You may have noticed a certain wobbliness in the markets recently. If you haven’t, you’re probably not even reading this; you’re likely on holiday somewhere without a Wi-Fi connection. Lucky you!

The rest of us, however, are now transfixed by significant volatility spikes in both the equity and fixed income sectors. There hardly seems a safe haven.

But, in fact, there has been a refuge. It’s gold. And, more particularly, gold stocks. Consider the chart below. It depicts the percentage of gold miner stocks in a bullish trend.

So, 38 percent of gold mining shares are trending upward now, That, by itself, doesn’t seem very compelling, does it? But consider the fact that miner bullishness was just 17 percent coming out of the summer. According to some gold aficionados, miners had nowhere else to go but up.

True, some upside momentum can be attributed to the recent buoyancy in the price of bullion, but it’s all the more remarkable that these stocks are fighting against a downstream current that’s causing the rest of the equity market to tumble over a volatility cataract.

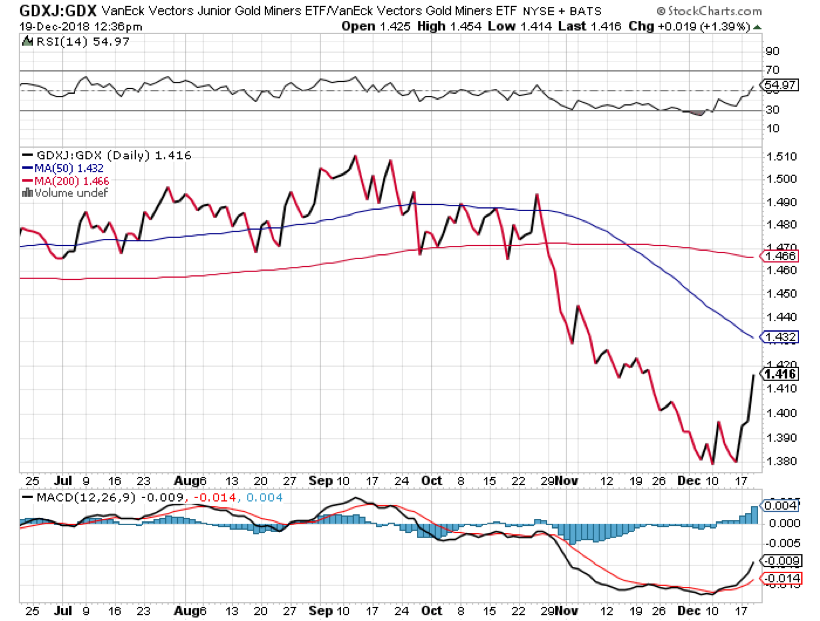

Is there more room on the upside for gold stocks? Well, that in part depends on how you define “gold stocks.” There are the large gold producers that populate the VanEck Vectors Gold Miners ETF (NYSE Arca: GDX) and then there are the smaller, more speculative issues that make up the VanEck Vectors Junior Gold Miners ETF (NYSE Arca: GDXJ). The price ratio of GDXJ over GDX is a barometer of the risk investors are willing to assume when they commit capital to gold stocks. A rising ratio denotes an increasing appetite, a falling ratio indicates defensiveness. The ratio’s current trend gives some nuance to the chart above.

Until just this week, buyers favored larger mining stocks. But now the ratio’s bouncing off a double bottom at the 1.38 level, indicating renewed interest in more speculative issues. Technically, the ratio’s shaping up for a test of 1.58, an area last visited in April 2017. So, it’s all good, right?

Maybe so. Over the past three years, an investment in gold stocks could have certainly enhanced the return of a balanced portfolio. The question for investors and advisors to ponder is whether a commitment to gold can actually diversify portfolio risk going forward.

