By Luzi Ann Javier and Megan Durisin

(Bloomberg) --The euphoria that had lured investors back into commodities is showing signs of fatigue.

After cash poured into exchange-traded funds linked to raw materials earlier this year, inflows have plunged in recent weeks. The spigot is turning off even as banks including Goldman Sachs Group Inc. urge investors to have “patience” in the wake of a waning price rally.

At stake is more than $400 billion that Citigroup Inc. estimates is invested in commodity markets stuck in a tug-of-war between supply and demand. Investors are focused on rising global inventories for everything from crude oil to soybeans, while Goldman says the pace of economic growth in China will drive raw-materials consumption.

“We were getting very close to initiating longs in a lot of commodities at the beginning of the year, and they just kind of fizzled out,” said Tom Dering, a New York-based executive vice president at Chesapeake Capital, which oversees $220 million. “We’re much lighter in our commodity exposure than average. When things get into this range, we’re neutral. We’re looking for some sort of movement one way or the other.”

The Bloomberg Commodity Index, which tracks returns for 22 components, has dipped about 4 percent since this year’s peak in mid-January. The gauge fell 2.7 percent in March, the first monthly loss since October, and hasn’t been doing much in April. Prices added 0.2 percent on Friday.

The listless track down has curbed enthusiasm for the asset class, especially after global equities reached all-time highs.

