Tuesday was a good day for inflationistas. According to the latest release from the Bureau of Labor Statistics, the Consumer Price Index ticked up 0.2% in December. The more telling stat, however, was the year-over-year inflation rate—2.3%. December’s number was the third straight monthly hike in the benchmark and takes urban inflation to its highest level in a year.

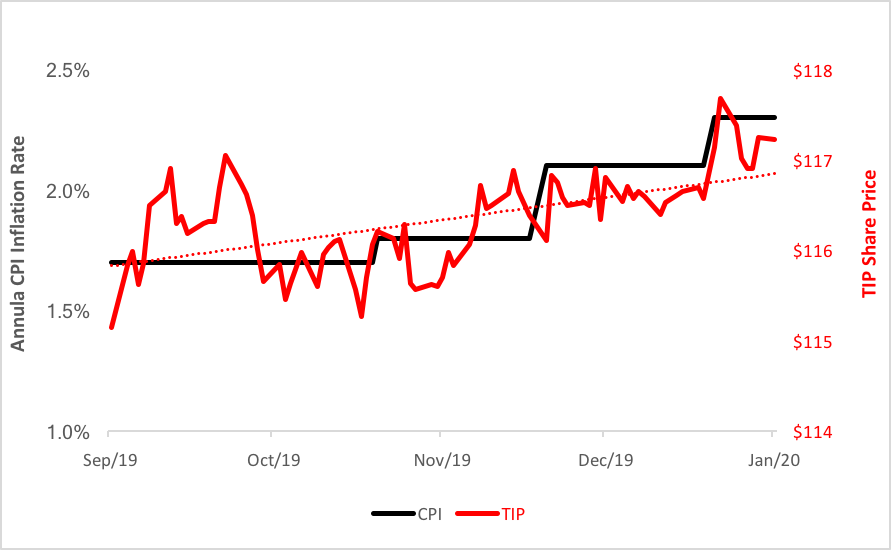

Clairvoyants and savvy traders could have foretold this spike months ago by watching the price trajectory of inflation-protected bond ETFs. Case in point: The market-leading iShares TIPS Bond ETF (NYSE Arca: TIP) actually bottomed in November 2018.

The iShares fund tracks a diverse and market-value-weighted index of U.S. Treasury inflation-protected securities (TIPS) with remaining maturities of at least one year.

The appeal of TIPS and, by extension, TIPS funds, rises and falls along with inflationary expectations. Unlike conventional Treasury notes, the principal of a TIPS rises with inflation so that, at maturity, the holder receives either the inflation-adjusted principal or the note’s original face amount, whichever is greater.