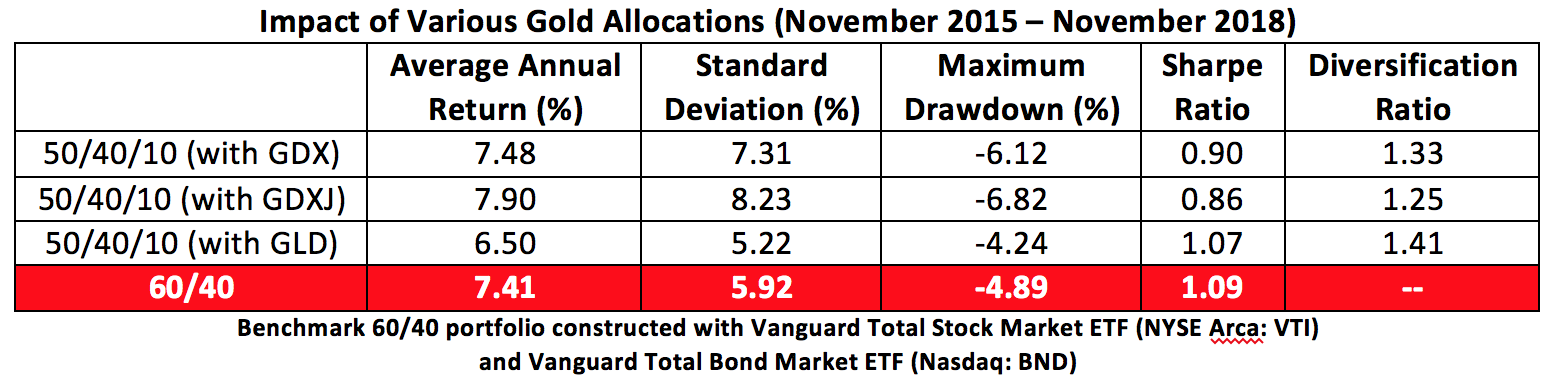

First, look to the past for some context. Start with a classic 60/40 portfolio and carve out a 10 percent allocation for gold, proxied by the SPDR Gold Shares ETF (NYSE Arca: GLD), or gold stocks—either GDXJ or GDX—from the equity side and you’ll see that miners, but not gold itself, would have boosted baseline returns. Bullion, however, has been a better volatility play over the past three years.

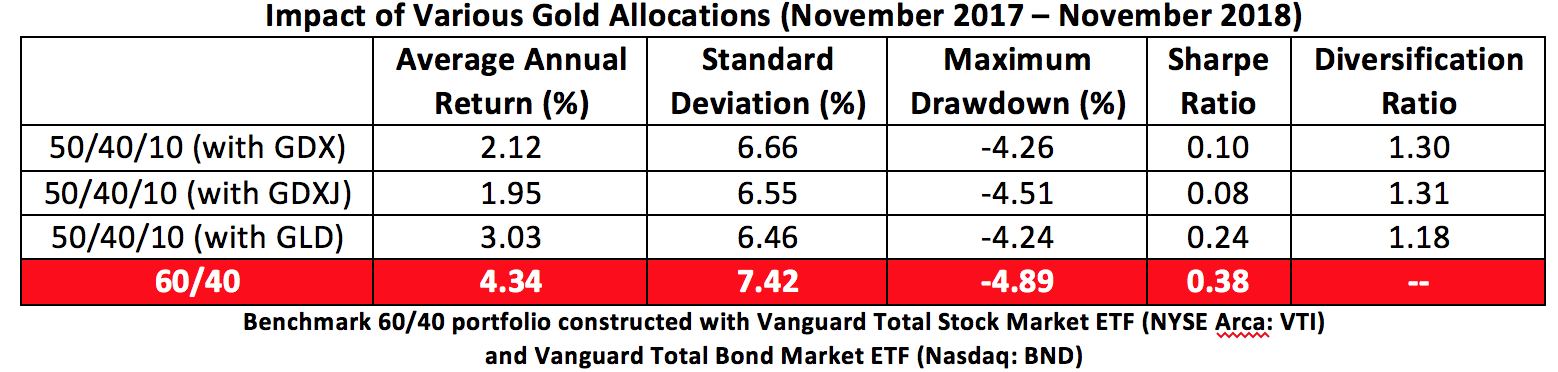

This fits well with history. Bullion tends to provide greater diversification although its price performance is often a drag on returns. More recently, though, conditions have been turned upside down. Over the past 12 months, investors have derived a greater diversification benefit from gold miners, but better returns with bullion.

So, what’s the best bet going forward? Gold stocks or gold bullion? Technically speaking, the nod goes to gold miners, especially those populating the GDXJ portfolio. Thoughtful portfolio managers may want to consider gold stocks in their future realignments along with other defensive market segments, such as utilities, consumer staples and healthcare.

Brad Zigler is WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.