It’s been a seminal week for interest rates.

But you knew that, right?

It’s really been a seminal year.

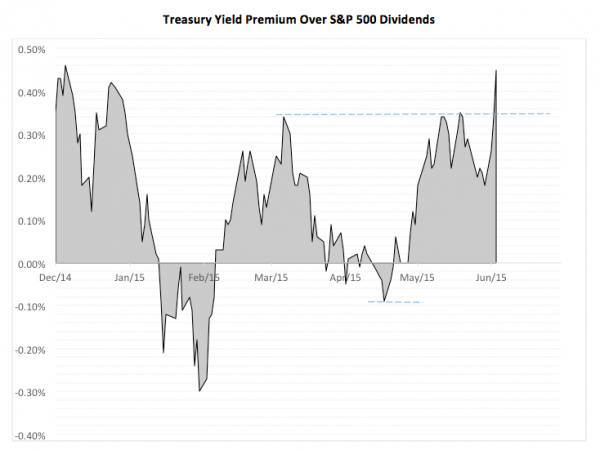

Remember back in January when the yield on the benchmark 10-year Treasury note dipped below the S&P 500 dividend rate?

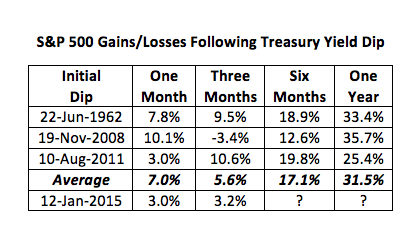

That’s happened only three times previously in the past 50 years.

Each dip has been a set-up for big stock market gains. According to research from Bespoke Investment Group, the S&P 500 has risen an average 31.5 percent within a year of the Treasury yield premium initially going negative.

Now, approaching the six-month anniversary of the January drop, the blue chip index is, indeed, ahead of its starting level but not by much. Certainly not to the degree of past episodes.

The stock market’s up only 4 percent since January, so a lot of ground would have to be gained in the next couple of weeks just to get the average six-month gain. Doable? Maybe, but not likely. Perhaps 2015 isn’t an average year. At least for this metric.

With equity yields now under those of notes, the stock market tailwind has clearly ebbed. That’s not to say that stocks aren’t attractive on an absolute basis, but investors will likely be more selective in their allocations going forward.

An easier forecast, is perhaps, the Treasury yield premium itself. There was a significant upside breakout on Wednesday when the 10-year rate popped up to 2.38 percent, a level not visited since last November. With S&P 500 dividends at 1.93 percent, the spread currently favors Treasurys by 45 basis points. Given the recent consolidation, though, a near-term target of 77 basis points seems reasonable.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.