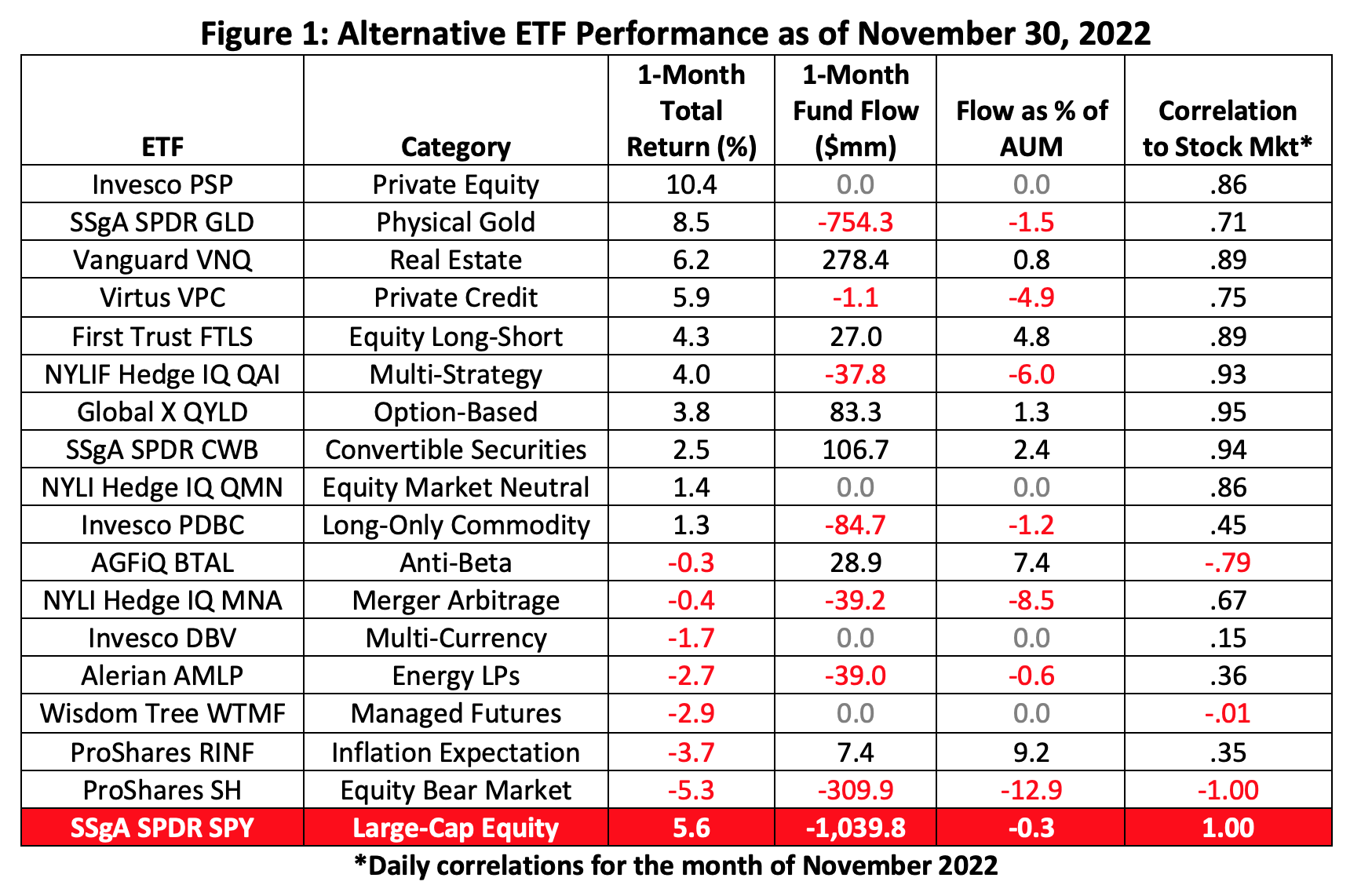

In November, many alternative investors gave thanks to, of all things, positive correlation to the stock market. By the time the last turkey croquette was consumed, our spectrum of alt ETFs had earned a median total return of 1.4% with a middling .71 correlation coefficient.

Four alt portfolios outdid the 5.6% gain netted by the SPDR S&P 500 Trust (SPY) in November. While this handful of funds posted some impressive one-month returns, they’ve not been notable alpha—that is, positive alpha—producers. Over the past year, they’ve notched an average -5.35 coefficient against the broad stock market. And with a mean beta of 0.81, November’s top four don’t offer much insulation from equity market volatility either.

