It's been an eventful 12 months for semi-transparent actively managed ETFs. Almost a year ago, American Century launched the first of what became approximately two dozen active ETFs that disclose holdings as frequently as mutual funds. American Century Focus Dynamic Growth ETF (FDG) and American Century Focused Large Cap Value ETF (FLV), the first two semi-transparent ETFs, kick-started the next phase in the ETF industry. Since then, Fidelity, Gabelli, Invesco, T Rowe Price and others launched similar products. In an exclusive interview with CFRA available on our MarketScope Advisor platform or at Growth Potential for Semi-Transparent Active ETFs - YouTube, we spoke to Ed Rosenberg, head of ETFs at American Century, about the appeal of these products and what to expect in the future.

Rosenberg explained clients get a fundamentally driven approach in a concentrated portfolio without fear of someone else front running the manager. For example, the $220 million FDG recently held 38 positions, but the top-10 represented 51% of assets. While we know Tesla and Amazon.com were the top two positions as of the end of February, American Century only provides the full portfolio for investors to assess on a quarterly basis. For example, less widely held stocks, such as Blueprint Medicines and Cactus, were part of the portfolio at the end of 2020, but might not be today.

It remains early days for these active ETFs. Actively managed ETFs gained popularity in 2020, in part due to the strong performance of—and client demand for—the well-established ARK Innovation (ARKK) ETF and its sibling products. Yet, active ETFs still represent less than 4% of overall ETF assets and many of the ETFs, particularly semi-transparent ones, are not widely available for purchase.

Rosenberg explained that these products are available on limited platforms, particularly only those used by registered investment advisors and self-directed investors, but not the broader wealth management community. He thinks we are not even in the first inning of the game; we have only just heard the national anthem and taken our seats. Indeed, while CFRA has favorable ratings on semi-transparent active ETFs such as T Rowe Price Blue Chip Growth ETF (TCHP) and FDG, our clients at various wirehouse and independent broker dealer platforms cannot yet follow our recommendations. We expect approvals will eventually be granted.

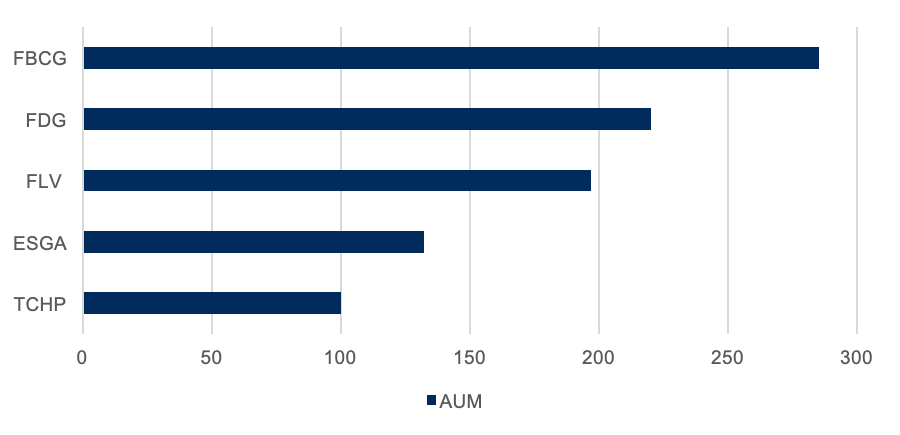

As we wrote last week in a thematic research article titled An Even Brighter Future for Active ETFs, 51% of respondents to a Schwab Investor study considered semi-transparent active ETFs a valuable investment tool. This interest, given the limited trading history of such ETFs, is particularly encouraging for funds like American Century Sustainable Equity ETF (ESGA), Fidelity Blue Chip Growth ETF (FBCG), FDG, FLV, TCHP and others.

Chart 1: Largest semi-transparent active ETFs ($M)

CFRA’s First Bridge ETF Database. As of March 19, 2021

As the SEC also becomes more comfortable with semi-transparent ETFs, advisors will have more funds to consider when building client portfolios. Rosenberg noted the semi-transparent ETF structures were approved by the regulators for use to support U.S. equity strategies. While the first product wave was focused on large-caps, in July 2020 American Century Mid-Cap Growth ETF (MID) began trading with management focused further down the market-cap spectrum, identifying approximately 30 companies with perceived upside potential.

In late 2019, American Century also sought regulatory approval to launch an international equity ETF and is awaiting the green light to move forward. We are hopeful that a year from now advisors will also have a range of international equity ETFs run by well-established active managers to consider.

Conclusion

A year ago, we had confidence that demand for then-pending semi-transparent active equity ETFs would materialize, but now we also believe advisors and investors will have access to more of these products in the next few years. Well established asset managers are making some of their best mutual fund strategies available through ETFs. Despite some differences between these ETFs and traditional active ETFs like ARKK, we think investors have sufficient insight to similarly consider these products. We provide a forward-looking star rating on these ETFs months after they begin trading.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.