In times like these, everybody’s eying VIX, the oft-tagged “fear index.” VIX, divined from the volatility embedded in S&P 500 index options traded on the Chicago Board Options Exchange (CBOE), represents the expected movement in the underlying benchmark over the upcoming 30-day period.

Historically, VIX hangs out at the 20 level, meaning an annualized volatility of 20 percent. Upward spikes in the metric signal option traders’ “padding” of premiums to cover the risk of anticipated price variations. VIX, for example, spiked above 40 in late August as China-related fears gripped the market. VIX, as a testament to mean reversion, has been drifting downward ever since.

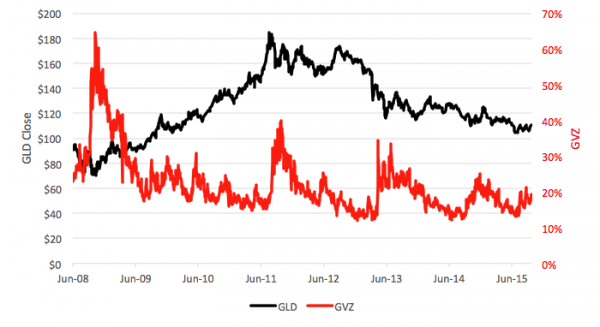

VIX isn’t the only fear index, though. The CBOE also calculates an indicator for the gold market. The CBOE Gold ETF Volatility Index, or GVZ, applies the VIX methodology to options on SPDR Gold Shares (NYSE Arca: GLD).

GVZ, like VIX, has averaged a reading of 20 or so over the past several years, but with a lot less, um, volatility. GVZ spikes tend to be smaller, but nonetheless offer insight into traders’ thinking. Big moves, like the 2008 run-up signaled a bullish turning point for GLD, just as a smaller 2001 advance that heralded GLD’s eventual weakening, can be seen easily on the chart; minor variances require monitoring GVZ’s 10-day moving average.

Gold caught a bid last Thursday, thrusting GLD above the $110 level for the first time since July. Volatility traders took note of a concomitant flash pick-up in GVZ. Spotting a 10 percent excursion above GVZ’s moving average, punters sold GLD down for a one-day gain of nearly two percent.

Two percent may not sound like much, but these opportunities crop up, on average, once every fifteen trading days. A few trades like these and, to paraphrase Everett Dirksen, you’re talking about real money.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.