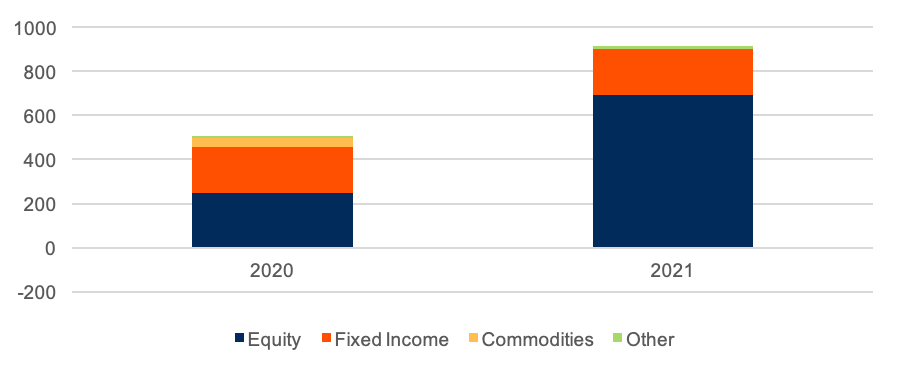

U.S.-listed ETF net inflows of $910 billion was nearly double the prior record. At the halfway mark for 2021, investors had already committed $473 billion to ETFs. But money continued to flow during the supposedly slow summer and net inflows persisted in the fourth quarter. In December alone, net inflows of $110 billion helped push the industry way past the $504 billion mark set in 2020. While 2020 flows were aided as fixed income and commodities ETFs punched above their weight, 2021 ETF flows have been driven by high demand for equity ETFs, according to CFRA data. The category’s $692 billion of net inflows was nearly triple the $249 billion gathered in 2020. Meanwhile, fixed income ETFs pulled in $207 billion, slightly more than the category’s 2020’s record inflows of $206 billion. The outlier among the asset classes was commodities, which incurred modest outflows after pulling in more than $40 billion in 2020.

Figure 1: Asset Category Net Inflows Since the Beginning of 2020 ($B)

CFRA’s ETF Database, as of December 31, 2021.

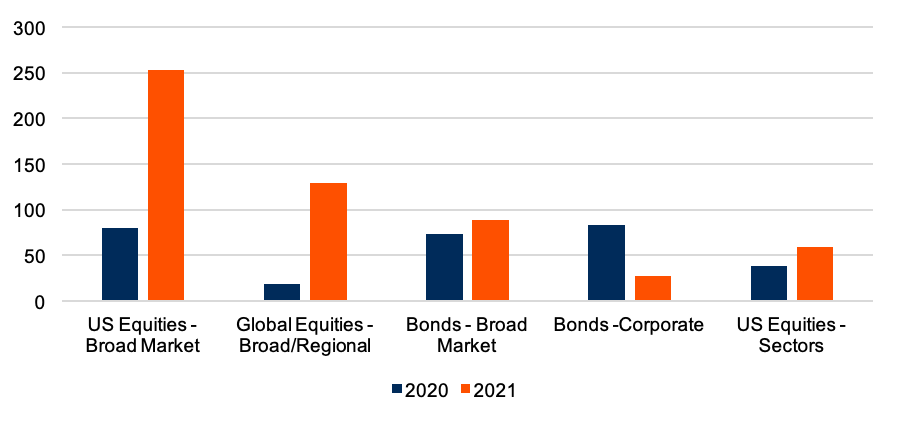

Broad and targeted equity exposure had been in demand in 2021. In 2021, investors piled into a wide range of equity ETFs. Broad market U.S. equity ETFs, such as iShares Core S&P 500 ETF (IVV), Vanguard Total Stock Market ETF (VTI) and Vanguard S&P 500 ETF (VOO), had net inflows of $252 billion, exceeding 2020’s $80 billion cash haul. Investors also took a more tactical approach with sector ETFs providing U.S. equity exposure as well. Financial Select Sector SPDR (XLF) and Vanguard Real Estate ETF (VNQ) led the subcategory to pass last year’s $38 billion of subcategory net inflows, with the two ETFs generating $17 billion of the $59 billion of net inflows. Yet the biggest shift in equities was investors focusing globally, as broad/regional global equity ETFs gathered $129 billion of new money in 2021, more than six times last year’s $19 billion. iShares Core MSCI EAFA ETF (IEFA) and Vanguard FTSE Developed Markets ETF (VEA) were the two most popular such ETFs as investors embraced global diversification to round out their portfolios.

