Most any financial advisor, and more than a few investors, know that Morningstar rates mutual funds and exchange traded funds on a one-to five-star scale based on a portfolio's past risk- and load-adjusted returns.

Fewer seem to be familiar with Morningstar's new companion ratings for sustainability.

Morningstar's new scheme evaluates how well a fund's investments follow environmental, social and governance ("ESG") best practices. Instead of stars, one to five globes are assigned; top-rated portfolios, i.e., those bestowed four or five globes, are heavily populated with companies that effectively manage their ESG risks and opportunities.

What, specifically, is ESG? And why bother ranking funds this way?

"ESG-based investing" is often used interchangeably with terms like "sustainable investing," "responsible investing" and" impact investing" all of which, to one extent or another, refer to assessments of the positive environmental or social outcomes of a particular investment.

The impetus for the new taxonomy is a demographic groundswell. Morningstar cites recent surveys from U.S. Trust and Morgan Stanley showing widespread investor interest, especially among millennials and women, in companies following good corporate practices (e.g., lower greenhouse gas emissions, ethically sourced raw materials and workforce diversity, among other things).

Investors, too, are coming to believe that focusing on ESG principles can deliver superior, risk-adjusted returns over the long term. That realization hasn't come easily. ESG, with its middle name ("social"), is often mistaken for "socially responsible investing" (SRI), an investment style characterized by chronic underperformance. The shortcoming's largely due to the deselection of "sin stocks" (most often, tobacco, gambling and alcohol issues), securities that can contribute outsized gains to broad market benchmarks.

SRI is essentially passive. ESG investing can be more active in the sense that it seeks out those companies engaged in best practices around a host of environmental or governance concerns that should, theoretically, lead to better business performance. High-ESG-scoring companies tend to produce more reliable earnings and are exposed to less legal and regulatory risk—hence, "sustainability."

It's mostly the "G" ("governance") in ESG that predicts the sustainability (not the size, necessarily) of a company's earnings and/or dividends. Governance issues include management structure, employee relations and executive compensation, among others.

A number of studies show that ESG principles positively affect long-term risk-adjusted returns. Most notably, Deutsche Bank's "Sustainable Investing: Establishing Long Term Value and Performance" surveyed more than 100 analyses of ESG investing and found that high ESG ratings were tightly correlated—at 89 percent—with market outperformance.

So, with all this you'd think ETF sponsors would be spewing out one ESG fund after another to capitalize on the demand and capture the return profile, right? Well, sort of. The current flock of ESG-mandated funds is rather sparse, but is undergoing a growth spurt. There are several ESG ETFs in the regulatory hopper.

Fund by fund

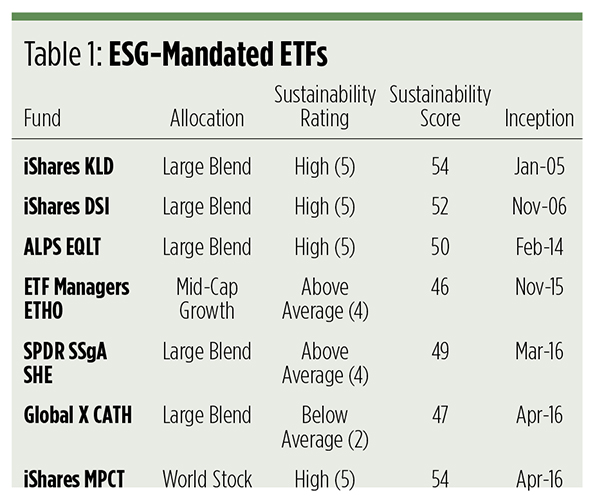

We found 10 extant ETFs with explicit ESG mandates. Three are so young that they haven't yet been awarded a Morningstar sustainability rating or score (a portfolio sustainability score indicates how a fund's component companies manage their ESG risks and opportunities relative to their industry peer group; scores above 50 indicate a fund's holdings place it in the top half of its group).

Seven funds (see Table 1) rely upon a single factor to select or, more appropriately, deselect securities—an ESG screen of one sort or another. Once securities squeeze through the funds' filters, little or nothing is done to further refine the portfolio selections. There's no qualitative vetting.

The iShares MSCI USA ESG Select Social Index Fund (NYSE Arca: KLD) typically holds 100 stocks with the highest ESG scores culled from the MSCI USA Index. It's the oldest ESG fund, judged on the basis of its inception date, but when launched, like its younger stablemate, it was an SRI index tracker. The fund's explicit ESG mandate is more recent. The fund's index methodology keeps its risk and return characteristics close to that of the broad market, very much akin to the iShares MSCI KLD 400 Social ETF (NYSE Arca: DSI). DSI tracks a market-cap-weighted index of 400 high-ESG-scored companies.

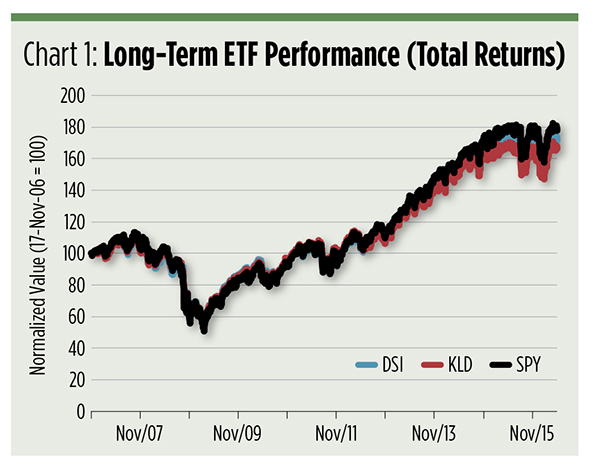

The cumulative track record of both funds is depicted alongside that of the SPDR S&P 500 Trust (NYSE Arca: SPY) in Chart 1. You can see the effect of the iShares portfolios' subtractive SRI policies over time: tight market tracking leading to eventual underperformance. KLD and DSI flag, in large part, because of dividends. KLD pays 1.50 percent while DSI's yield is 1.54 percent. SPY's payout is 2.06 percent.

