U.S. industry and sector ETFs are punching above their weight in 2020.

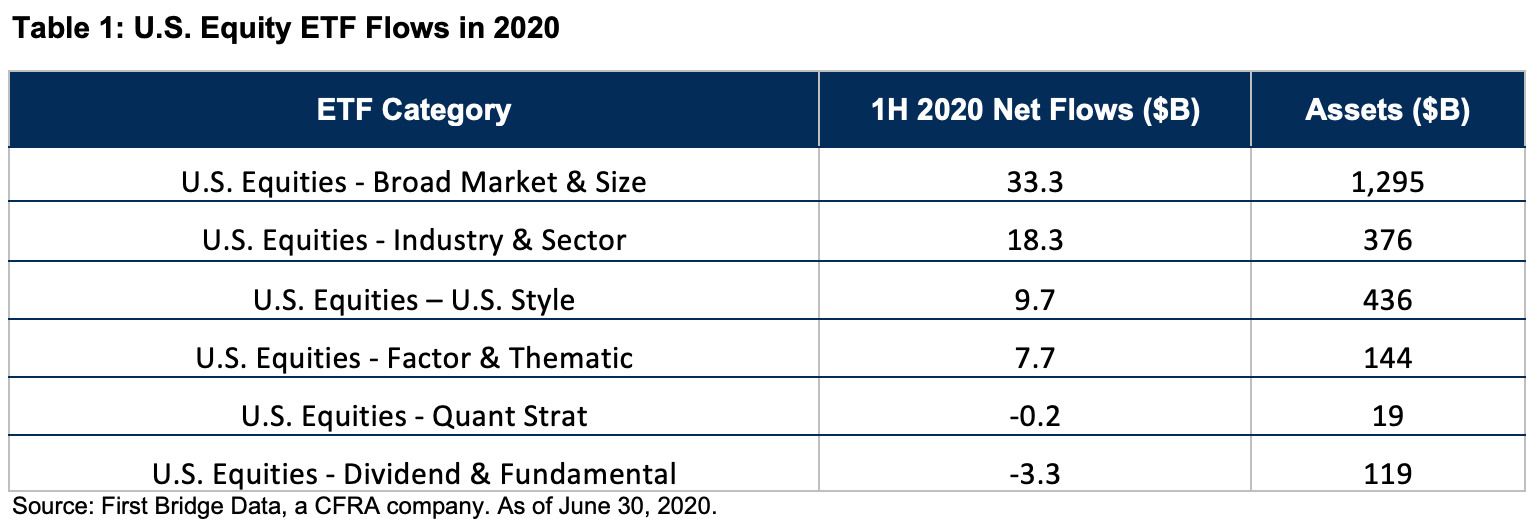

Investors added $66 billion to U.S.-focused equity ETFs in the first half of 2020, according to our First Bridge data, despite a 3% decline for the S&P 500 Index and double-digit losses for small-cap benchmarks. While $33 billion was added to broad market ETFs, often used strategically for asset allocation strategies, we are encouraged by demand for the more tactical industry and sector ETFs. This much smaller ETF category gathered $18 billion of net inflows, equal to 28% of the U.S. equity asset class net inflows, a higher percentage than its 16% share of the broader asset class’ base. Demand for industry and sector funds occurred even as interest in U.S. style funds (growth or value) was more muted, with $9.7 billion in net inflows, while dividend and fundamental ETFs had $3.3 billion of net redemptions.

Industry and sector ETFs provide exposure to a collection of stocks likely to benefit from similar market trends but limit the company-specific risks through diversification; such ETFs thus can appeal to investors and advisors who use individual stocks. We think demand for industry and sector ETFs will persist in the second half, though rotation between the leaders and laggards is inevitable as sentiment shifts.