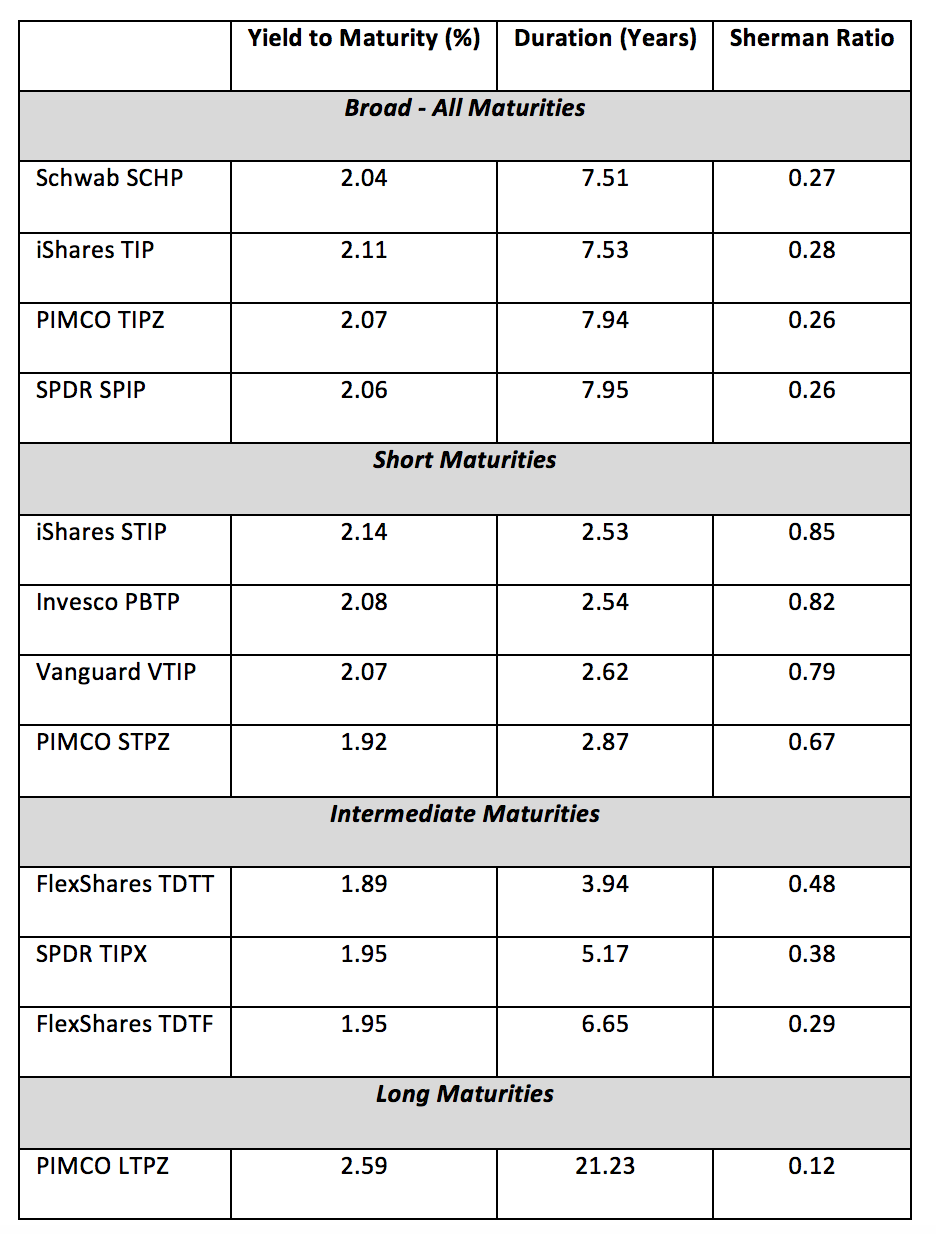

There are a dozen U.S.-oriented TIPS ETFs available to investors nowadays. Because inflation is generally associated with a rising rate environment, a TIPS fund investment is necessarily two-dimensional. Portfolio managers and advisors must find funds that provide optimal combinations of protections from inflation and interest rate risk. Rate risk is reflected by the fed funds futures market, which is predicting increased odds of rate hikes over the next two FOMC meetings.

Portfolio managers have to go beyond considering duration in isolation. That rising rates are corrosive to a bond’s market value is well-known, but there’s another consequence—the negation of a bond’s coupon income. At some point, increasing market rates can offset a security’s return yield. The breakeven point can be quantified through a ratio named for a DoubleLine Capital investment officer. The Sherman ratio, found by dividing a fund’s yield by its duration, represents the rise in interest rates over a 12-month period required to counterweigh a bond fund’s return income. The higher the breakeven point, the greater the insulation from interest rate risk.

So, of these dozen TIPS ETFs, which offers a yield least likely to be chewed up by rising rates? The table below surveys the field segment by segment.

The takeaway here? The ratio brings the duration statistic to life. It tells an investor the actual cost to a portfolio for a shift in market rates. A move of just an eighth of a percentage point wipes out the return earned by the PIMCO 15+ Year US TIPS Index Fund (NYSE Arca: LTPZ).

Not surprisingly, shorter-duration funds pose the least risk, but the important thing is to keep an eye on the yield-to-duration ratio going forward. If yields change significantly while durations remain stable (more than likely, given each fund’s mandate), the ratios could start to look a lot different. And, given the odds, that’s probably not going to be a good change.

Brad Zigler is WealthManagement's alternative investments editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.