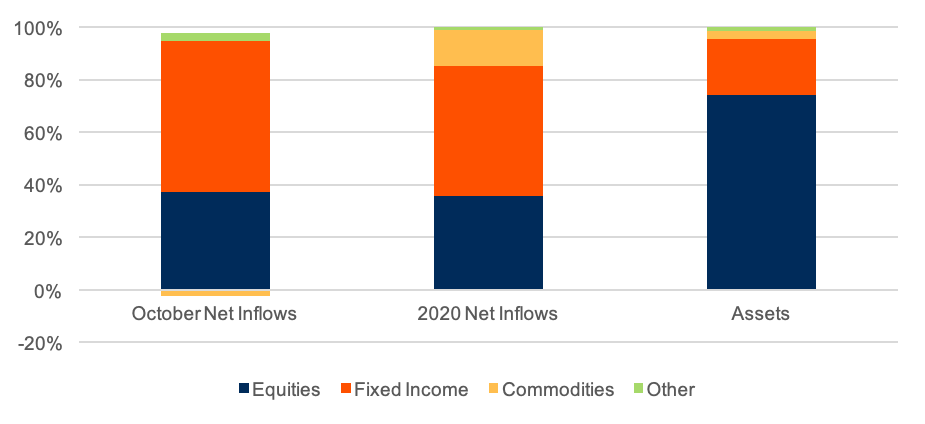

Aided by a strong October, fixed income ETFs represent half of net inflows in 2020. With $20 billion of net inflows last month, the fixed income ETF category pulled in 60% of the industry’s new money in October and pushed the year-to-date total cash haul to $172 billion. This 50% share of the net inflows is significantly higher than the 22% share of the overall asset base and is a further sign of growing adoption by institutional and retail investors. While equity funds still represent the lion’s share, at 74% of overall assets, investors benefit when they are broadly diversified to other investment styles, particularly as fixed income can act as a ballast.

Chart 1: Growing Demand for Fixed Income ETFs in 2020

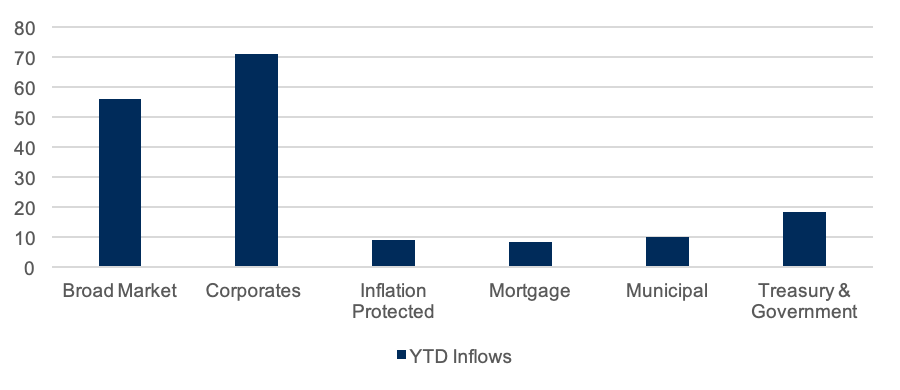

Corporate bond ETF demand persisted even without the Fed in October. While the Federal Reserve’s direct purchases of corporate bond ETFs earlier in the year helped support investor interest, the subcategory gathered $4.6 billion of net inflows in October to further drive year-to-date net inflows past $70 billion. Meanwhile, last month, a strong $7.8 billion of new money flowed into broad market fixed income ETFs, which generally own both investment-grade corporate bonds as well as Treasury and other government securities. For the year, this subcategory pulled in $56 billion of net inflows. In contrast, it has been a relatively muted year for Treasury and government ETFs, as investors have been more willing to embrace risk taking. The $18 billion for this subcategory was equal to an 11% share of the $172 billion of fixed income net inflows, much less than its 20% share of the overall category’s asset base.

Chart 2: Subcategory Fixed Income ETF Net Inflows in 2020 ($B)

Fixed income ETFs are a swiss-army knife for investors. While iShares Core U.S. Aggregate Bond ETF (AGG) and Vanguard Total Bond Market ETF (BND) provide a strong core for investors, there is an array of increasingly popular and liquid ETFs that have been well utilized. iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) pulled in the most money, with $18 billion of year-to-date inflows, but less interest-rate sensitive Vanguard Short-Term Corporate Bond ETF (VCSH) and iShares Short-Term Corporate Bond ETF (IGSB) gathered $8.1 billion and $7.9 billion, respectively.

Meanwhile, some investors were willing to embrace credit risk, as seen by the $5.1 billion of net inflows thus far in 2020 to iShares iBoxx $ High Yield Corporate Bond ETF (HYG), while $5 billion and $3.4 billion of new money sought the relative safety of SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) and Schwab U.S. TIPs ETF (SCHP).

Active ETFs are punching above their weight in 2020. While actively managed funds manage 9.6% of fixed income ETF assets, these products have gathered 13% of the net inflows in 2020. Demand remains particularly high for ultra-short-term active funds, including JPMorgan Ultra-Short Income ETF (JPST), JPMorgan Ultra-Short Income ETF (JPST), First Trust Enhanced Short Maturity (FTSM), iShares Ultra Short-Term Bond (ICSH) and Janus Short Duration Income ETF (VNLA). As with BIL, these funds incur similarly modest interest rate risk but provide higher income. Given the likelihood of market uncertainty following the 2020 election, we think investor demand for these active funds could remain high through the end of the year.

Conclusion

Fixed income ETF demand has continued to climb higher throughout 2020 as investors have embraced the liquidity and targeted exposure these funds provide. We think demand will remain high in the last two months of the year, as these funds provide stability during times of market uncertainty.

CFRA will be hosting a webinar with PIMCO portfolio managers titled Be Cash Conscious in a Low-Rate High-Tax World; The Appeal of Active Short-Term Bond ETFs on November 10. To register for the event, visit https://go.cfraresearch.com/pimco-cash.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.