Invesco S&P 500 Low Volatility ETF (SPLV) has gathered assets in the past month in contrast to peer iShares Edge MSCI Min Vol USA ETF (USMV). Invesco’s portfolio of the 100 least volatile stocks in the S&P 500 Index amassed $1.4 billion of new money in the one-month period ended August 20, erasing prior redemptions, and pushing the year-to-date net inflows total to approximately $320 million, according to CFRA’s ETF data. SPLV climbed 3.3% in the past month, ahead of 1.8% gain for SPDR S&P 500 ETF (SPY) as the more defensive approach added value. In contrast, iShares’ U.S. minimum volatility peer USMV incurred $200 million of net outflows in the past month and $8.4 billion of redemptions in 2021, despite outperforming SPY with a 2.8% gain in the last month. Both SPLV and USMV have lagged SPY thus far in 2021, which we think should be expected during a bull market.

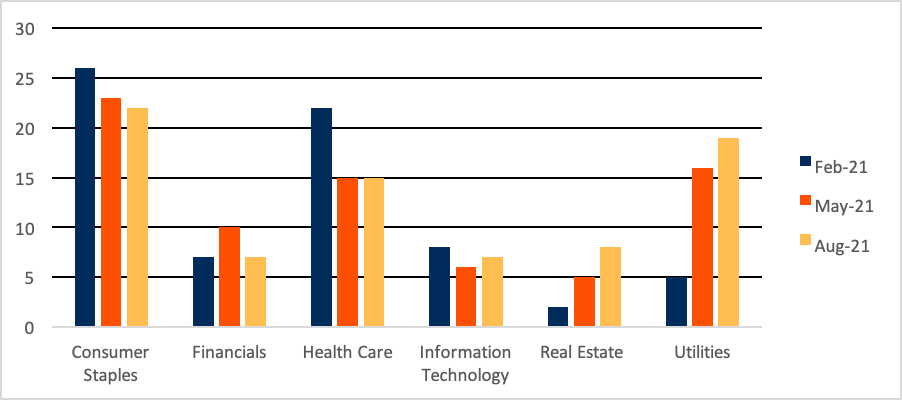

SPLV increased its exposure to certain defensive sectors during its August rebalance. The index behind SPLV is rebalanced on a quarterly basis, with the latest changes occurring last week. Exposure to higher-dividend yielding sectors such as real estate and utilities continued to climb from the February and May levels, as shown in Figure 1. Utilities now represents 19% of assets, up from 16% and 5% in May and February, respectively, while real estate is 8%, up from 5% and 2%. Meanwhile, stakes consumer staples and health care were 22% and 15% of the portfolio, down from the 26% and 22% weights in February, though little changed from May. The financial sector shrunk the most in August, with the weight falling back to the 7% February level, after initially climbing to a 10% stake in May.

Figure 1: Select Sector Weightings of the S&P 500 Low Volatility Index (% weight)

S&P Dow Jones Indices. As of August 19, 2021

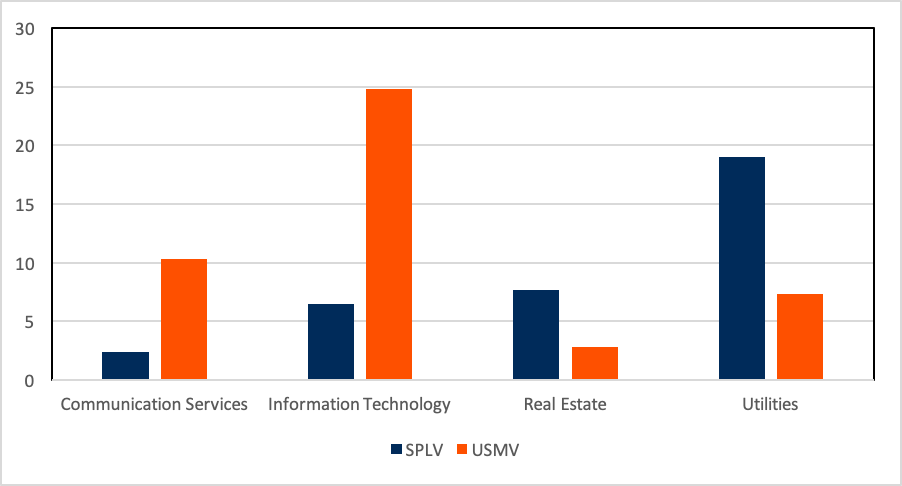

USMV is rebalanced semiannually and has sector constraints, resulting in a distinct portfolio. The iShares offering, which will next be rebalanced in November, currently has more exposure to certain growth sectors and less exposure to defensive ones. For example, information technology represents 25% of assets, more than triple SPLV’s stake, while real estate and utilities comprise 2.8% and 7.3% of USMV’s assets, much less than half the amount held by SPLV. When it rebalances, USMV only can deviate from its broad market parent MSCI index by 500 basis points, which impacts its sector construction as the information technology sector is heavily weighted due to high exposure to mega-cap companies.

Figure 2: Sector Exposure of Select Lower Volatility ETFs (% of assets)

CFRA’s ETF Database. As of August 20, 2021

Conclusion

CFRA has unfavorable star ratings on SPLV and USMV, due to our belief that the ETFs each have lower reward potential over the next nine months relative to the broader U.S. equity category. Indeed, we are more bullish on Invesco and iShares U.S.-focused quality and value-oriented ETFs than their lower volatility offerings. CFRA’s ETF research is based on a combination of holdings-based analysis and fund attributes tied to performance and costs. However, we think investors need to understand what makes these two widely held ETFs different from one another and how, despite passively track indexes, they are not static portfolios.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.