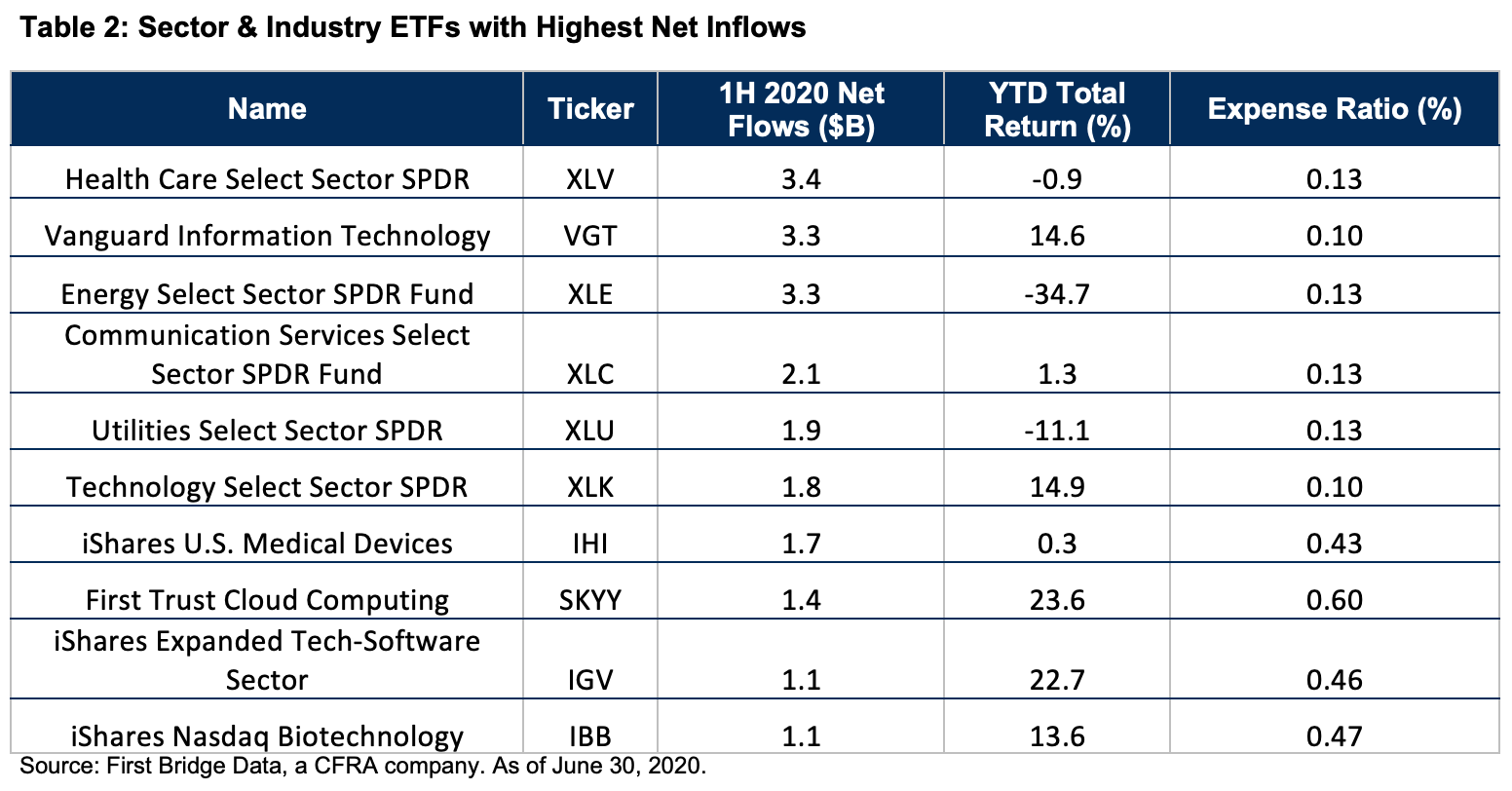

Health Care funds were popular. Health Care Select Sector SPDR (XLV) provides exposure to large-cap health care stocks in the S&P 500 Index and it pulled in $3.4 billion of net inflows in the first half of 2020. The fund holds stakes in pharmaceuticals, health care equipment and supplies, biotechnology and other industries, offering a broad approach to the sector. XLV declined just 0.9% in the first half of the year, outperforming the S&P 500 index.

Investors also sought narrower slices of the sector, with iShares U.S. Medical Devices ETF (IHI) and iShares Nasdaq Biotechnology ETF (IBB) pulling in $1.7 billion and $1.1 billion of new money, despite charging relatively high 0.43% and 0.47% expense ratios. These focused funds are skewed toward larger-cap stocks in a specific health care industry, such as Abbott Laboratories and Amgen.

