Has anybody noticed how expensive it's gotten to hold gold? Gold futures, I mean. The contango in the Comex market has ballooned.

Contango's the premium you pay for contracting a deferred delivery. Typically, the further out your futures delivery date - in the gold market, anyway - the higher the premium. Today, for example, the July 2016 contract's selling for about $1,323 an ounce while the August 2017 delivery's at $1,343.

What accounts for the difference? The "cost of carry" is made up of storage charges and the cost of money, mostly. With a long-dated contract, you effectively pay "rent" for your gold's vault space as well as for the money used to finance the gold purchase.

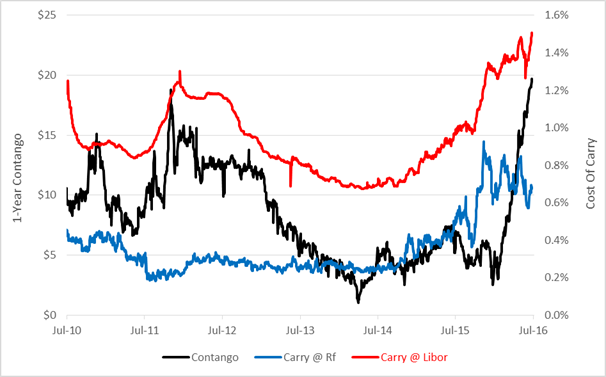

That cost has been skyrocketing this year. Take a look at the chart below:

The black line represents the rolling one-year contango for Comex gold futures. Six years ago, the contango was about $10 an ounce. Now it's nearly twice as high. Has the cost of storage gone up? Not really. As a fraction of gold's price, storage costs have actually come down. How about the cost of money? Well, that has gone up. Doubled, in fact, if you consider the risk-free (Rf) rate used in arbitrage calculations. A more real-world representation is the one-year Libor rate, which is now 30 percent higher than it was in July 2010. You can see the aggregate cost of carry traced by the blue and red lines on the chart.

So, does the rise in interest rates account for the hike in the contango? To a large extent, yes. But there are other factors, too. Chief among them is speculative pressure.

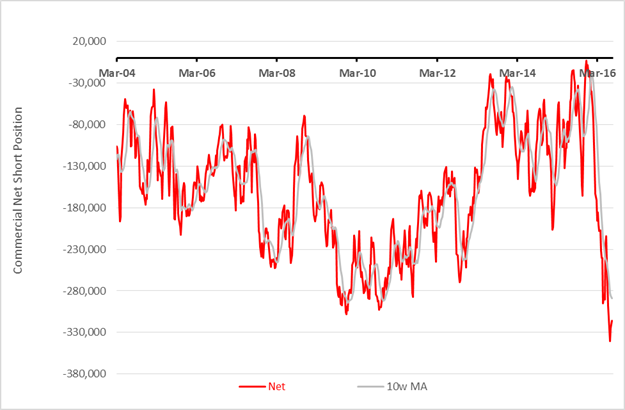

Speculative spikes in a contango are generally viewed as bearish by professional traders. That may explain why commercial traders, those with their fingers on the pulse of the gold market, have dug a historically deep net short position in gold futures. There's apparently a lot of hedging going on.

Even if the hedgers are wrong, investors in the PowerShares DB Gold ETF (NYSE Arca: DGL) should be especially mindful of the large and growing contango. DGL uses futures, rather than bullion, to obtain gold exposure. Despite an optimized roll methodology, contango has cost DGL investors an average 22 basis points per year, compared to return of the SPDR Gold Shares Trust (NYSE Arca: GLD), since contango rebounded in May 2014. And that cost is mounting. Just this month, DGL's negative roll yield was 1.3 percent.

It won't take but a few more months like that to convince some bulls that it's just too expensive to invest in gold futures.