As a kid, I loved watching magicians seemingly transform inanimate objects into living creatures. I remember especially "The Amazing Silvan," who could conjure a passel of white doves out of brightly colored scarves.

There’s a bit of magic employed in the oil refining business, too. Though not as dramatic as Silvan’s, it’s nonetheless remarkable. Over the past couple of months, refiners have turned a 7 percent increase in the price of oil into a 25 percent boost in gross profits.

What form of prestidigitation transforms a rise in input costs into higher returns? Here, the silk scarves hide the underlying “crack spread.”

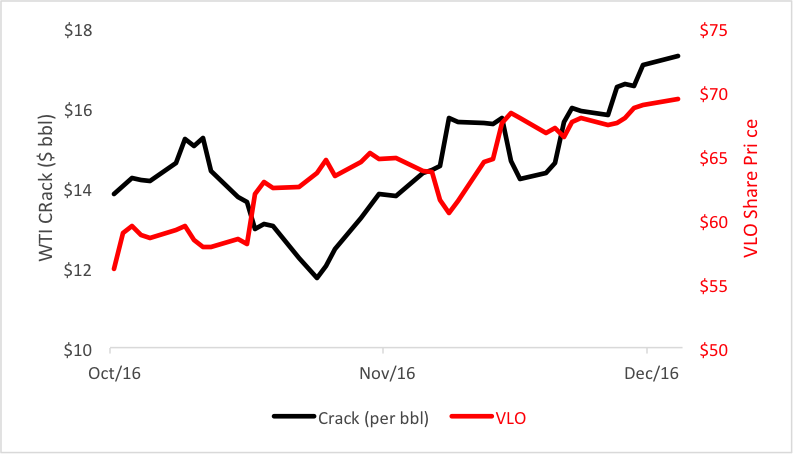

You would have learned of the spread in our October 26 column. The “crack” refers to the distillation of crude oil into primary finished products such as gasoline and diesel fuel. Independent refiners like Valero Energy Corp. (NYSE: VLO) are paying more for crude now, but they’re receiving more-than-offsetting proceeds for the sale of their distillates. Wholesale gasoline prices have risen 13 percent since the column was published; diesel prices have climbed half as much percent. Cracking produces more gasoline than diesel (typically, three barrels of light, sweet crude yield two barrels of petrol and one barrel of diesel or heating oil), so gross profits are weighted in favor of the lighter product.

The magic’s in the numbers: The crack spread was worth $14 per barrel back in October; it’s now $17. VLO’s share price has risen alongside, vaulting 24 percent to better than $69. Two months ago, we were looking at a $71 objective for VLO. Now we have to consider raising the target price.

We’re only halfway through the seasonal crack trade, which typically runs from October to February. Over the past decade, the spread’s widened, on average, by 82 percent annually. The average gain in VLO’s price over that same period has been 18 percent. Traders might understandably think VLO’s current move may be overextended. It’s certainly above average.

While VLO’s technically set up for a reach to the $92 level, conservative punters may want to take their capital off the table now, perhaps just leaving the market’s money at risk through February. That would mean peeling off about 80 percent of their positions.

And if VLO hits the new objective? Voilà! A 32 percent return. That’s not magic. It’s just good money management.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.