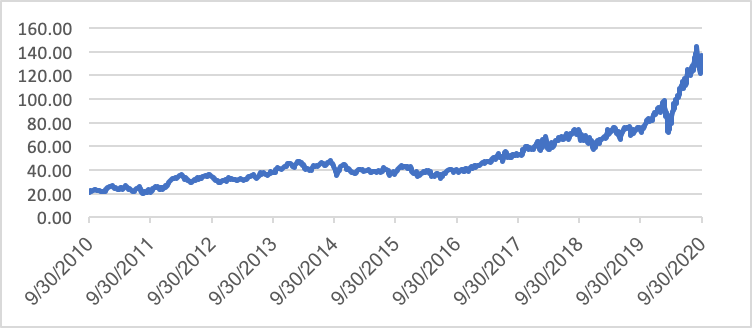

Invesco QQQ Trust's (QQQ) asset growth has accelerated in the last few years. At the end of the third quarter of 2010, QQQ had $22 billion in assets, according to CFRA’s First Bridge ETF database. The fund grew to $38 billion three years later but was still at the same mark at the end of the third quarter of 2016 before taking off. By the end of September 2018, QQQ assets doubled to $74 billion and as of early September 2020, the fund’s asset base exceeded $140 billion before closing the quarter with $137 billion. As of Oct. 9, the fund remained a $137 billion juggernaut.

Chart 1: QQQ’s Asset Growth ($B)

CFRA’s First Bridge ETF database. As of September 30, 2020.

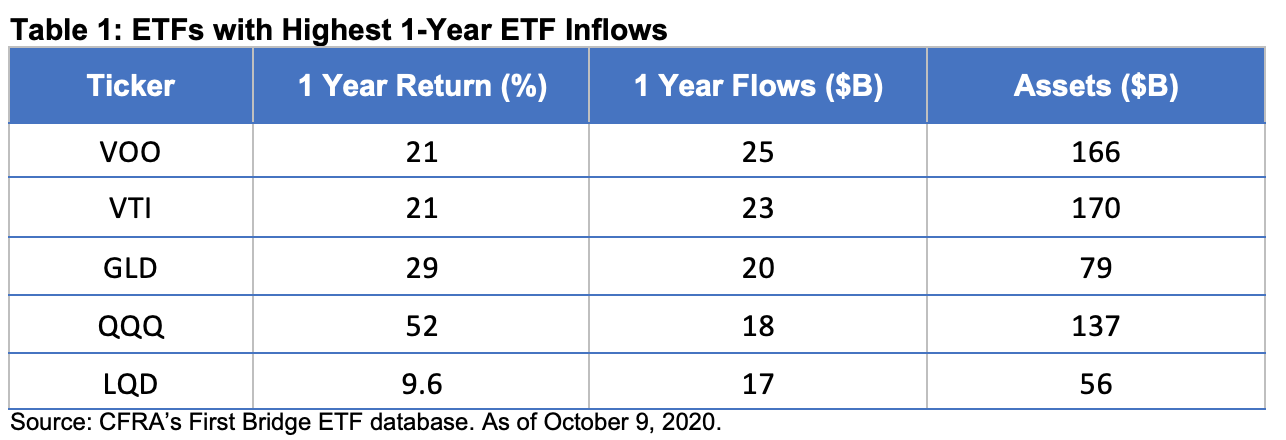

QQQ benefited from strong investor interest, as well as rapid appreciation of its holdings. In the year ended October 9, 2020, QQQ rose 52% and received $18 billion of net ETF inflows, the fourth most in the industry behind Vanguard Total Stock Market Index ETF (VTI) and Vanguard S&P 500 ETF (VOO), which we think are regularly used for asset allocation purposes by expense-ratio-conscious investors. In contrast, we believe QQQ is used by institutional and retail investors with shorter-time horizons. This is what makes Invesco’s new products important to understand.

Invesco NASDAQ 100 ETF (QQQM) will have the same holdings as QQQ but with a lower expense ratio and lower share price. QQQM charges a 0.15% expense ratio, five basis points less than QQQ, to appeal to an ETF or an index-mutual fund investor base that focuses on fees more than trading costs. QQQ is one of the most liquid ETFs trading in the U.S., with recent average daily volume exceeding 60 million shares and trades occurring with a penny spread. We think it is highly unlikely that QQQM will trade with a spread that low in its initial months.

“Our research shows that some investors will prioritize fund size, liquidity and history, while others are more fee conscious,” said John Hoffman, Head of Americas, ETFs & Index Strategies at Invesco. “Over time, we expect both ETFs to grow by appealing to different audiences.”

What is inside an ETF matters more than its fee. In rating equity ETFs and mutual funds, CFRA combines holdings-level analysis and fund attributes like performance and costs. An equity fund is a basket of securities and with the benefits of transparency, we believe investors can understand the risk and reward prospects of these holdings. We combine this analysis with a review of performance and costs.

Five-star rated QQQ holds many stocks CFRA views favorably from a reward and risk perspective. These include Alphabet, AMZN, AAPL, MSFT, NVIDIA and Tesla that have CFRA Buy or Strong Buy recommendations. These will be the same positions in QQQM, as it also tracks the NASDAQ-100 Index.

QQQ is likely to remain among the 10 largest ETFs in the near-term given its liquidity and the strong affinity growth investors have gained over the past decade. However, we expect some investors to find the lower-cost QQQM alternative, with a lower share price, to be appealing. In 2021, CFRA expects to offer a rating, based on our review of the portfolio as well as the ETF’s performance and costs.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.