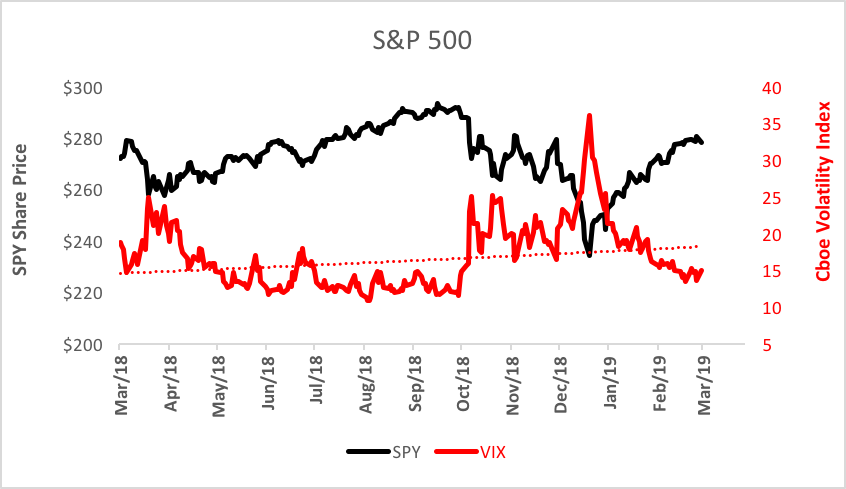

A week ago, we reported a significant decline in the so-called fear index. The Cboe Volatility Index (VIX), a barometer of the anxiety built into the prices of S&P 500 Index options, has been slipping mightily since Christmas. Now, volatility is a mean-reverting business so precipitous moves in either direction tend to be followed by opposite, if not always equal, reactions.

VIX is now simmering below its one-year exponential trend line as the S&P 500, proxied by the SPDR S&P 500 ETF (NYSE Arca: SPY), attempts to reach its 2018 high watermark.

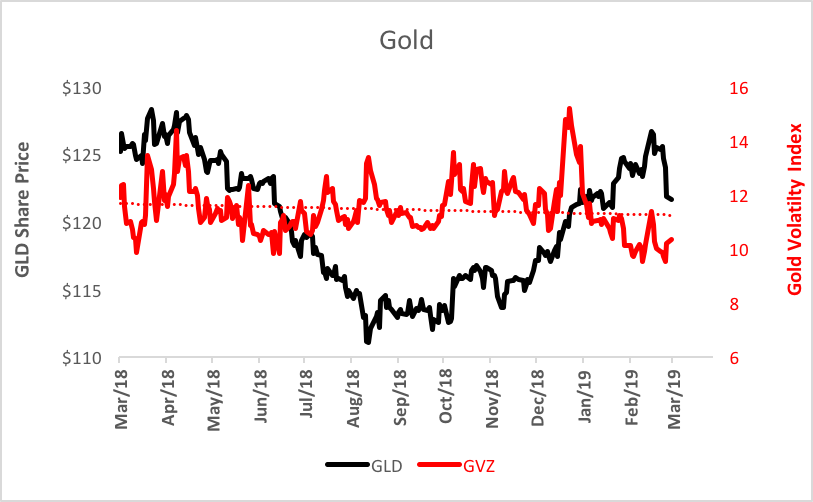

Volatility, it seems, has vamoosed from other markets as well. Take a look at gold, represented by the SPDR Gold Shares Trust (NYSE Arca: GLD) and its associated Gold Volatility Index (GVZ). GVZ is derived in much the same way as VIX; GLD options prices are parsed to isolate their anticipated volatility, or fear, assumptions. As you can see from the chart below, gold volatility’s recently sunk to a new one-year low. GLD’s price, meanwhile, has been rising off mid-summer-2018 lows.

Can you see the problem presented in these two charts? Both markets, ordinarily uncorrelated to each other, show similar setups. Both gold and stocks are in uptrends characterized by increasing complacency. There’s a volatility spike in the making for each. Investors relying on gold to be the yin to stocks’ yang may very well be disappointed if both assets sink simultaneously.

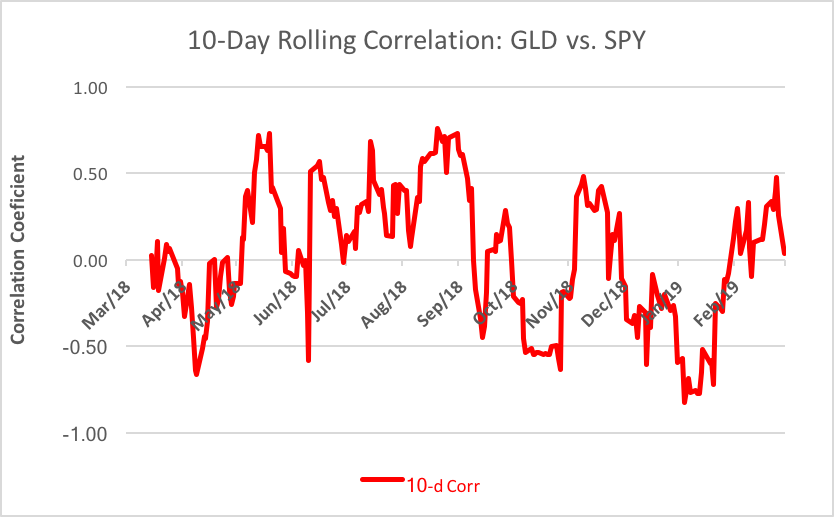

Over the past year, in fact, gold and stocks have been more correlated than not. As you can see in the chart below, the rolling 10-day correlation between SPY and GLD has been positive more than half the time.

The upshot of all this? Though gold and stocks have historically been good portfolio complements, they can at times move in the same direction and often to a startling degree. A portfolio that relies on a single diversifier such as gold may not be able to shed enough risk to offer a smooth ride.

Brad Zigler is WealthManagement's alternative investments editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.