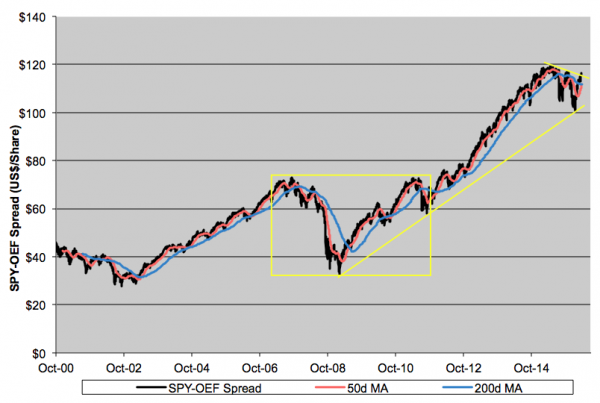

This week, ahead of a Fed meeting and more earnings reports, equity investors turned on the risk switch. Take a look at the chart depicting the price spread between the SPDR S&P 500 Trust (NYSE Arca: SPY) and the iShares S&P 100 ETF (NYSE Arca: OEF). The spread broke above overhead resistance and now boasts a bullish cross. The spread’s near-term price trend (its 50-day moving average, in red) has inched above its longer-term trend (the 200-day moving average, in blue) for the first time since last August.

SPY, with 500 slots in its portfolio, is the more egalitarian fund. About 49 percent of its constituents are mega-cap stocks such as Apple Inc. (Nasdaq: AAPL) and Wells Fargo & Co. (NYSE: WFC). The remainder are spread out mostly in the large- and medium-cap categories, leaving a handful of small-caps. OEF, on the other hand, is narrowly focused on the biggest of the big outfits. Nearly 77 percent of its components are mega-caps; the rest are exclusively large-caps.

Big stocks are typically a refuge for gun-shy equity investors. Small stocks are for gunslingers. When SPY outpaces OEF, investors lean on the risk button. Caution’s the watchword when OEF leads.

Investors apparently see blue skies ahead. Energy and materials stocks have rebounded, commodity prices are buoyant and bond prices are slipping (read: yields are rising).

Yes. All this ahead of a Fed meeting!

We’re by no means out of the woods economically, but we seem to be clawing our way out of a pit into which we tumbled at the top of the year. Regard the spread between ten-year Treasury note and S&P 500 dividend yields, a telltale of economic vibrancy. The spread turned deeply negative (stocks yielding more than notes) in February. We’re less than 20 basis points away from breakeven now, a rebound of nearly 60 bips.

Back to that SPY-OEF spread. SPY costs about $116 more than OEF now. Technically, the breakout pattern points to a long-term objective of $147. Clearly, there’s a whole lot of optimism – and risk – baked into that number.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.