There were 53 ETFs launched in 2020 that already have more than $100 million in assets. While some investors and research providers wait for an ETF to hit a three-year anniversary or reach $100 million in assets before giving it due consideration, for more than a decade CFRA has focused on funds much earlier in the life cycle and regardless of asset size. With the ability to look at fund holdings from a risk and reward perspective and understand the fund’s costs, our research provides analysis to help begin the due diligence process and put money to work within the first few months of an ETF’s trading. Overall, 17% of the products that came to market in 2020 and were tracked by CFRA’s First Bridge ETF database hit the key $100 million milestone as of Feb. 19 aided by ETF inflows. This is impressive as COVID-19 limited travel and previously planned investor education efforts, including conferences and road shows.

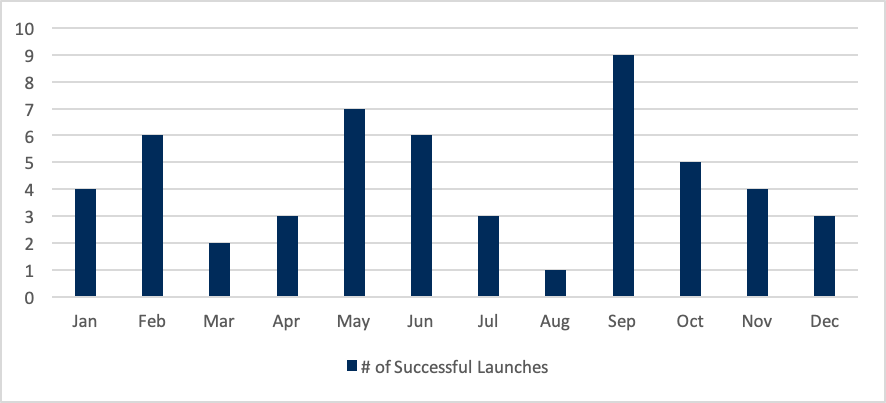

Highly successful 2020 ETF launches were spread out throughout the year. While products initially trading early in the year had the benefit of time, there were 12 ETFs launched in each of the first and fourth calendar quarters already above the $100 million mark. Moreover, during the second quarter there were 16 funds that came to market and subsequently were successful at achieving the $100 million asset level, according to our research. September launched the most ETFs (nine) to hit $100 million in assets by Feb. 19, with May (seven), June (six) and February (six) other strong months.

Chart 1: When did highly successful ETFs launch in 2020?

CFRA’s First Bridge ETF Database. As of February 19, 2021.

BlackRock and Goldman Sachs leveraged their scale to support new ETFs in 2020. BlackRock is the overall ETF industry leader based on assets and has always had a healthy product pipeline, so it is not surprising the asset manager had the most funds that began trading in 2020 already crossing the $100 million mark. The firm’s six biggest success stories among new ETFs consisted of three ESG products, including iShares ESG Advanced MSCI USA ETF (USXF); two fixed income funds, including iShares BB Rated Corporate Bond ETF (HYBB); and a cross-sector thematic fund, iShares U.S. Tech Breakthrough MultiSector ETF (TECB).

Meanwhile, Goldman Sachs has a more modest ETF presence, as the 15th largest provider, but the asset manager was well equipped to drive assets for the firm’s own broad market products such as Goldman Sachs MarketBeta US Equity ETF (GSUS) and Goldman Sachs MarketBeta International Equity ETF (GSID) as an alternative to SPDR S&P 500 ETF (SPY) and iShares MSCI Core EAFE ETF (IEFA). In total, the firm launched four ETFs in 2020 that already have accumulated more than $100 million in assets.

American Century, Cabana, Dimensional Funds, Exchange Traded Concepts, First Trust and Innovator Management each had three 2020-launched ETFs eclipse $100 million in assets by February 19.

