By Luzi Ann Javier

(Bloomberg) --Donald Trump has not been good to gold.

After starting 2016 as the world’s hottest commodity, bullion’s prospects have dimmed since the election and investors are pulling money out at the fastest rate in three years.

Over the past month, exchange-traded funds backed by precious metals saw a net outflow of $6.31 billion as gold prices tumbled to a 10-month low, according to data compiled by Bloomberg. As the money exited, ETFs tied to equity markets saw an inflow of $76.2 billion, helping to send the Standard & Poor’s 500 Index to an all-time high.

While precious metals ETFs still show a net inflow for the year of more than $26.3 billion, money began exiting around the Nov. 8 U.S. election. Fund managers are finding better returns elsewhere as equities and the dollar surged. Yields on government bonds rose on mounting expectations the Federal Reserve will boost interest rates. All that makes holding gold or silver less appealing because they don’t pay dividends.

“It would be hard to go against the momentum” of gold dropping and equities rallying, said Lara Magnusen, a La Jolla, California-based portfolio manager at Altegris Advisors LLC.

Gold had been on a roll in 2016 until Trump was elected president. Before then, prices were up 20 percent and heading for their first annual gain since 2012 on signs that interest rates would remain low. That helped boost investment in long-only ETFs backed by precious metals, which took in $13.6 billion during the first quarter, the most in seven years, according to data compiled by Bloomberg Intelligence. SPDR Gold Shares are the biggest commodity ETF.

But after a brief post-election rally, bullion’s outlook dimmed. Gold futures in New York are down 7.7 percent, touching a 10-month low of $1,158.60 an ounce on Monday. Trump’s pledge to cut taxes and boost infrastructure spending to bolster U.S. economic growth was viewed by some investors as bullish for riskier assets such as stocks.

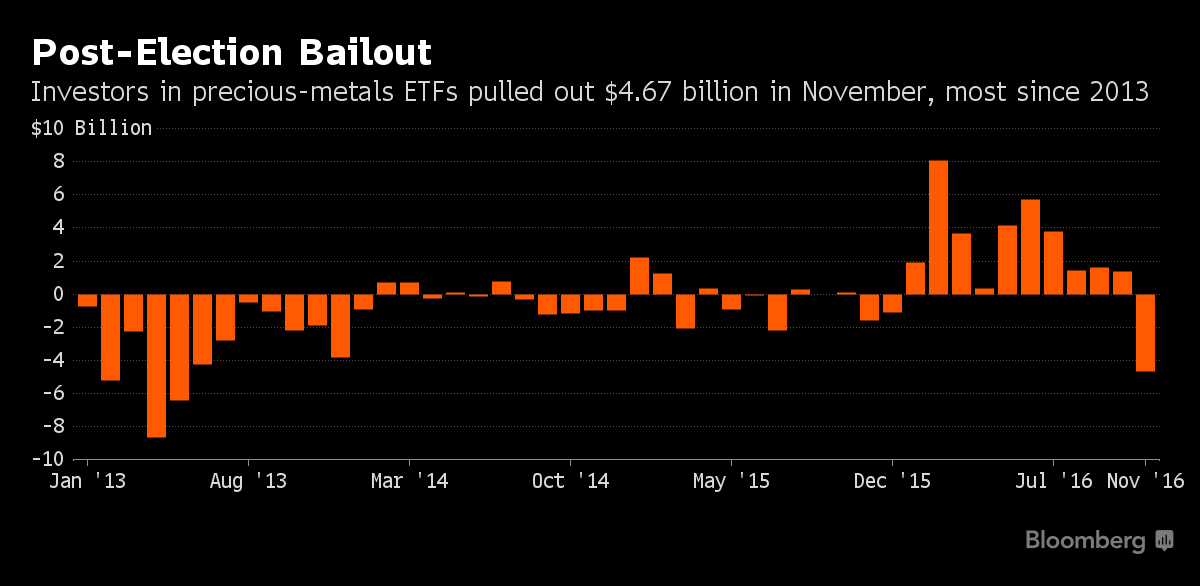

In November, investors pulled $4.67 billion from precious metals ETFs -- the most since May 2013, data compiled by Bloomberg Intelligence show. The outflow more than offset gains in energy, leading to $3.6 billion in losses for all commodity ETFs.

Investors have already withdrawn about a quarter of the more than $12 billion that they poured into SPDR Gold in the first half, when bullion prices touched a two-year high. In November, the ETF had the biggest monthly outflow since May 2013, when gold was languishing in a bear market.

There’s more pain to come. Citigroup Inc. estimates that gold prices will average $1,135 in the second quarter of 2017, 10 percent less than a year earlier, as it sees the Fed boosting interest rates this month and twice in 2017.

Many early investors, including billionaires George Soros and Stanley Druckenmiller, saw this coming. In the third quarter, hedge funds including Soros Fund Management LLC pulled a combined 19.9 million shares of SPDR Gold. That’s almost half of the shares they bought in the three months through June, when the price of the metal was off to its best first half in almost four decades.

In the case of Druckenmiller, he told CNBC last month that he sold all his gold on the night of the election, as he bet on economic growth.

Fund Losses

You can’t really blame investors for exiting. The 162 funds invested in precious metals and tracked by Bloomberg posted an average loss of 8.2 percent this quarter, the worst of all asset classes, according to data compiled by Bloomberg on more than 100,000 hedge funds, private equity, ETFs and other funds worldwide. Those holding physical gold are worse off, with the metal poised for an 11 percent loss this quarter.

Some analysts aren’t convinced the rally is over. More infrastructure spending in the U.S. and low global interest rates may accelerate the pace of inflation, which would renew demand for gold as an alternative asset, Commerzbank AG analysts led by Eugen Weinberg, wrote in a note dated Dec. 2.

Gold may rise to $1,300 in the fourth quarter of 2017 and may reach $1,400 in 2018, according to Commerzbank.

Other Risks

There’s also the possibility of a Trump-led trade war with China, uncertainty from elections in Europe, risks to market stability from the Italian banking sector and complications from Britain’s exit from the European Union. All those could revive the appeal of bullion.

The sell-off in gold “is a little bit too violent and too short-sighted,” said Chad Morganlander, a money manager at Stifel, Nicolaus & Co. in Florham Park, New Jersey, where he helps oversee about $172 billion. The fund hasn’t pared its positions in SPDR Gold, he said. “We’re expecting gold to start to move higher over the course of the next six to 12 months as interest rates stay anchored below expectations.”

To contact the reporter on this story: Luzi Ann Javier in New York at [email protected] To contact the editors responsible for this story: James Attwood at [email protected] Steve Stroth, Joe Richter