The S&P 500 slumped 2.5 percent in March, giving back nearly half this year’s gain. This came as a surprise to many investors who weren’t paying attention to the market’s overexuberence. We noted in our February 6 column (“Fear Factor? Not For Stocks,”) that “near-vertical ascents” in the equity market’s risk appetite “often induce nosebleeds.”

We gauged investors’ increasing taste for risk by tracking the prices of two related exchange-traded funds (ETFs). The PowerShares S&P 500 High Beta ETF (NYSE Arca: SPHB) peels off 100 of the highest-beta stocks in the S&P 500 while the PowerShares S&P 500 Low Volatility ETF (NYSE Arca: SPLV) takes 100 of the blue chip benchmark’s stocks with the lowest daily volatility. SPHB is risky; SPLV less so. Put SPHB’s price in ratio to SPLV’s and you get an ongoing measure of investors’ enthusiasm for stocks.

The S&P 500 continued to rise through February, though the risk measure started to fall off precipitously (see the chart below). In the past, such divergences foretold selloffs in the market index. And so it seems again. A double bottom breakdown on the near-term chart signals some significant weakness ahead. This may only a temporary setback that allows the market to catch its breath. We’re still trying to take its measure.

In our February column, we suggested investors “identify an exit strategy should the ratio start wobbling.” Whether an investor should bail out of equities depends on his/her entry level and risk tolerance. There are a number of tactics that can hedge an equity exposure against temporary market setbacks. By employing these, investors can hold their equity positions for a potential recovery.

A basic hedge can be obtained through inverse S&P 500 ETFs. There are now five portfolios that provide short exposure – at varying levels of leverage – to the index. Leverage provides more bang – or hedge effect – for each buck invested, but can prove costly if the ETF is held for an extended period. The greater the leverage, the more dramatic the compounding error. Put simply, just because your -2x (short 200 percent) fund gave you twice the inverse S&P 500 return today doesn’t mean you’ll have a 200 percent hedge position a week from now.

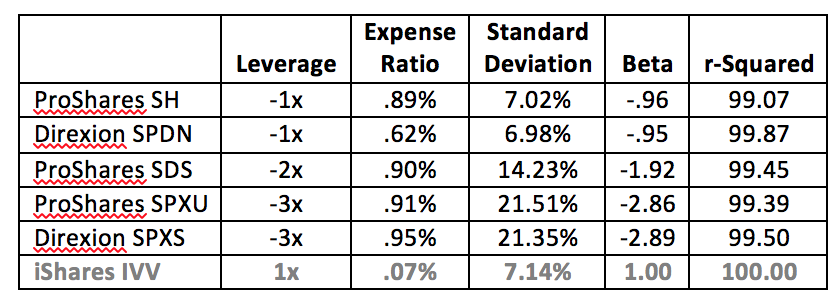

Here’s what’s on offer now, with their metrics for the last six months:

If you want to stay away from leverage, the Direxion Daily S&P 500 Bear 1x ETF (NYSE Arca: SPDN), at 62 basis points, is cheapest to hold. Crank up the leverage and you crank up the cost, though there isn’t a significant difference between the holding costs for the 2x and 3x products. The real cost differential for these funds is described by the standard deviation. To put that into perspective, consider the funds’ biggest drawdown over the past six months. The ProShares UltraShort S&P 500 ETF (NYSE Arca: SDS) was set back by 20.60 percent, while the Direxion Daily S&P 500 Bear 3x ETF (NYSE Arca: SPXS) took a 29.62 percent hit.

Here’s the essence of hedging: You’re not ridding yourself of risk altogether. You’re really exchanging one (a large, potentially unknown) risk for another (ideally, smaller or more predictable).

We’ll look at other hedge strategies in upcoming columns.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.