In Star Wars, there are few things more puzzling than the stormtrooper. More specifically, the contradiction between their reputation (Obi Wan states “only Imperial stormtroopers are so precise”) and what we see (wildly inaccurate shooting). We believe that ESG funds are the stormtroopers of the investment world. Investors believe these funds to be ruthlessly efficient in providing the kinds of socially responsible companies they want to own, when the reality is, their aim is nearly as bad as those hapless stormtroopers.

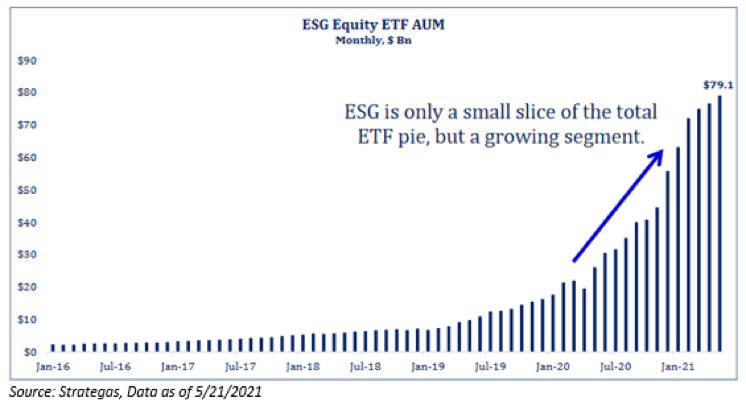

Born within the confines of foundations and college endowments, the trend of owning ESG has spread to public pension plans and most recently, individual investors. This should come as no surprise given that we live in a time in which social media links politics and popular culture. Furthermore, asset managers have been increasingly asked to take into account the environmental and social impact of the companies they own while paying attention to the standards of governance, given that they are managing other people’s money. Just look at the amount of assets that have flown into ESG-related funds over the last two years:

Don't get me wrong, at Aptus, we believe that understanding ESG is pivotal to our overall investment process—we want to do well, by doing good. So let's take a look at where we believe most people are missing the mark on ESG investing:

Same Exposure as the S&P 500:

