Fixed income ETFs have pulled in half of the net inflows to U.S.-listed ETFs thus far in 2020. As a category, fixed income ETFs gathered $134 billion of new money year to date through Aug. 21, according to CFRA’s First Bridge ETF database, much higher than the $87 billion for equity products and fixed income’s modest 21% share of the $4.8 trillion ETF asset base. The $66 billion of inflows to corporate bond ETFs has dwarfed all ETF asset subcategories, such as broad market U.S. equities ($38 billion) and gold and metals commodities ($37 billion).

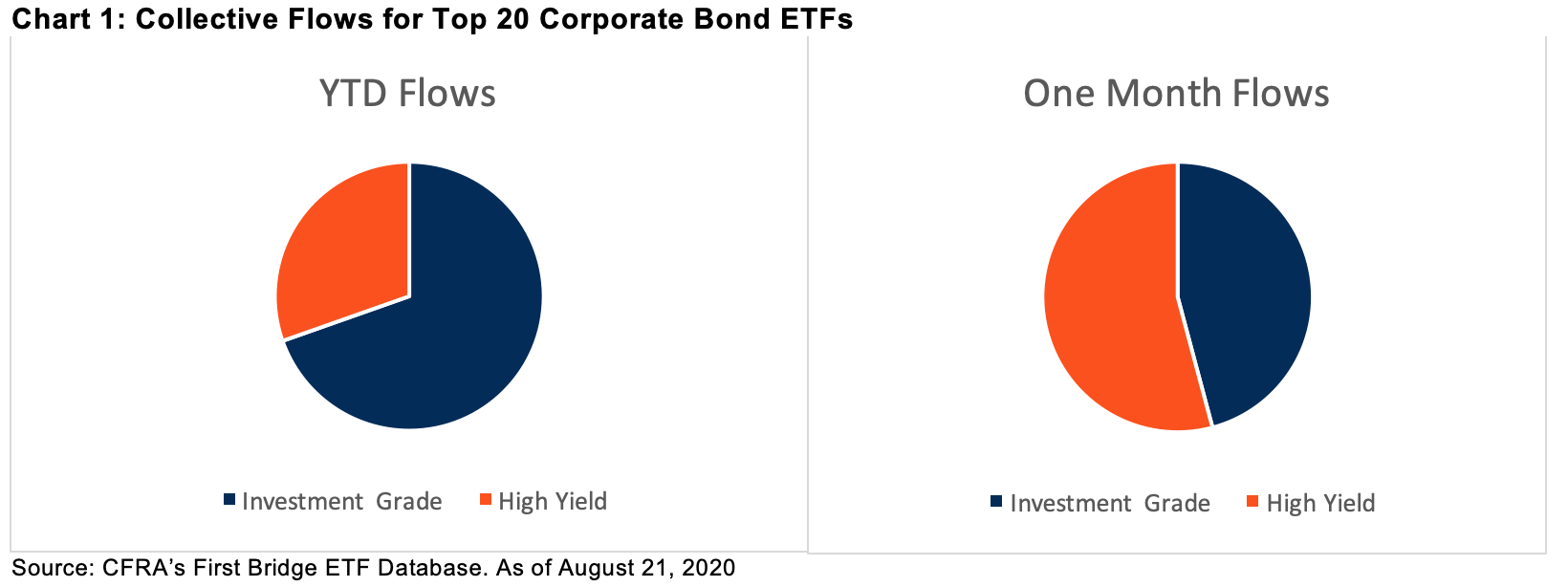

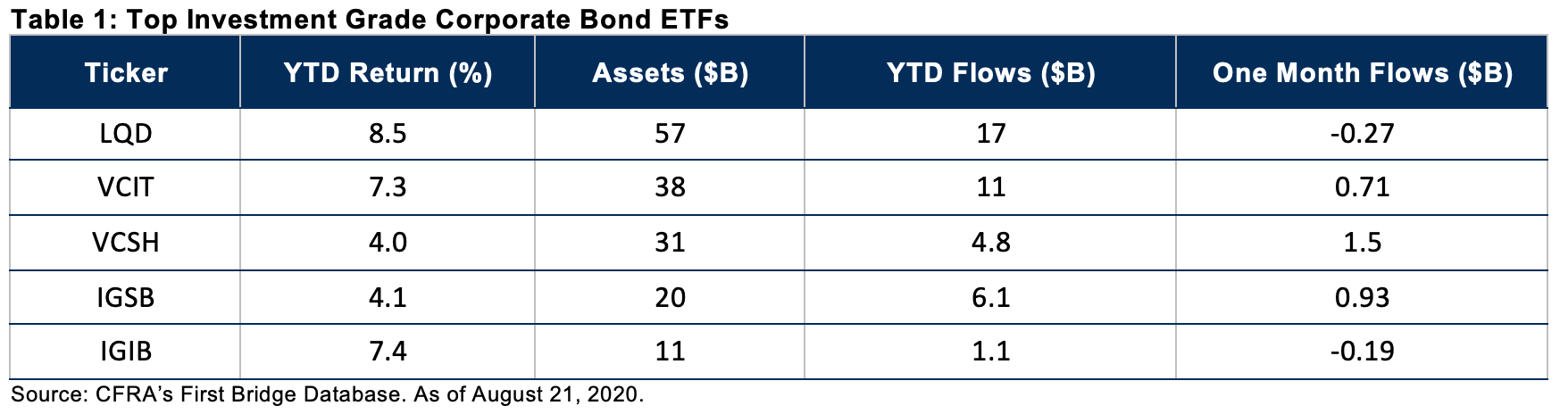

The corporate bond ETF market is highly concentrated. The 20 largest corporate bond ETFs received $63 billion of net inflows in 2020. Among this cohort, investment-grade ETFs gathered 70% of the cash haul year to date through Aug. 21, largely consistent with the 73% share of the corporate bond ETF asset base. iShares iBoxx $ Investment Grade Corporate Bond (LQD) had net inflows of more than $17 billion this year to push the ETF’s asset above $56 billion, while Vanguard Intermediate-Term Corporate Bond (VCIT) pulled in $11 billion to reach $38 billion. iShares Short-Term Corporate Bond ETF (IGSB) and Vanguard Short-Term Corporate Bond ETF (VCSH) were also popular and brought in $6.1 billion and $4.8 billion, respectively.

