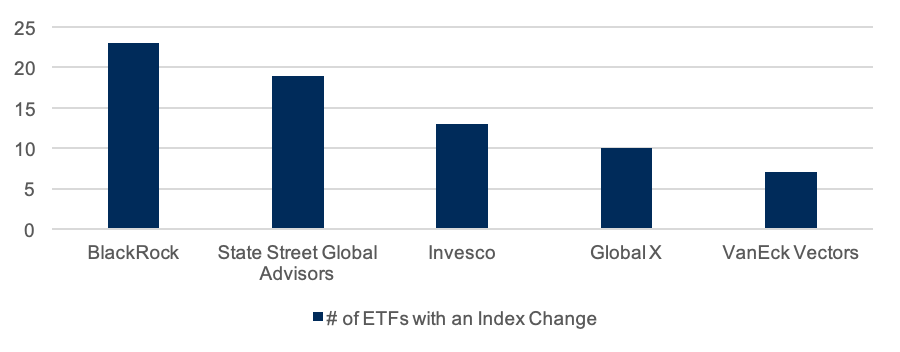

Since the beginning of 2018, 124 U.S. listed ETFs tracked by CFRA changed the underlying tracking index, limiting the value of the ETFs’ track records. While 96% of ETF assets passively track a benchmark, typically from outside firms such as S&P, Dow Jones or Morningstar, the securities inside a growing number of these ETFs shifted in the last few years due to adoption of new indexes. Investors in a smart-beta ETF may be aware that regular reconstitution occurs during a year, based on the rules of the low volatility, momentum or value index. However, they may be surprised to learn that the managers often have to toss out the old rule book and replace it with another one for market-cap weighted and smart-beta products. CFRA tracks index replacements in our global ETF database.

Figure 1: The # of ETFs Using a Different Benchmark Since 2018

CFRA’s ETF Database. As of June 21, 2021.

BlackRock changed underlying indexes on 23 ETFs in the last three-plus years. In late May, we wrote an article titled “The Largest Biotech ETF is Emerging from the Lab with a New Index” highlighting how $10 billion iShares Biotechnology ETF (IBB) was soon shifting from a Nasdaq benchmark to an ICE one that had historically performed better and that would be adding life sciences and tools companies such IQVIA and Waters. The change occurred, as we expected, following the market close on June 21. This week, BlackRock also shifted to an ICE index for its $6.5 billion iShares Semiconductor ETF (SOXX). CFRA’s current ETF ratings on IBB and SOXX reflect their prior portfolios, but we will be refreshing our ratings next month.

In March 2021, BlackRock, which is the largest ETF provider, also revamped eight U.S. equity style ETFs. BlackRock changed the Morningstar benchmarks the funds were tracking and simultaneously slashed fund expense ratios. iShares Morningstar Growth ETF (ILCG), a $2 billion offering, is one example that underwent changes. This ETF, which charges a minuscule 0.04% expense ratio, now tracks the multi-cap Morningstar U.S. Large-Mid Cap Broad Growth Index rather than the prior Morningstar Large Cap Growth Index. The addition of mid-cap stocks has adjusted the risk and reward profile of the portfolio, according to CFRA.

BlackRock has a series of sector ETFs set to change benchmarks in the coming months.

State Street Global Advisors adjusted the benchmarks for 19 ETFs since 2018. In January 2020, State Street replaced proprietary benchmarks for four of its ETFs with ones from S&P Dow Jones Indices. The $10 billion SPDR Portfolio S&P 500 ETF (SPLG) is the most prominent, as SPLG tracks the same index as the industry’s largest product, SPDR S&P 500 ETF (SPY). SPLG stands out for charging an expense ratio of 0.03%, one-third the fee of SPY, providing State Street a more retail friendly alternative to offer investors.

Meanwhile, in September 2019, SPDR Portfolio High Yield Bond ETF (SPHY) began tracking the ICE Bank of America Merrill Lynch High Yield Index instead of the ICE Bank of American Merrill Lynch Diversified Crossover Corporate Index, taking on additional credit risk. SPHY charges a 0.10% expense ratio and is now a lower-cost alternative to the firm’s popular SPDR Bloomberg Barclays High Yield Bond ETF (JNK).

Invesco’s smart-beta lineup has also undergone some makeovers. In June 2019, Invesco changed the benchmarks for many of its alternatively weighted equity products. One example is Invesco S&P 500 GARP ETF (SPGP), which moved from a Russell index focused solely on growth characteristics to S&P-based benchmarks combining growth, quality, and value analytics. Other Invesco ETFs that shifted in 2019 from a Russell index to an S&P one include Invesco S&P 500 Value with Momentum (SPVM) and Invesco S&P MidCap Momentum (XMMO).

Conclusion

CFRA’s ETF star ratings are derived from what is inside the portfolio and how much it costs rather than solely relying on past performance. The value of this approach is particularly notable when an ETF changes its tracking index, as this makes the fund’s track record less useful. Our favorable view on ILCG, SPGP, SPHY, and XMMO incorporates a risk and reward assessment of the current portfolio despite benchmark changes.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.