In the market for gold? Just how many barrels of oil are you willing to give for an ounce of bullion? That’s not a silly question. Pundits watch the gold/oil ratio scrupulously to meter the state of the U.S. economy.

Let me explain.

At the top of the year, you’d have had to part with 28 barrels of light, sweet crude to get your hands on an ounce of 24K metal. And now? It only takes 19 barrels. So what, I hear you ask.

Perhaps a picture will give you some perspective. Historically, an ounce of gold buys 15 barrels of light, sweet crude oil. The ratio spikes upward in deflationary periods as gold, a safe harbor, rises relative to oil. Look, for example, what happened to the ratio during the Great Deleveraging of 2008-09. Then the ratio nearly tripled as the price of oil toppled 74 percent. Investors fled from the petroleum complex to squirrel money away in gold, pushing the ratio up from a 6 multiple to 25.

Generally, a ratio above 20 denotes a recessionary environment. Conversely, a slip below 10 signals inflation.

Now look at where we are. After the ratio’s recent near-record peak (it rose over 30 during the 1985-86 oil slump), its 200-day moving average is in sight on the downside. That said, are we going back to a more normative economy?

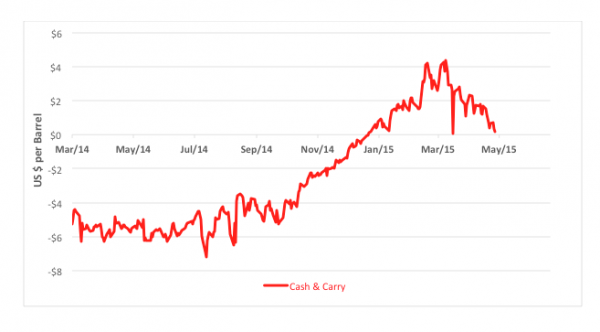

On the face of it, yes. With a caveat. The hike in the ratio was more likely due to an oil production boom than fears of global deflation. So much oil was afloat that a carry trade developed in the domestic market. Commercial traders, in fact, used the bourse as a bank. By buying oil cargoes, storing them and selling futures contracts against inventories, players could lock in profitable sales prices. At the peak, these cash-and-carry operations could net traders more than $4 a barrel, or nearly 10 percent, for a three-month hold. Now the trade’s worth little more than 30 basis points, still a better return than T-bills or commercial paper but not by much.

So yes, for whatever reason, normalcy is returning. And with the gold/oil ratio below 20, the odds favor buyers of oil and sellers of gold.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.