While ETFs focused on companies helping protect the environment or practicing good corporate governance remain a small piece of the growing ETF pie, they are starting to capture larger slices. Assets in environmental, social and governance (ESG) equity ETFs climbed 63% since the end of 2017, stronger than the 17% growth for broader smart beta ETF strategies as of late May. In 2019, some highly successful ESG product launches helped to drive overall flows; however, we think many investors do not understand what drives, and what does and does not make it into an ESG ETF.

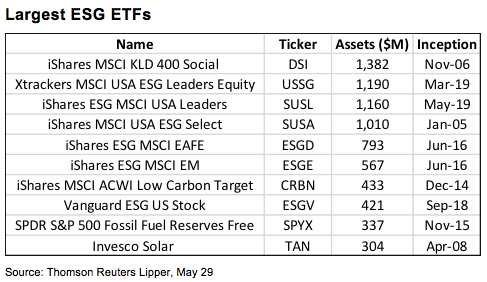

As of late May, $8.5 billion was invested in ESG ETFs, $2 billion more than at year-end. This was largely driven by the successful launches of Xtrackers MSCI USA ESG Leaders Equity (USSG) in March and iShares ESG MSCI Leaders (SUSL) in May. Aided by investments from a European insurance company, the two ETFs pulled in $2.3 billion within the first three months of trading. They joined iShares MSCI KLD 400 Social (DSI) and iShares MSCI USA ESG Select (SUSA) in the $1 billion assets under management club.

Unlike smart-beta ETFs that screen in securities based on fundamental and/or performance-based attributes, these $1 billion ESG ETFs focus more on excluding stocks that do not score well based on ESG criteria. Under the three ESG pillars (environment, social and governance), MSCI breaks down companies based on 10 themes. For environmental, these are climate change, environmental opportunities, natural resources and pollution waste. For social, these are human capital, product liability, social opportunities and stakeholder opposition. Last, for governance, these are corporate behavior and corporate governance.

However, some of the recent demand for these ETFs has been offset by outflows from others. For example, iShares MSCI ACWI Low Carbon Target (CRBN) and SPDR SSGA Gender Diversity (SHE) had approximately $430 million and $270 million in assets, down from $540 million and $360 million at the mid-point of 2018. These two ETFs focus on just one of the three ESG pillars—CRBN on environment and SHE on governance—rather than covering all three.

Historically, ESG ETFs had been priced at a premium fee to market-cap-weighted and smart-beta ETFs. However, asset managers have brought the same level of competition to this potentially up-and-coming investment approach as they have others. USSG charges a minuscule 0.10% expense ratio and all but one of the top-10-largest ESG ETFs has a 0.25% expense ratio or less. In addition, investors that prefer an ESG approach can build a global portfolio. iShares also offers popular developed and emerging-markets-focused ETFs through iShares ESG MSCI EAFE (ESGD) and iShares ESG MSCI EM (ESGE), while Vanguard and DWS offer competitors.

We think ESG investors will continue to gain comfort in using ETFs to gain exposure to these approaches in the coming years. To support further education, CFRA will be hosting a webinar at 11 a.m. on June 12 on Understanding ETFs strategies that align with sustainable and responsible investing. To register for the event, visit https://go.cfraresearch.com/ESG-Approaches-ETFs.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.