By Sarah Ponczek and Vildana Hajric

(Bloomberg) --Wall Street’s going to have to adjust its business to account for a not-so-new but fast growing asset class: exchange-traded funds.

Treating ETFs as a class of assets independent from stocks is among the nine biggest market structure trends for 2019, according to a report from Greenwich Associates Wednesday. It’s testament to just how popular these tradable portfolios have become -- and how increasingly important they are to global financial markets.

“The last two years have really seen ETFs come into their own as a tool for institutional portfolios,” Kevin McPartland, managing director at Greenwich Associates and one of the authors of the report, said in an interview. “Now it’s time to think about how can we do this better.”

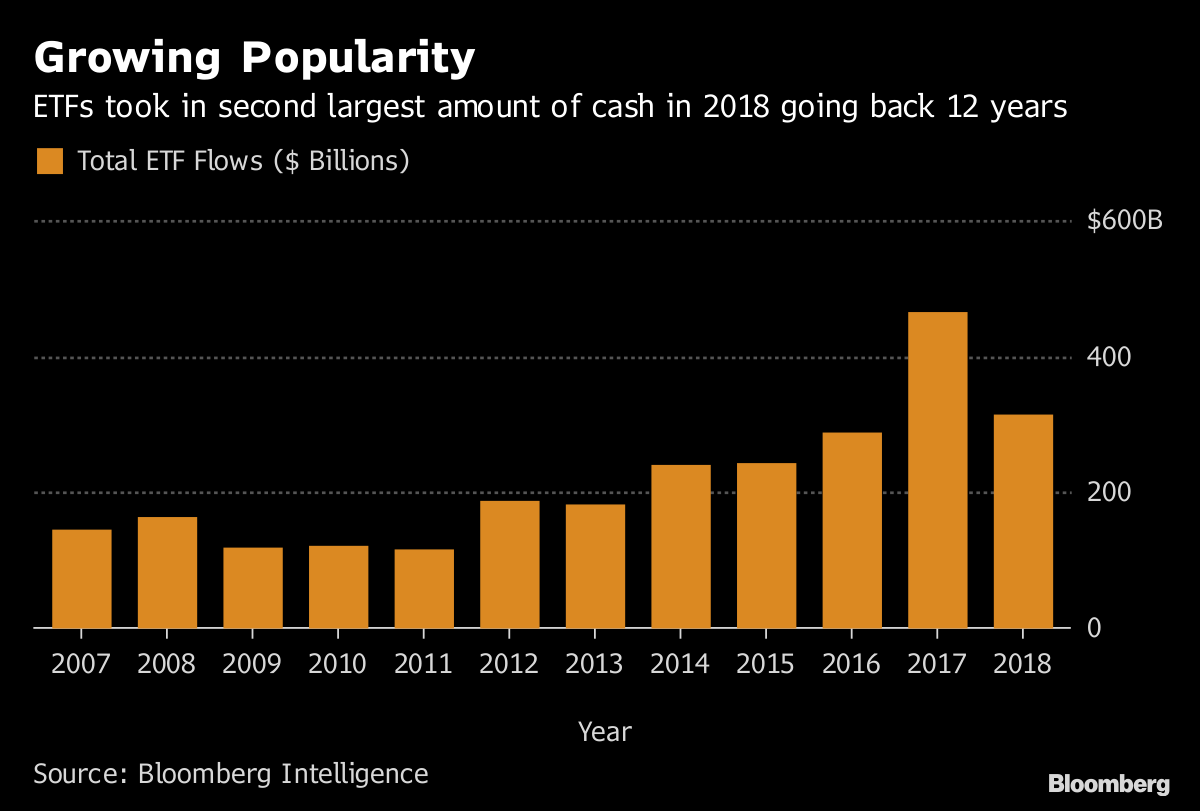

ETFs took in more than $310 billion in 2018, down about 33 percent from 2017 but still the second best performance in the past dozen years, Bloomberg Intelligence data show. And while mutual funds have recently seen redemptions, ETFs continue to rake in cash.

Although ETFs trade like stocks, the authors of the Greenwich report believe that investors need to stop treating the two as if they’re the same. For example, increasingly popular bond ETFs shouldn’t be evaluated as if they’re a single stock. So industry evolution is necessary. To keep up, investors will need trading algorithms, transaction cost analytics and other tools to optimize portfolios.

“You wouldn’t trade IBM the same way you’d trade a basket of bonds,” McPartland said. “It’s not looking at the right market factors, it’s not taking into account the underlying value of the basket of bonds. The market is really starting to accept that fact -- that they’re not stocks and should be traded on the fundamentals or makeup of underlying portfolios, and that tools should be developed to do just that.”

It’s crucial for Wall Street to adapt because ETFs are increasingly at the center of market activity. And with the volatility of 2018 likely to continue this year, investors will need all the help they can get in assessing how well these funds can withstand turmoil after a long stretch of relative tranquility.

“This will be a good test for a variety of things over the last decade,” McPartland said. “How will they stand up to market shocks? And some of the early trading tools that have been developed, will they perform as expected under tougher market conditions?”

--With assistance from Rachel Evans.To contact the reporters on this story: Sarah Ponczek in New York at [email protected] ;Vildana Hajric in New York at [email protected] To contact the editors responsible for this story: Jeremy Herron at [email protected] Eric J. Weiner, Andrew Dunn