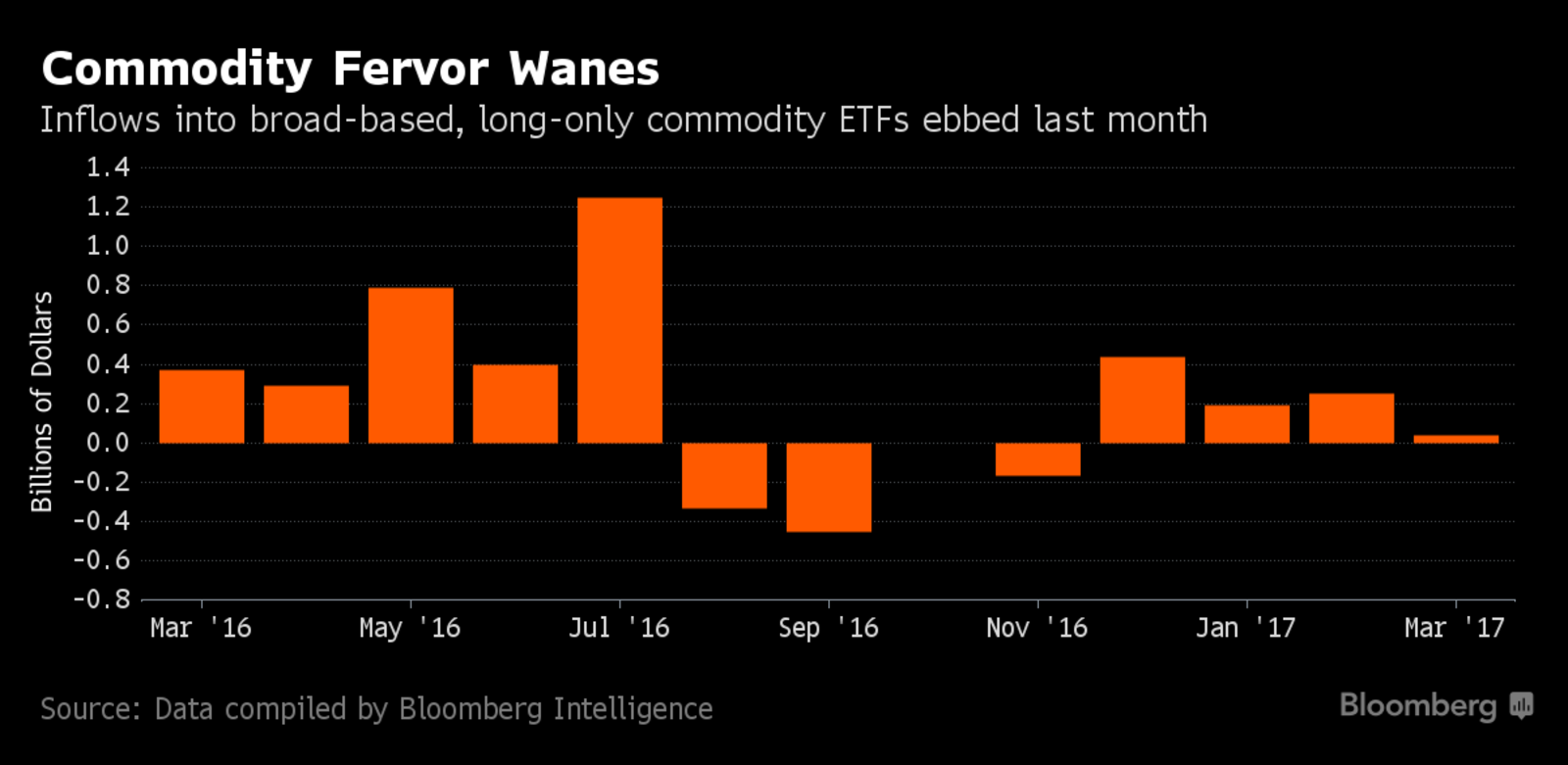

ETF Flows

Long-only ETFs linked to broad-baskets of raw materials attracted just about $20 million in March, the least since November, data compiled by Bloomberg Intelligence show. Since then, investors have grown even more weary. In the past week, commodity ETFs as a whole saw outflows of almost $88 million, data compiled by Bloomberg show. The declines were led by two energy ETFs, and one broad-basket fund.

Even commodity hedge funds have been bleeding. Chicago-based Hedge Fund Research Inc.’s index tracking funds invested in commodities dropped 2.3 percent in the six months ended in February, the latest figures show. That compares with a gain of 3.4 percent for global hedge funds and 4.4 percent for those investing in equities.

The declines have sent money managers packing. Hedge funds and other large speculators cut their combined net-long position, or the difference between bets on a price increase and wagers on a decline, across 18 commodities for six straight weeks, U.S. government data show. They now have a holding of 728,778 futures and options contracts, the lowest in almost a year, figures through March 28 show.

Investor sentiment turned negative amid renewed concerns that commodity supplies are much larger than demand as economic expansion cools in China. U.S. crude stockpiles have reached the highest level in Energy Information Administration data compiled since 1982, a report showed this week. The U.S. Department of Agriculture predicts global wheat, corn and soybean reserves will climb to records. Copper inventories monitored by exchanges in London, New York and Shanghai are up 23 percent from a year ago.

Still, Goldman insists there’s no need to hit the panic button. The bank, which in November recommended an overweight position in the asset class for the first time in more than four years, says investors’ concerns, especially over a slowdown in China, are “misplaced.” Oil-supply cuts from OPEC countries, a surge in Chinese credit, and strong signals of global industrial activity will underpin commodity prices, the bank said in a March 12 note, its latest outlook.

Goldman View

“We remain very confident in the fundamental follow through and maintain our positive outlook across the commodity complex,” Goldman analysts led by Jeff Currie, the bank’s head of commodities research, said in the note.

Goldman isn’t alone.

Citigroup predicts a rebound of inflows during the second quarter for commodity-tracking assets estimated at $408 billion at the end of February. While some of that passive-index investment retrenched in March, it will grow as crude prices rally, boosted by production limits imposed by the Organization of Petroleum Exporting Countries, analysts including Aakash Doshi said in an April 3 report.

There’s one area where both the investors and Goldman seem to agree: agriculture.

Investors pulled about $60 million from agriculture ETFs in March, the biggest monthly outflow since November. Speculators have a combined net-long position across 11 farm products of 56,025 contracts, the lowest in a year, and they’re betting on declines for corn, wheat, cocoa, coffee and soybean oil. Goldman forecasts the sector will lose about 1.1 percent over three months, the bank said in its March report.

“As long as inflation is contained, then we’d really be looking at more of a neutral stance on commodities as a whole,” said Mark Watkins, the Park City, Utah-based regional investment manager for the Private Client Group at U.S. Bank, which oversees $138 billion. For energy, “we’re starting to see more demand as the global economy improves, but that’s something that’s still relatively slow.”

To contact the reporters on this story: Luzi Ann Javier in New York at [email protected] ;Megan Durisin in Chicago at [email protected] To contact the editors responsible for this story: James Attwood at [email protected] Millie Munshi, Steve Stroth