So what’s an investor to do when looking for a low-correlation portfolio diversifier with the magic combination of high alpha and low beta?

We scanned the universe of actively managed ETFs, screening for those parameters over the past one-month and one-year periods and found two hedged equity portfolios that ticked the boxes.

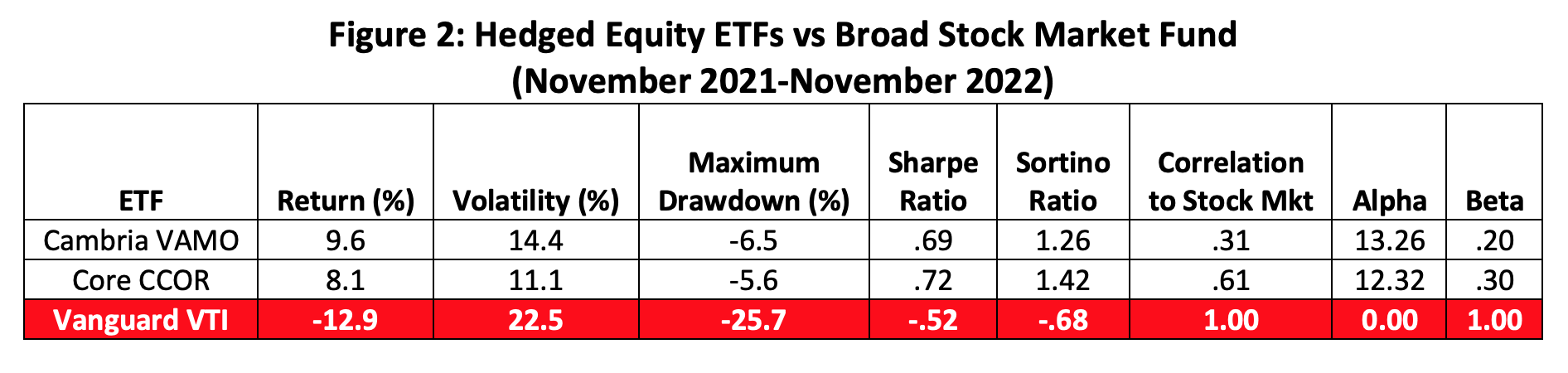

The $139 million Cambria Value and Momentum ETF (VAMO) is a portfolio of large-, mid- and small-cap U.S. stocks selected for their long-term value and mid-term momentum factors. The fund is often lumped in the "long/short equity" category, but it’s most definitely a hedged equity operation.

Each quarter, VAMO’S managers rank its stock universe through a fundamental valuation model, looking back five to 10 years at earnings, dividends, cash flow and other factors. The field is also ranked by absolute and relative momentum measures to screen out stocks likely to be value traps. The value and momentum score for each stock are then averaged. VAMO invests in the 100 highest-ranked issues.

