The smart beta train has definitively left the station. One of the fastest-growing ETF categories, smart beta is being used to target a variety of outcomes by a growing—and more diverse—group of investors.

The numbers are pretty astonishing: Flows into smart beta strategies reached a record $17.6 million globally in the first half of 2016, according to BlackRock. We expect this trend to continue, with smart beta assets under management potentially increasing to $1 trillion by 2020 and $2 trillion by 2025.

Four ways to implement

From my many discussions with advisors, I know that while many financial professionals are interested in the concept of smart beta, they frequently have questions about whether these strategies are right for their clients, and if so, how they might fit within an overall allocation.

Broadly speaking, we put smart beta usage into two categories, with two “sub-categories” each:

1. Smart beta as a portfolio solution

Within this category, smart beta ETFs can help advisors strategically add diversification as well as enhance risk-adjusted return potential. How you might deploy these products would depend on your investment approach.

- For traditional index investors, smart beta provides a means to target incremental returns without sacrificing the transparency and efficiency of beta. For example, a multi-factor smart beta product could provide the potential to outperform a broad market index, or minimum volatility ETFs could be used to strategically seek to reduce risk, while aiming to realize asset class returns over a full market cycle. But like traditional ETFs, both are still systematic, rules-based and transparently designed index funds.

- Investors who primarily use active strategies may look to smart beta ETFs to increase efficiency by reducing portfolio costs, improving transparency and diversifying sources of potential outperformance. For this type of user, multi-factor stock strategies or fixed-income risk parity strategies, which target specific risk allocations, might serve as a complement the rest of the portfolio.

2. As a portfolio tool

Smart beta ETFs can also be put to work more tactically within an overall portfolio to seek incremental returns or to diversify and potentially reduce unwanted risk. As an investment tool, they’re most often used in the following ways:

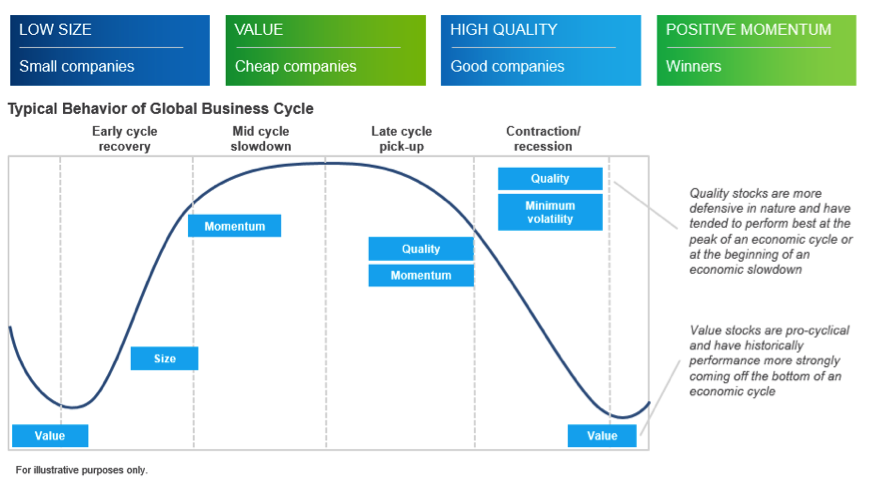

- To express an investment view. Certain style factors have tended to work better, or worse, than others during each stage of the economic cycle. (See chart below.) While judging where we are in a business cycle can be difficult, single-factor strategies can be used to efficiently and inexpensively implement tactical views. Examples include expressing conviction in the early parts of a recovery, which have historically favored small-cap or value stocks, or introducing minimum volatility strategies late in the cycle, when market turbulence might be expected to rise. (Note that factors may not perform as expected or may even detract from returns during certain environments; for example, minimum volatility may not always reduce risk.)

- To execute completion strategies. Single-factor ETFs can also be a convenient means to implement completion strategies—for example, filling a gap in the current manager lineup or offset unintended factor overweights.

Plug-and-play

A well-designed smart beta product should find a natural home within familiar asset allocation models—in other words, built along the traditional asset class lines of large- and small-cap, international, emerging markets and so on. Likewise, while fixed-income smart beta ETFs represent a much smaller part of this category, they may be of interest as a complement to a broad investment-grade fixed income allocation (typically covered by the Barclays Aggregate Bond Index), and potentially help balance interest rate and credit risks.

In others words, smart beta should play an intuitive role in an allocation approach, and simply take traditional approaches one step further. These ETFs aren’t for everyone, of course, and there’s no assurance that performance or risk reduction goals will be achieved. But they do provide yet another, powerful means to help advisors address fundamental and increasingly challenging client goals, from outperforming the markets to reducing risk to generating a sustainable income stream.

Click here to view a prospectus, which includes investment objectives, risks, fees, expenses and other information that you should read and consider carefully before investing. Investing involves risk, including possible loss of principal.

Robert D. Nestor is managing director and head of iShares Strategic Product Segments, including smart beta and next-generation fixed income.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular. The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective. The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”). iS-18757