We finally got a break in gold prices on Tuesday. And now there’s plenty of punditry explaining why. British PM Theresa May was named a culprit by many observers for talking down sterling (read: talking up the Yankee dollar) as she laid out a Brexit timeline. A strong dollar means weak gold, according to common wisdom.

That’s all fine and good, but gold’s move was ripening beforehand. We looked at the warning signs in last week’s column.

When gold lost its $1,300 handle this week, it sent the SPDR Gold Shares Trust (NYSE Arca: GLD) toward the $119 level targeted in our September 19 column. But is this move the end of the sell-off?

The answer may be found in the chart below.

See the green line? That’s the 100-week simple moving average (SMA) of GLD’s closing price. It’s been a reliable indicator of support and resistance levels when matched against crossovers in the ETF’s 13- and 34-week exponential moving averages (EMAs). Exponential moving averages weight recent market activity more heavily than earlier price action, while a simple moving average assigns the same weight to each day’s price action.

If the $119 level is breached to the downside, you should look to the 100-week SMA as a level of significant support. As of Tuesday’s close, the 100-week SMA was $115. That translates to a spot gold price near $1,204. Keep in mind, though, that moving averages are just that—moving. If a GLD rebound is persistent, the SMA rises; a protracted sell-off reduces the SMA.

Now, about that September 19 column…

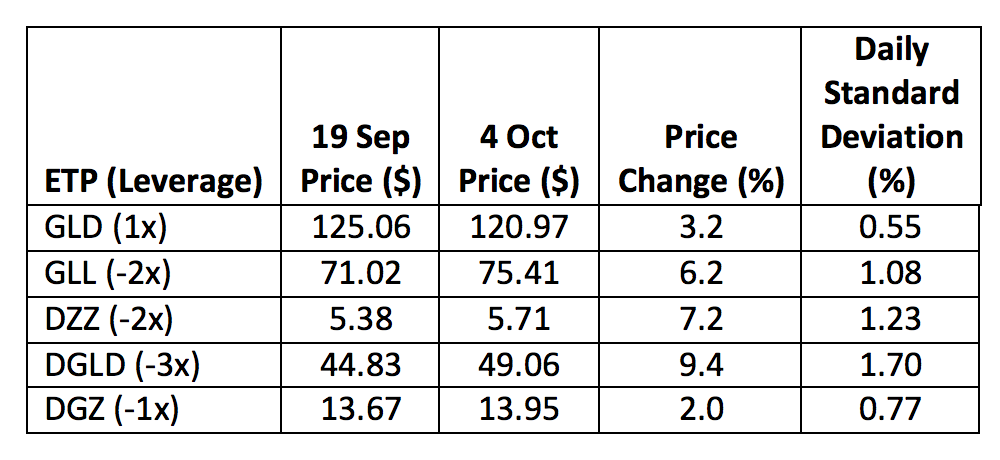

Back then, when spot gold was $1,313 or so, we looked at short gold exchange-traded products (ETPs) that traders or hedgers might use in anticipation of a metal sell-off. Here’s how they would have shaped up after Tuesday’s break:

If you’re a long-term bull, the current sell-off may be a buying opportunity, especially if you believe gold has the strength to challenge the bear market trendline established by the August 2011 top and the October 2012 test.

But if you think gold’s facing further headwinds, you’ve got plenty of ways to play the downside.

Brad Zigler is WealthManagement.com's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.