While KLD and DSI both earned the highest (five-globe) ratings for sustainability, their star ratings (for returns) are middling to above average. DSI gets four stars, KLD three. In contrast, SPY earns four stars for its returns and three globes for sustainability.

Five other ETFs started their lives with explicit ESG mandates:

The oldest is the ALPS Workplace Equality Portfolio (NYSE Arca: EQLT) which tracks an equally weighted index of about 140 companies that support lesbian, gay, bisexual and transgender employees in the workplace. Last year the fund lost 2.3 percent, according to Morningstar, while the S&P 500 had a total return of 1.4 percent.

Climate impact is the base upon which the underlying index for the ETF Managers Group Etho Climate Leadership U.S. ETF (NYSE Arca: ETHO) is built. ETHO owns nearly 400 equally weighted stocks of companies with the smallest carbon footprints in their industries. Launched at the end of 2015, the fund has returned 5 percent year-to-date, besting the broader market.

The SPDR SSgA Gender Diversity Index ETF (NYSE Arca: SHE) is a market cap-weighted portfolio of large companies boasting of women in executive and director positions. At last look, the portfolio was composed of 138 stocks. The fund was launched earlier this year.

The S&P 500 index is the universe from which the Global X S&P 500 Catholic Values ETF (Nasdaq: CATH) pulls its components. This cap-weighted portfolio of 469 stocks excludes S&P components engaged in businesses incompatible with the tenets of the U.S. Conference of Catholic Bishops. This fund too only recently launched.

The iShares Sustainable MSCI Global Impact ETF (Nasdaq: MPCT) is designed to track an index of companies deriving at least half of their revenues from products and services addressing the United Nation's Sustainable Development Goals. The MPCT portfolio tilts heavily toward large-cap issues domiciled in the United States. This fund started trading in April.

New ESG funds

The ranks of ESG-mandated ETFs will more than double when a flight of new products works their way out of registration. There are two iShares funds now in the wings, along with a pair of FlexShares portfolios and a singleton for OWLshares. A three-fund suite from Columbia Threadneedle Investments (CTI) just launched on June 13.

The iShares MSCI EM ESG ETF will be based on an optimized index of emerging market companies with positive ESG characteristics and will aim to hew closely to the risk and return attributes of the cap-weighted MSCI EM Index. A similar tack will be taken by the iShares MSCI EAFE ESG ETF with respect to the MSCI EAFE Index. High-ESG-rated companies from Europe, Australasia and the Far East will populate the portfolio.

The FlexShares offering includes the FlexShares STOXX US ESG Impact Index Fund, a portfolio modeled from the STOXX USA 900 Index that weights its component stocks on the basis of their ESG scores. International stocks, drawn from the STOXX Global 1800 Index, are featured in the ESG-score-weighted FlexShares STOXX Global Impact Index Fund.

The OWLshares ESG 500 Index Fund will be populated by the stocks of the 500 largest-capitalized U.S. companies weighted by their ESG scores.

If these five ESG ETFs look similar to ones already brought to market, that's because they're all single-factor portfolios made up of ESG-screened stocks.

Columbia Threadneedle's new funds, however, are different. First of all, the primary investment objective of CTI's three ETFs is sustainable dividend income; capital appreciation is secondary.

Each fund's underlying index is built around a so-called "Beta Advantage" strategy, a rules-based, multi-factor methodology focused on dividend yield, dividend growth and cash-based dividend coverage ratios, along with an ESG screen. Stocks in each portfolio are weighted on the basis of their composite model scores and dividend yields.

According to CTI, the Beta Advantage strategy produces an index portfolio that "... by design, holds competitive, dividend-paying companies that also appear to have the financial stability and cash flow consistency to support future dividend payments. These companies may be less likely to subject their shareholders ... to reduction in dividend rates or be vulnerable to increased volatility stemming from falling valuations."

CTI's launched the 100-stock Columbia Sustainable U.S. Equity Income ETF (NYSE Arca: ESGS), based on a subset of the MSCI USA Index, the Columbia Sustainable International Equity Income ETF (NYSE Arca: ESGN), an array of 100 stocks culled from the MSCI World ex-USA Index, and the Columbia Sustainable Global Equity Income ETF (NYSE Arca: ESGW), a portfolio of 200 stocks sorted by the Beta Advantage methodology from the MSCI World Index. The funds, being so new, haven't yet earned their Morningstar sustainability scores or ratings.

Bottom line

Morningstar launched its sustainability rating system just in time to catch a wave of new ESG ETF entrants. In all likelihood, the crop of portfolios in registration and the newly debuted CTI funds ought to earn sustainability ratings similar to those for the ETFs in Table 1.

It'll take three years of seasoning for the new funds to earn their star ratings, however. When they do, their sponsors might have to opportunity to crow about their investors doing well while doing good.