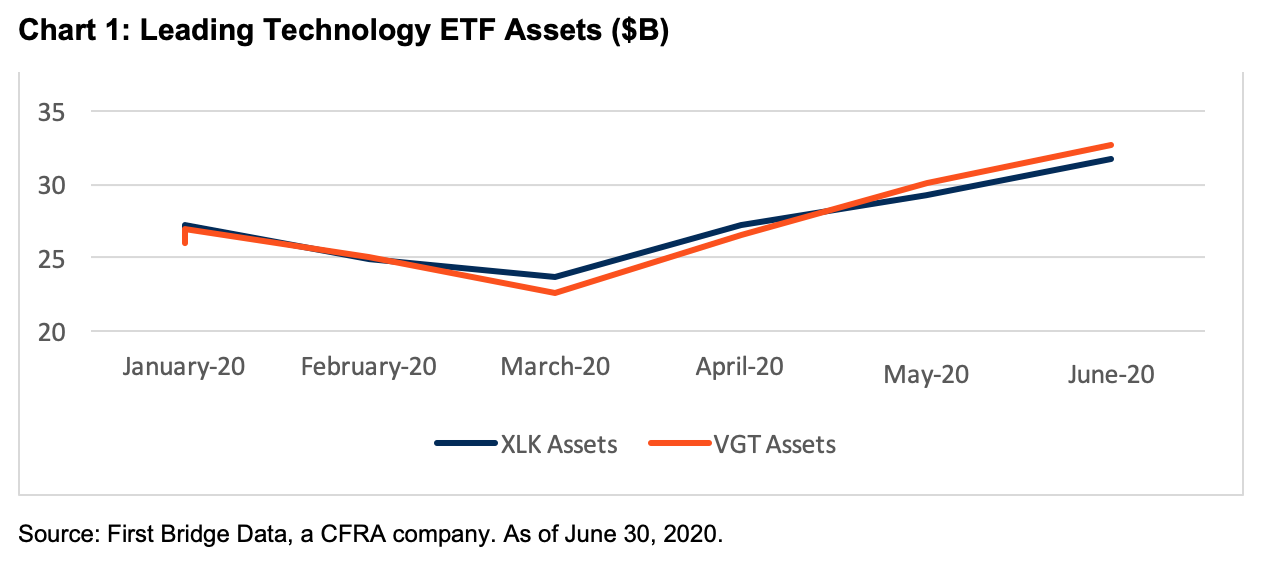

Vanguard became the new king of technology ETFs near the mid-year mark. In most of the sectors, State Street Global Advisors Select Sector ETFs have long boasted the largest funds. Yet, aided by $3.3 billion of net inflows in the first half of 2020, Vanguard Information Technology (VGT) had $32.6 billion of assets, overtaking its peer Technology Select Sector SPDR (XLK), with $31.7 billion.

Invesco QQQ Trust (QQQ) is known to some as a technology ETF, but has sizable stakes in Communications Services, Consumer Discretionary and Health Care stocks. VGT and XLK only own Information Technology stocks and are heavily concentrated, with double-digit percentage stakes in Microsoft and Apple.

Interest in VGT was not necessarily due to performance chasing as XLK narrowly edged out VGT—14.9% to 14.6% in the first half of the year—but likely growing use by more cost-conscious wealth management investors.VGT’s 0.10% expense ratio is cheaper than XLK’s 0.13%, even as VGT’s average daily volume is considerably lower.

Software-heavy focused ETFs are gaining traction as well. First Trust Cloud Computing ETF (SKYY) grew to $4.4 billion in assets at the end of June 2020, aided by $1.4 billion in inflows and a 24% first half total return. The ETF owns Internet & Direct Marketing Retailer Amazon.com and IT services firm IBM, but most assets are in software companies including mega-caps like Microsoft and moderately sized firms like HubSpot and Splunk. Amazon is the largest weighting at just over 4% of assets.

A second offering, iShares Expanded Tech-Software ETF (IGV), increased in size to $4.8 billion in assets as of the end of June, with $1.1 billion of first half net inflows and a 22.7% return. IGV is more concentrated than SKYY, with 8%-plus weightings in Adobe, Salesforce.com and Microsoft.

Meanwhile, Energy and Utilities funds underperformed the S&P 500 index but still garnered interest. Energy Select Sector SPDR (XLE) was down 35% at the mid-point of the year, hurt by weak commodities prices. Another State Street Global Advisors fund, Utilities Select Sector SPDR (XLU), lost 11% of its value as stock investors rotated away from the higher-dividend yielding stocks amid falling interest rates. Yet ETF investors found these funds compelling. XLE and XLU pulled in $3.3 billion and $1.8 billion, respectively, in the first six months of 2020.

For the second half of 2020, CFRA recommends overweighting exposure (relative to the S&P 500 index) to the Health Care, Information Technology, and Communication Services sectors and underweighting Energy, Utilities, and Real Estate.

Many U.S. industry and sector ETFs have been popular in 2020, providing exposure to top as well as bottom performing sectors. While industry-diversified health care and information technology funds typically get the attention, smaller more targeted funds focused on biotechnology and software experienced strong demand too.