Figure 2: Subcategory ETF Inflows Since the Beginning of 2020 ($B)

CFRA’s ETF Database. As of December 31, 2021.

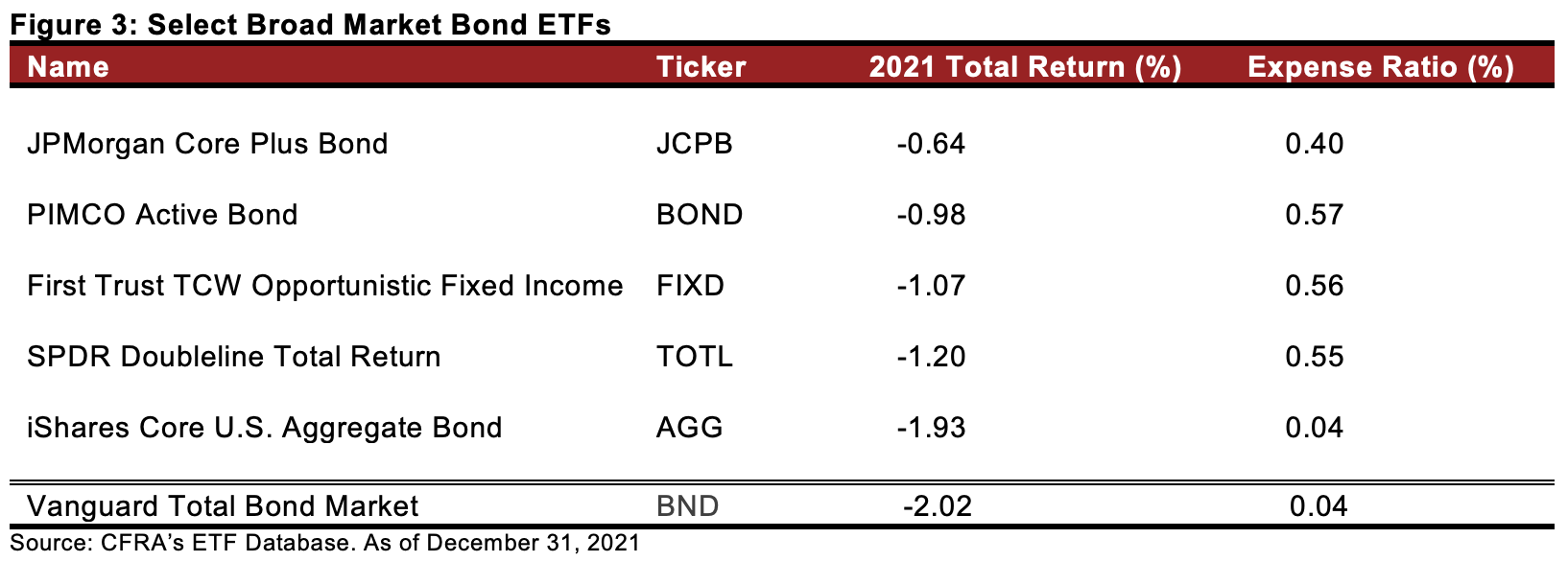

Investors were rewarded for taking an active approach to fixed income in 2021. Last year, investors poured $89 billion into broad market bond ETFs, a 22% increase from the $73 billion in 2020. While index-based iShares Core Aggregate Bond ETF (AGG) and Vanguard Total Bond Market ETF (BND) were extremely popular, actively managed peer products with unique ETF holdings performed even better despite charging higher expense ratios. For example, JPMorgan Core Plus Bond ETF (JCPB) and PIMCO Active ETF (BOND) lost only 0.64% and 0.98%, respectively, in 2021, less than the 1.93% and 2.02% losses for AGG and BND. Actively managed fixed income ETFs gathered 14% of the broader category’s record inflows and ended 2021 with 11% of the overall assets. We think investors will further embrace active ETFs in 2022 ahead of a more hawkish Federal Reserve.

Conclusion

Investors’ comfort with ETFs for strategic and tactical purposes continued to climb during 2021, pushing flows to record levels. Even with $7.2 trillion in U.S.-listed ETF assets, we also expect more innovative products to come to market in 2022 and new investors and advisors to seek out the benefits ETFs offer. We are ready to support education to understand what makes each ETF different, both new and more established products. CFRA has star ratings on 2,181 ETFs at the end of 2021 based on a combination of risk, reward and cost analysis.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.