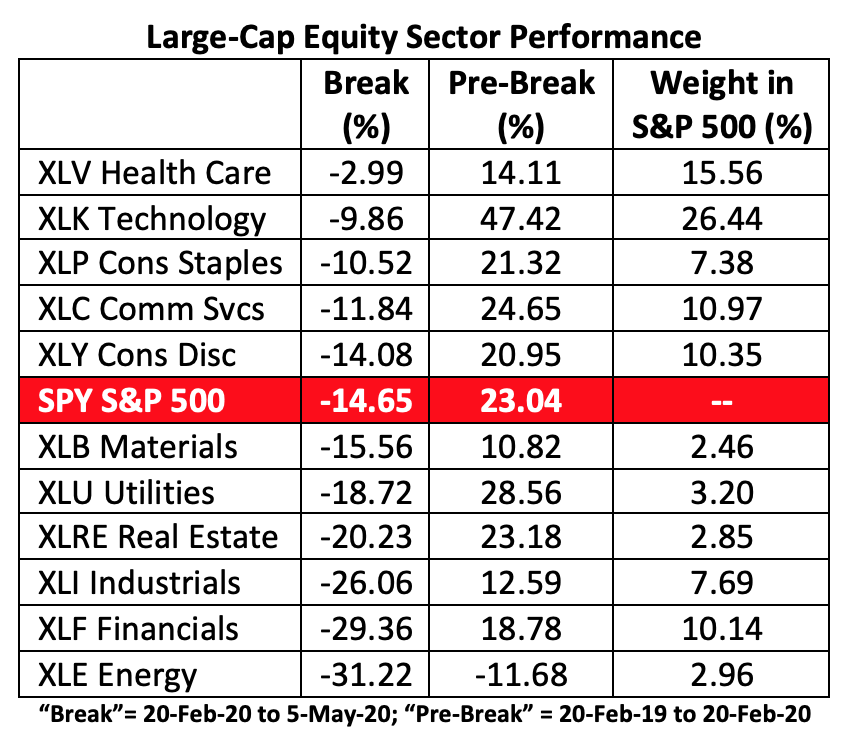

The coronavirus stopped a bull market dead in its tracks this year. From the market peak on February 20, the S&P 500 Index—proxied by the SPDR S&P 500 Trust (NYSE Arca: SPY)—has lost 14.7% to date. For the one-year period preceding the break, SPY was up 23%.

All sectors of the market were affected by the coronavirus scare, but not equally. Owners of health care stocks—at least those included in the S&P 500—would have hardly noticed the market upset. The Health Care Select Sector SPDR (NYSE Arca: XLV) has ticked down just 3% since February 20, after a one-year gain of 14%. A 3% slump over 53 trading days is well within the ETF’s normal volatility range.

The same can be said for the Technology Select Sector SPDR (NYSE Arca: XLK). Big tech is off less than 10% in the virus’ wake. For an ETF with a standard deviation well in excess of the S&P 500’s, a much bigger drawdown could have reasonably been expected.

That health care stocks are relatively buoyant isn’t really a surprise. The sector tends to fare well in the early stages of a bear market. Perhaps especially in this downturn, since its genesis is a medical crisis. And most particularly because many XLV companies are researching COVID-19 vaccines and treatments.

At the top of XLV’s 61-stock portfolio—representing more than 10% of the ETF’s capitalization—is Johnson & Johnson (NYSE: JNJ). The company, through its Janssen Pharmaceutical Companies partnership with the Biomedical Advanced Research and Development Authority (BARDA), is working on a vaccine with the objective of supplying more than a billion doses by early 2021. JNJ’s Janssen subsidiary identified a potential vaccine candidate back in January. Taking note of this, investors have pushed up JNJ’s stock 1.4% since the February 20 break.

Pfizer Inc. (NYSE: PFE) accounts for 5.6% of XLV’s market weight and is preparing, in collaboration with the German firm BioNTech SE (Nasdaq: BNTX), its own vaccine. With its mRNA inoculation already in clinical trials, PFE’s stock has stoutly rebounded since the February break and is now ahead 7.4%.

Another 16% of XLV’s market value is given over to companies engaged in coronavirus therapies, most notably Amgen Inc. (Nasdaq: AMGN), Eli Lilly & Co. (NYSE: LLY) and AbbVie Inc. (NYSE: ABBV). Amgen, in partnership with Adaptive Biotechnologies (Nasdaq: ADPT), is aiming to develop human neutralizing antibodies to treat COVID-19 infections. Lilly is in trials assessing the efficacy of Baricitinib while AbbVie’s focused on testing the antiviral capacity of Kaletra/Aluvia.

Nine XLV constituents, making up a third of the ETF’s capitalization, are involved in some way with the control or treatment of the coronavirus. That said, it’s likely XLV’s price action will be greatly influenced by these companies’ stocks for some time to come. XLV is now trading at the $100 level. Technically, the ETF’s longer-term trend points to a $156 objective that, if attained, would certainly be a bright spot on an otherwise dim investment horizon.

There’s a cautionary note to such a sanguine prognostication. The vaccine derby may be ultimately decided in favor of one, or none, of the XLV incumbents. The “loser” risks some deflation in its stock price when a “winner” is declared.

Still, history favors the health care sector now, at both the secular and business cycle levels. Even if 50%appreciation doesn’t materialize, our aging demographics and the industry’s traditional role as a recession investment militate for its inclusion, and perhaps an overweight, in asset allocations.

Brad Zigler is WealthManagement's alternative investments editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.