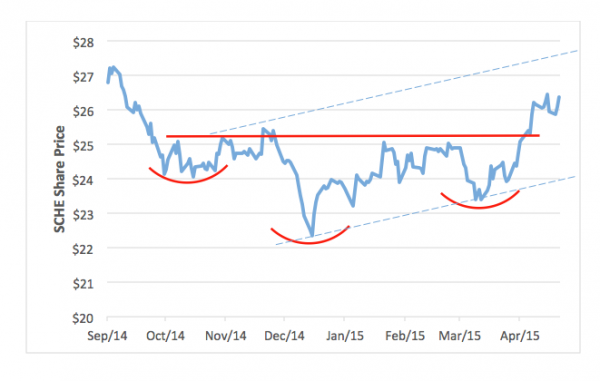

After a horrid collapse late last year, emerging market stocks have come roaring back in 2015. Not without considerable basebuilding, however. Several emerging market exchange-traded funds spent the last six months churning in head-and-shoulder bottom formations. The chart for the low-cost leader, the Schwab Emerging Markets Equity ETF (NYSE Arca: SCHE) is typical.

SCHE, the smallest of the broad-based emerging markets funds, competes head-to-head with sector behemoth Vanguard FTSE Emerging Markets ETF (NYSE Arca: VWO). Both funds track the same index but, due to tracking error, produced slightly different year-to-date returns. The funds’ greatest exposure – 25 percent of assets -- is to China. India makes up 13 percent while South Africa makes up 10 percent.

Emerging market indices do not represent a homogenous group of countries. Two BlackRock products, the iShares Core MSCI Emerging Markets ETF (NYSE Arca: IEMG) and the iShares MSCI Emerging Markets ETF (NYSE Arca: EEM), for example, include Korean companies in their asset mixes; the FTSE-based funds do not.

The IEMG portfolio looks very similar to its EEM sibling but is more comprehensive because it includes smaller firms. IEMG boasts more than 1,700 stocks in portfolio; there are 800 or so issues stashed within EEM.

Rounding out the head-and-shoulders set is the Direxion Daily Emerging Markets Bull 3X ETF (NYSE Arca: EDC) which tracks the same benchmark (for one day at a time anyway) as EEM. EDC offers 300 percent exposure to the MSCI Emerging Markets Index.

Arguably, the FTSE-based ETFs may be the more “emerging” of the emerging market products. Why? Because Korea’s per capita income is fast approaching that of many developed countries. And, since Korean companies aren’t in the funds’ benchmarks, more room is allotted for other countries like India which has a standard of living more closely aligned with frontier markets.

Still, the year-to-date performance of the four unlevered funds has been similar, averaging slightly more than 11 percent (versus a shade over 2 percent for the S&P 500). And, because of the similarities in their price patterns, their near-term price objectives are alike as well. Each of the unlevered funds have the potential to rise another 5 percent from here to complete their head-and-shoulders configurations. The leveraged EDC fund, of course, has the potential to crank out a more substantial gain -- at the cost of greater volatility, mind you.

| YTD Return (%) | Yield (%) | Assets ($mm) | Expense (%) | Price ($) | Target ($) | |

|---|---|---|---|---|---|---|

| Schwab SCHE | 11.1 | 2.8 | 1,270 | .14 | 26.55 | 28 |

| Vanguard VWO | 11.3 | 2.7 | 63,440 | .15 | 44.50 | 47 |

| iShares IEMG | 12.0 | 2.3 | 6,770 | .17 | 54.12 | 56 |

| iShares EEM | 11.4 | 2.1 | 29,570 | .67 | 45.20 | 46 |

| Direxion EDC (3X) | 33.0 | -- | 265 | .95 | 30.50 | 37 |

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.