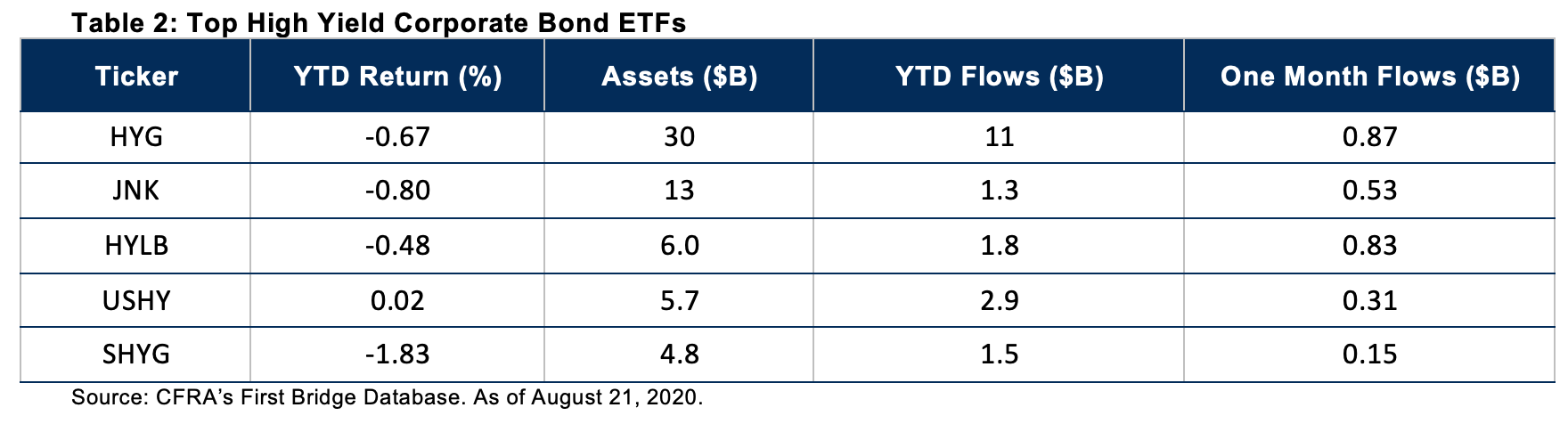

However, in the past month the higher-credit-worthy-bond funds pulled in just 46% of new money, as investors embraced credit risk. For example, the $30 billion iShares iBoxx $ High Yield Corporate Bond ETF (HYG) gathered approximately $870 million of new money, while LQD had $268 million of net outflows in the one-month period ended August 21.

Taking on interest rate has been rewarding in 2020 as the 10-year Treasury yield remains below 1%. LQD rose 8.5% year to date through Aug. 21, ahead of the 7.4% for iShares Intermediate-Term Corporate Bond ETF (IGIB) and 7.3% for VCIT, aided by LQD’s elevated interest rate sensitivity. LQD’s average 9.6 years of duration was higher than IGIB’s 6.4 years and VCIT’s 6.5 years. Meanwhile, the iShares Short-Term Corporate Bond ETF (IGSB) and VSCH rose just 4.1% and 4%, respectively.

Looking forward, CFRA thinks the prospects for LQD are strong; the ETF earns a five-star rating in our fixed income ETF category, while VCSH and IGSB earn three-star ratings. CFRA fixed income ETF ratings combine holdings-level analysis and fund attributes to assess the costs, risk and reward potential relative to the broader asset category.

Cheaper high-yield ETFs are gaining ground. While HYG remains the largest high-yield bond ETF, Xtrackers USD High Yield Corporate Bond (HYLB) and iShares Broad USD High Yield Corporate Bond ETF (USHY) are growing in size faster than $13 billion SPDR Bloomberg Barclays High Yield Bond ETF (JNK), which is the second-largest high-yield ETF offering. Year to date through Aug. 21, USHY and HYLB gathered $2.9 billion and $1.8 billion of new money, respectively, higher than JNK’s $1.3 billion 2020 cash infusion.

HYLB and USHY both charge 0.15% expense ratios, much lower than JNK’s 0.40% fee. As more investors embrace ETFs to support tactical asset allocation needs, we think the fee savings will matter more. This year, there have also been slight performance differences in favor of the cheaper products, with JNK’s 0.80% loss wider than HYLB’s 0.48% decline and USHY’s 0.02% gain.

CFRA thinks credit risk has and will continue to be rewarded given the low interest rate environment and the prospects for an economic recovery in 2021. We have five-star ratings on HYG, HYLB, JNK and USHY.

Conclusion

Investors continue to embrace corporate bond ETFs in 2020. The Federal Reserve’s recent efforts to improve the credit markets, by purchasing individual bonds and more diversified ETFs, has proven a catalyst. However, we think demand will persist throughout the remainder of the year and beyond as institutional and wealth markets benefit from the liquidity, transparency and low costs of corporate bond ETFs. Using our forward-looking star ratings, we help investors sort through the universe.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.