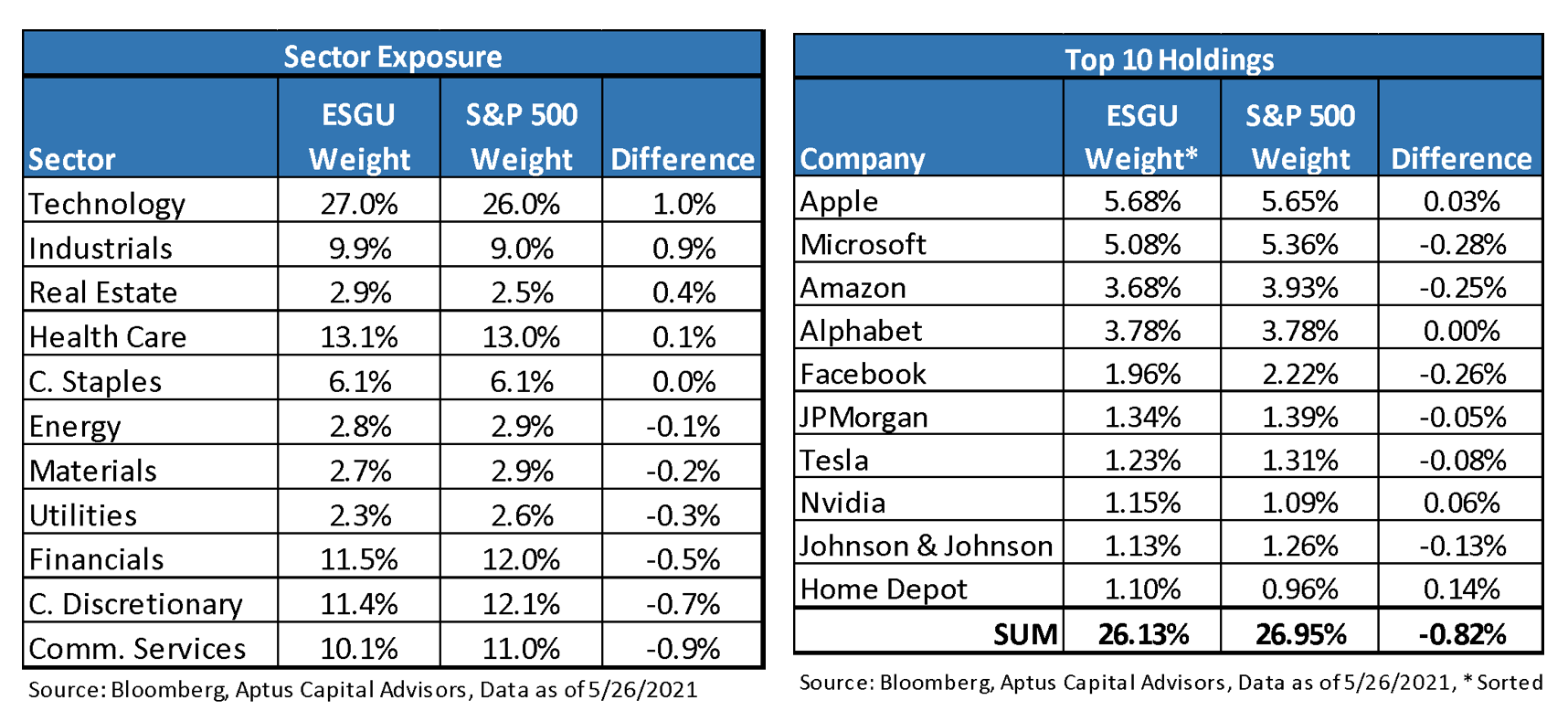

The most popular ESG ETF, the iShares ESG Aware ETF (ESGU), has ~22% of all assets in this thematic space—the dominant player. So, let us pick on this fund. If you look below, do you see any differences between the sector allocation and top holdings?

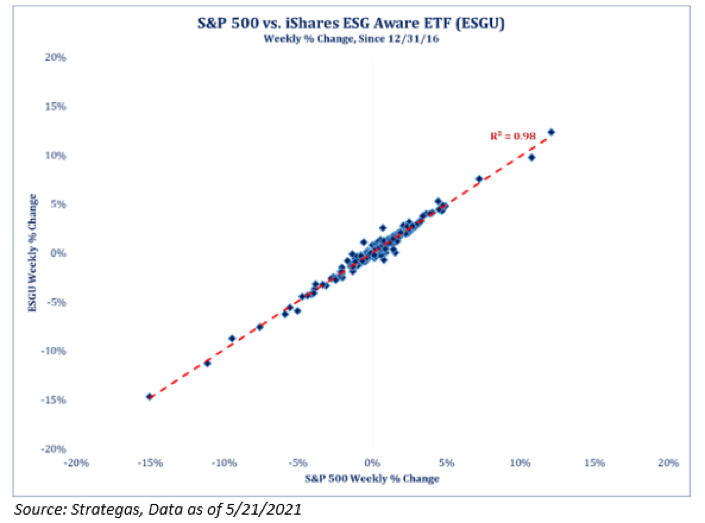

If you start to get into the weeds of these funds, you find out that it’s very difficult to find any material differences. More importantly, the fund itself has a 98% correlation with the S&P 500—basically identical to the broader index.

Inconsistency Surrounding Holdings:

We believe that viewing all companies and the products they produce through a lens of virtue leads to very few easy decisions regarding investing. For example, per MIT Sloan’s working paper entitled “Aggregate Confusion: The Divergence of ESG Ratings,” the correlation between ESG ratings across different providers is around 0.3. This contrasts with credit ratings, where the correlation between ratings by S&P and Moody’s is around 0.99.

The inconsistencies are inexplicable in my mind on two different levels:

- Binary Discrepancies—ESGU owns General Motors and Tesla but does not own Ford. That does not make sense to me. Furthermore, ESGU does not own Lockheed Martin, Boeing and Northrup Grumman, which we feel is understandable, but owning Textron and Honeywell is contradictory. We believe that there needs to be consistency.

- Rating Discrepancies—Rating companies rate/rank the same companies differently. Examples:

- Provider 1 ranks Wells Fargo as top-quartile in Governance, while Provider 2 ranks it in the bottom 5%. That’s because Provider 1 counts the fake bank accounts scandal within “Information to Customers,” which is part of its Social score, not Governance score.

-

- Provider 1 gives Facebook a top 10% Environmental rating, while Provider 2 ranks it in the bottom 30%. That’s because their Environmental ratings measure quite different attributes, and each attribute has different weights.

What does this tell investors? We think it means that we cannot solely rely on ratings—there needs to be a deep understanding of a company—talk to management and take into account its strategic context—and means that human investors can add what we believe is a substantial amount of value even in a big data world.

Pricing:

As we continue to pick on ESGU, and this is very consistent among all ESG funds, the biggest difference and the most appalling problem to us is pricing. Given that you are basically getting S&P 500 exposure, why are investors carrying a freight of 15 bps in expenses for ESGU—relative to an index fund around 3 bps? In short, from our perspective, and what is often not said, is that the products being sold to achieve these social goals are little different from the broader Index itself, merely more expensive.

We love that a lot of our clients understand the societal and alpha-generative benefits of ESG. At Aptus, we believe that there is a lot of validity in ESG—we want to do well, by doing good. But we want to make sure that we are hitting the intended target of the desired exposure.

For simplicity, since this topic is far from that, we’ll heed to Yoda’s basic advice: “You must unlearn what you have learned”.

Don’t be a stormtrooper, be a Jedi.

Dave Wagner is a portfolio manager and analyst at Aptus Capital Advisors.