Despite the market volatility Monday through Thursday of last week and fears of panic selling by investors who could trade commission-free, ETF investors pulled only $22 billion out of these diversified products, according to First Bridge ETF data, a CFRA company. Indeed, 83% of all the redemptions occurred through the selling of just one ETF, albeit the industry’s largest: SPDR S&P 500 ETF (SPY). Meanwhile, 43 ETFs gathered $100 million or more last week and not just in a flight to safety.

There has been a persistent concern that as the ETF asset base climbed to approximately $4.4 billion, ETF investors would act irrationally during equity market pullbacks. CFRA did not believe this was based on facts but rather on the unknown, given the ETF industry’s emerging growth.

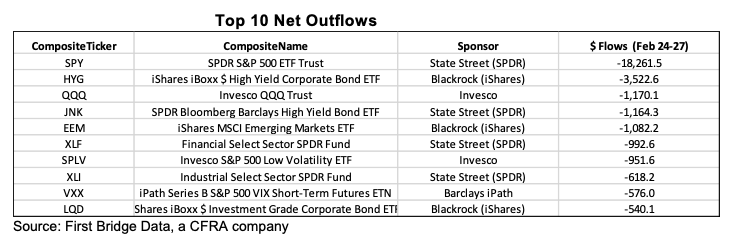

SPY had $18 billion of net outflows between Monday and Thursday, but lower-cost funds Vanguard S&P 500 ETF (VOO) and iShares Core S&P 500 ETF (IVV) successfully gathered $1.1 billion and $600 million, respectively. We think SPY’s higher trading volume has typically appealed to short-term institutional investors, while VOO and IVV are more attractive to retail investors given their more modest expense ratios.

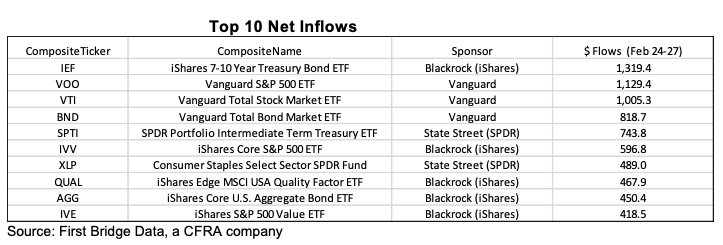

Meanwhile, four of the 10 biggest inflows were into fixed income funds. iShares 7-10 Year Treasury Bond ETF (IEF) led the way with $1.3 billion of net inflows. Vanguard Total Bond Market (BND), SPDR Portfolio Intermediate Term Treasury (SPTI) and iShares Core US Aggregate Bond ETF (AGG) also had a strong few days. These funds benefited from exposure to the high credit quality offered by U.S. Treasuries and for taking on some interest rate risk as bond yields shrank to record low levels.

Vanguard led all fund families with $5.3 billion of net inflows. The breadth of Vanguard’s asset-gathering lineup was impressive as 11 funds pulled in $100 million or more, while just one fund—Vanguard Information Technology ETF (VGT)—experienced a similar level of net outflows.

Schwab ($823 million), Direxion Shares ($280 million) and JPMorgan Chase ($180 million) were other firms that were not hurt by the market volatility. While conservative fixed income funds Schwab Short-Term US Treasury (SCHO) and JPMorgan Ultra-Short Income (JPST) help support the growth for Schwab and JPMorgan Chase, Direxion offers leveraged ETFs that appeal to investors seeking to benefit from the short-term volatility. Direxion Daily Semiconductors Bull 3X Shares (SOXL) was the most popular of them.

SPY’s net outflows dragged State Street Global Advisors' redemptions to $21 billion; Invesco ($3.2 billion of outflows) and iShares ($2.1 billion) were also slightly out of favor. High-yield bond funds iShares iBoxx $ High Yield Corporate Bond (HYG) and SPDR Bloomberg Barclays High Yield Corporate Bond (JNK) along with Invesco QQQ Trust (QQQ) suffered more than $1 billion of net outflows.

Overall, CFRA thinks ETF investors acted rationally during last week’s volatility, continuing to put money to work in many fixed income funds and select, low-cost broadly diversified equity products. We believe ETFs will continue to be a go-to-vehicle for investors for years to come.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.