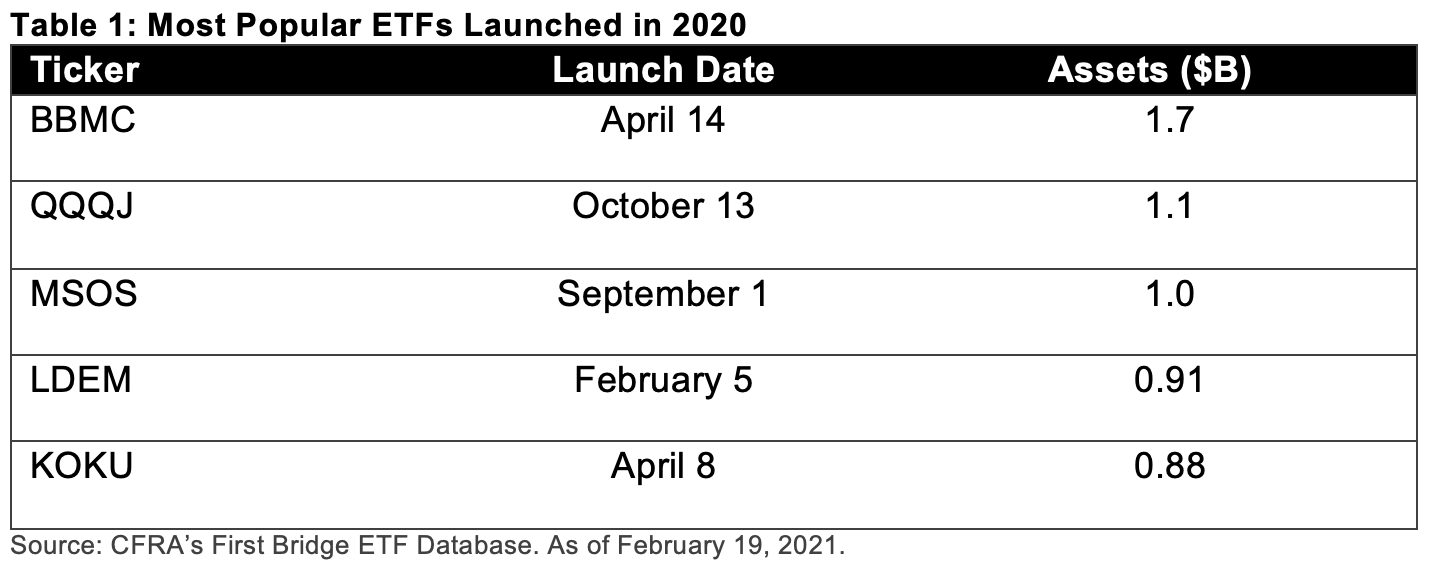

JPMorgan BetaBuilders Mid-Cap Equity (BBMC) gathered the most assets among the 2020 vintage. This mid-cap ETF charges a modest 0.07% expense ratio relative to iShares Russell Mid-Cap ETF (IWR) and others. As of Feb. 19, BBMC had $1.7 billion in assets despite launching only in April 2020. BBMC gathered $213 million of new money this year with the bulk arriving a few months after the fund rolled out. Meanwhile, Invesco NASDAQ Next Gen 100 ETF (QQQJ) began trading in mid-October and crossed the $1 billion mark four months later aided by approximately $400 million of net inflows in 2021. The fund is a more mid-cap growth version of the Invesco QQQ Trust (QQQ).

Thematic ETF AdvisorShares Pure US Cannabis ETF (MSOS) was the other ETF to launch in 2020 and hit the $1 billion mark—benefiting from expectations of potential decriminalization of marijuana with the onset of Democratic control in Washington, D.C.

Conclusion

As the U.S. ETF industry approaches the $6 trillion mark in overall assets, investors are responding quickly to new products and not treating them like a mutual fund or a fine wine needing to age well. CFRA thinks the transparency provided by ETFs allows us all to understand what is inside and put key cost factors into perspective. CFRA has star ratings on just under 1,900 ETFs to help our clients compare the new entrants with the well-established products.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.