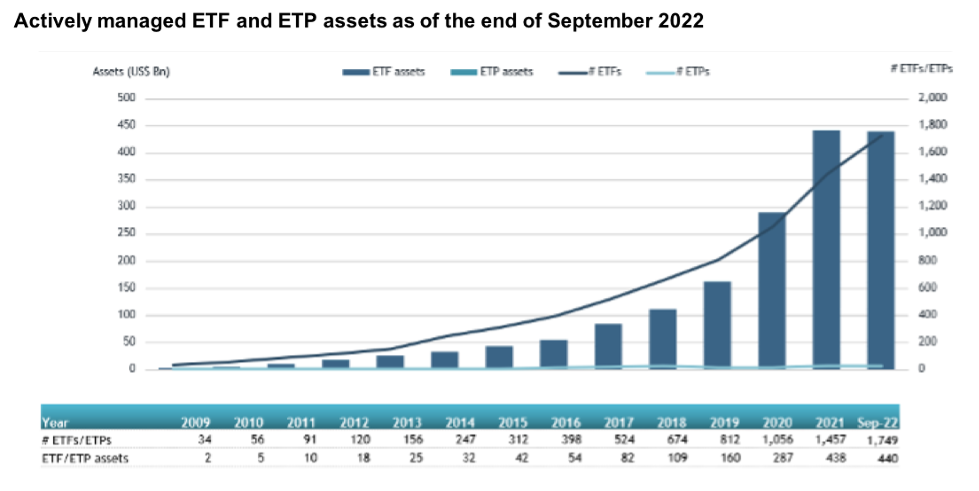

As 2022 draws to a close, some interesting trends have emerged in the exchange traded fund space, none more intriguing than actively managed ETFs becoming the product of choice for issuers launching new ETFs in 2022, as investor adoption continues to rise.

In fact, launches of new actively managed ETFs outnumbered passively managed ETFs as of the close of the third quarter of 2022; maintaining the 60/40 split that has held fairly steady since 2021, according to ETF.com. Additionally, globally listed actively managed ETFs amassed $8.8 billion in capital net inflows for the month of September, bringing year-to-date net inflows to $88.8 billion, the second highest on record after 2021 based on data from ETFGI.

ETFGI.com, “ETFGI reports actively managed ETFs listed globally gathered US$8.80 billion in net inflows in September 2022,” October 25, 2022)

When you consider that active ETFs make up less than 5% of the overall U.S.-listed ETF assets but account for 12% of the industry’s net inflows, this shift toward more active strategies has room to continue to grow in 2023.

In terms of market performance, the market has recently experienced significant fluctuations—due to geopolitical concerns, inflation, rising interest rates and more—thus it is a little surprising that advisors and investors alike are attracted to actively managed strategies, which generally have higher cost structures than their passive index counterparts.

The bifurcation between current market fundamentals and investor behavior, particularly when it comes to interest in higher priced products in a depressed economic cycle, raises some interesting questions. Why is this the case, and what are the benefits of an actively managed strategy? Additionally, why is now a good time for advisors to consider these products for a diversified portfolio, depending on a client’s risk appetite?

For starters, an actively managed strategy provides more flexibility, allowing portfolio managers to make changes to ETF holdings during a market session and pivot on the fly depending on market trends and conditions. With inflation still running hot, interest rates rising and ongoing concerns that a recession is looming, volatility is expected to continue, and an active strategy allows managers to react more nimbly in the market. Over time, portfolio managers can tailor the exposure to account for changing market dynamics in a timelier manner than their passive counterparts, who are more limited in their available options.

Another benefit is a portfolio manager’s ability to better manage positions for funds that hold thinly traded securities or derivatives. For instance, funds that hold derivatives, such as futures contracts, can roll the exposure more opportunistically using a technique that some have labeled an “optimized roll” strategy, which aims to employ a rules-based process to select the futures contracts they hold.

Generally, such ETFs attempt to minimize costs (and maximize yields) by rolling into contracts with the mildest contango or the steepest backwardation. More specifically, in contango markets, the financial instrument may invest further down the curve in longer-dated contracts where the contango effect is usually less pronounced. By rolling the contracts over less frequently, the strategy can minimize the traditionally high compounding costs associated with monthly rollovers. In other words, an optimized roll strategy may minimize roll costs, but at the expense of exposure to movements in spot prices. Therefore, these types of strategies are more suited for longer-term investment horizons.

Finally, you have the core difference between active and passive products as they relate to market cycles. Passive ETFs generally mirror the ups and downs of whichever index is being tracked whereas active ETFs can offer the potential to outperform benchmarks and indexes.

Of course, there are some challenges with actively managed products, such as their higher cost compared to some passive funds. But it’s important to understand that not all actively managed vehicles are priced the same—there are lower cost active products available—so advisors need to do their due diligence to find the right investments that will align with their client’s investment goals.

Activity within the ETF space this past year indicates that actively managed products will continue to be of interest to investors. Supporting this idea is data from a recent report from Schwab Asset Management, titled “ETFs and Beyond,” which found that about one-third (32%) of ETF investors surveyed plan to purchase actively managed ETFs in the year ahead, while 27% plan to purchase ESG ETFs and 26% plan to add thematic ETFs to their portfolios.

As we herald in this new era for actively managed strategies, advisors should be ready to talk to their clients about these types of products and begin researching investment vehicles that make sense for their clients. Education will be key during these conversations with clients, who will most certainly be interested in better understanding the differences between passive and active ETF wrappers, the types of active products available in the marketplace and what these products might do to bolster yield when added to a portfolio, as well as the performance history of the active manager. Taking a proactive approach to having these conversations with clients and presenting the data in a clear manner will help them decide whether to incorporate active ETFs into a diversified portfolio in the year ahead.

Tim Collins is the President of Elemental Advisors Inc. and Carbon Fund Advisors Inc., which act as sub-advisors to PSYK ETF (PSYK) and Carbon Strategy ETF (KARB).