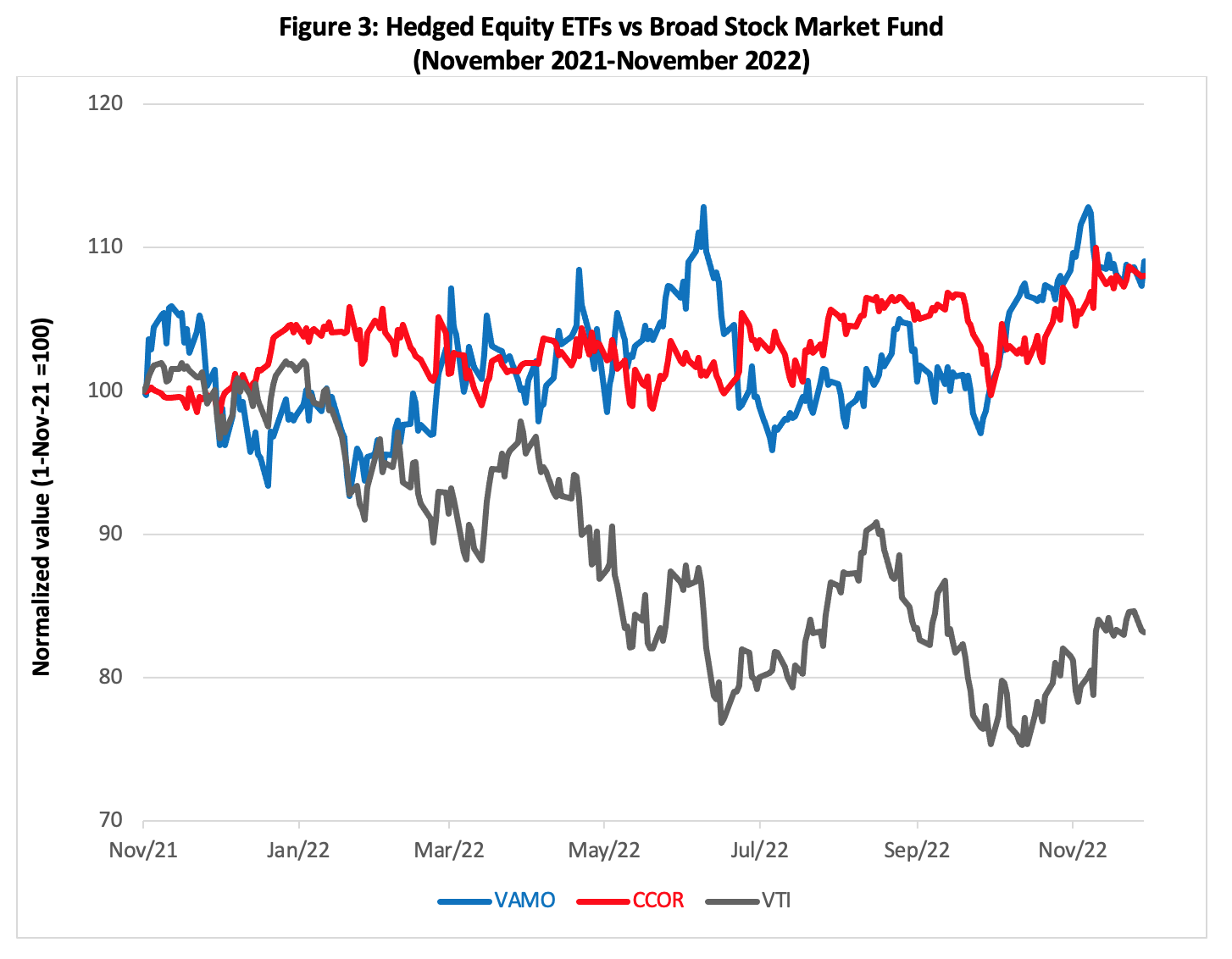

Thereafter, the VAMO portfolio is dynamic because its managers have license to engage in tactical hedging, systematically reducing net long exposure when the markets subsequently trend downward or become overvalued.

Weekly, VAMO’s managers re-evaluate the broad equity market trend. If a downtrend is confirmed, managers will hedge 25% or 50% of the portfolio, depending on the degree of bearishness detected, by shorting S&P 500 Index futures. Then, on a quarterly basis, long-term metrics are checked to gauge the market’s valuation. If the market’s trading above fair value, managers may use S&P 500 futures to hedge a further 25% to 50% of the portfolio.

Thus, the VAMO portfolio could at any time hold 100% long stocks, be hedged 25% or 50%, or assume a market-neutral stance (long stocks fully offset by a short S&P 500 Index position).

VAMO, moderately priced at an annual expense ratio of 64 basis points, has thrived over the past year as attested by its 1.00 information ratio. Think of the information ratio as a higher-order Sharpe ratio. It measures the success of the manager’s active performance. A fund with a ratio between .40 and .60 is considered to be a good investment; one with a ratio between .61 and 1.00 is deemed great.

An entirely different hedging approach is taken by the $567 million Core Alternative ETF (CCOR). Prior to December 2019, the fund was known as the Cambria Core Equity ETF. CCOR is known for using an option overlay known as a "collar" to manage the risk of owning its large-cap stock portfolio.

CCOR’s stock selection methodology focuses on finding high-quality issuers managing earnings growth and dividend increases over time. Options are then used to control portfolio volatility and to maintain cash flows. As a hedge, the fund may sell S&P 500 calls to finance the purchase of S&P 500 puts. This strategy may cause the fund to give up some upside potential in exchange for downside protection. Managers may utilize other option strategies like spreads for hedging and income generation as well.

With an annual expense ratio of 1.07%, CCOR is rather pricey, but when investors and advisors consider its 1.17 information ratio, that cost may be well justified in today’s market.

And therein lies the rub. How does hedged equity fare over a cycle when the market is rising? The histories of CCOR and VAMO aren’t long, but their track records over the past five years are instructive—to a degree. In the face of one of the headiest bull markets on record, information ratios for both portfolios were negative, though CCOR still earned positive alpha.

So, are we likely to have another bull run of such magnitude? That’s not for us to say. Still, the probabilities for a repeat of the economic conditions that gave rise to it seem small in the short run.

Brad Zigler is WealthManagement's alternative investments editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.