We don’t want to jump the gun, but we did want to get an early look into the workings of Dimensional Fund Advisors’ raft of exchange traded funds launched in mid-November. This flotilla comprised the first four of the company’s active transparent fixed income ETFs, so it’s a milestone event.

Three of the funds are unique exposures that differ in some ways from Dimensional’s mutual fund offerings, so it may be hard to predict their behavior. One ETF, however, seems ready to hoe the same row as an existing DFA portfolio. The Dimensional Inflation-Protected Securities ETF (DFIP) is benchmarked against the Bloomberg U.S. TIPS Index, the same index used to gauge the performance of the Dimensional Inflation-Protected Securities Portfolio (DIPSX), a mutual fund floated in 2006.

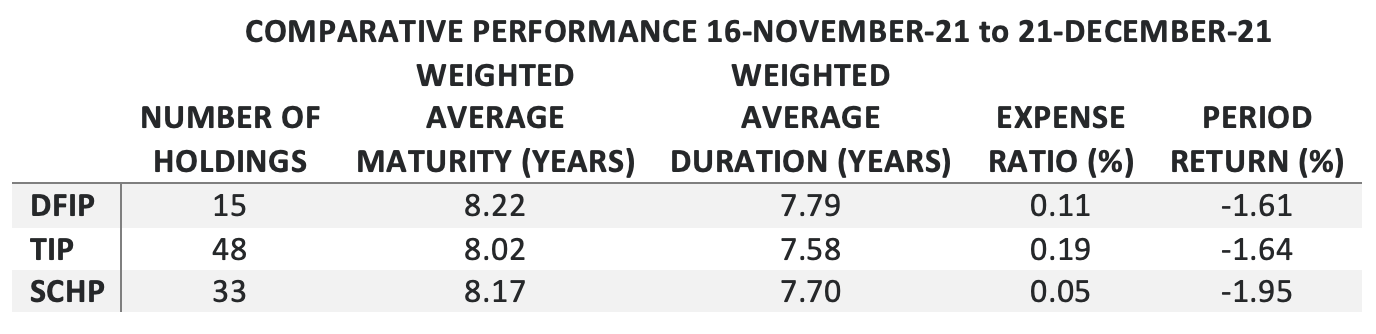

DFIP doesn’t appear to be a direct clone of DIPSX, but both share some DNA, namely a concentration of Treasury paper with maturities in the 5- to 10-year range. That sets DFIP apart from passive ETF competitors—the iShares TIPS Bond Fund (TIP) and the Schwab U.S. TIPS ETF (SCHP)—designed to track the performance of the Bloomberg index.

Dimensional’s ETF holds 15 different Treasury issues while its mutual fund analogue is populated with 19 TIPS. The iShares and Schwab ETF portfolios have a much broader range of security holdings and go deeper into maturities at the extremes of the yield curve.

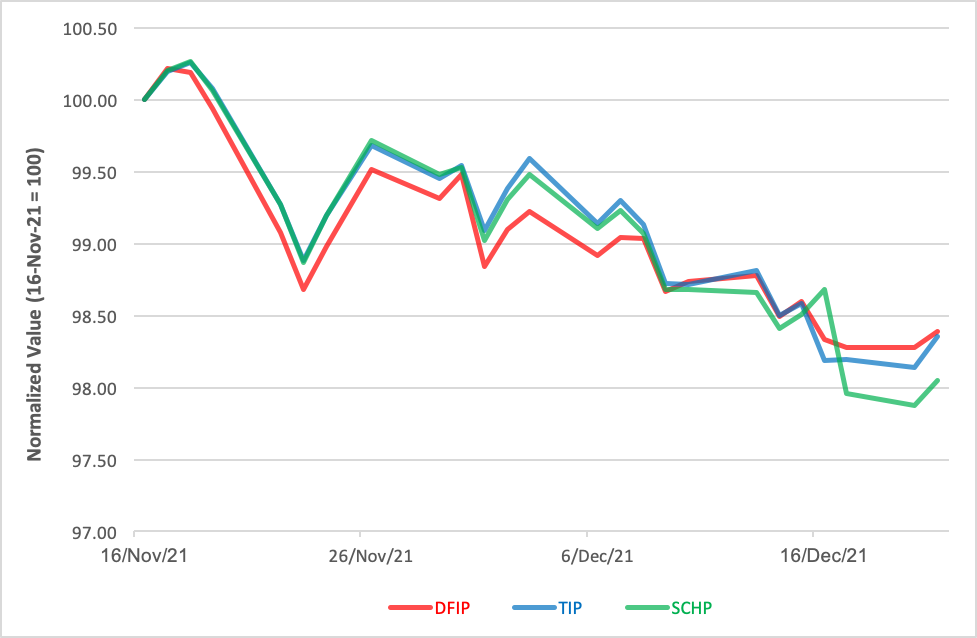

It’s early days yet, but Dimensional’s ETF has fared better than its passive competitors in the rising rate environment of the past month, albeit with a bit more price volatility.

Dimensional’s goal for DFIP is consistent with the objective for all of its products, according to Wes Crill, DFA’s vice president and head of investment strategists. “For over 40 years, our approach has focused on increasing expected returns and managing risk by taking the best attributes of indexing along with the flexibility of active investing,” he said.

What’s an expected return you ask? It’s the profit or loss that can be reasonably anticipated from an investment based on its historical rates of return. By definition, it’s predicated on the investment’s beta or relative volatility against the broader market.

To boost expected returns, DFA focuses on size and relative price in its equity funds while concentrating on duration and credit quality for the company’s fixed income portfolios. In a portfolio of Treasury securities—all backed by the full faith and credit of the United States—the remaining lever that heightens expected return is duration. By lopping off short-dated paper, Dimensional tilts its portfolios toward a longer average duration. That accounts for most of DFIP’s recent price volatility.

Crill talks of deviance from the market portfolio as “capturing premiums.” Compared to the benchmark, a Dimensional portfolio’s bound to exhibit a fair degree of tracking error to snag these factors. A fair degree, but not an excessive degree. “All else being equal,” he said, “the lower your tracking error, the higher the probability of outperformance versus the benchmark and the more reliable the outcomes.”

But, Crill cautions, not all contributions to tracking error contribute to expected outperformance. Dimensional’s moves are data-driven. “When we emphasize the premiums, that’s adding tracking error,” he said. “But it’s also increasing the expected return of the portfolio. We believe that’s a worthwhile tradeoff.”

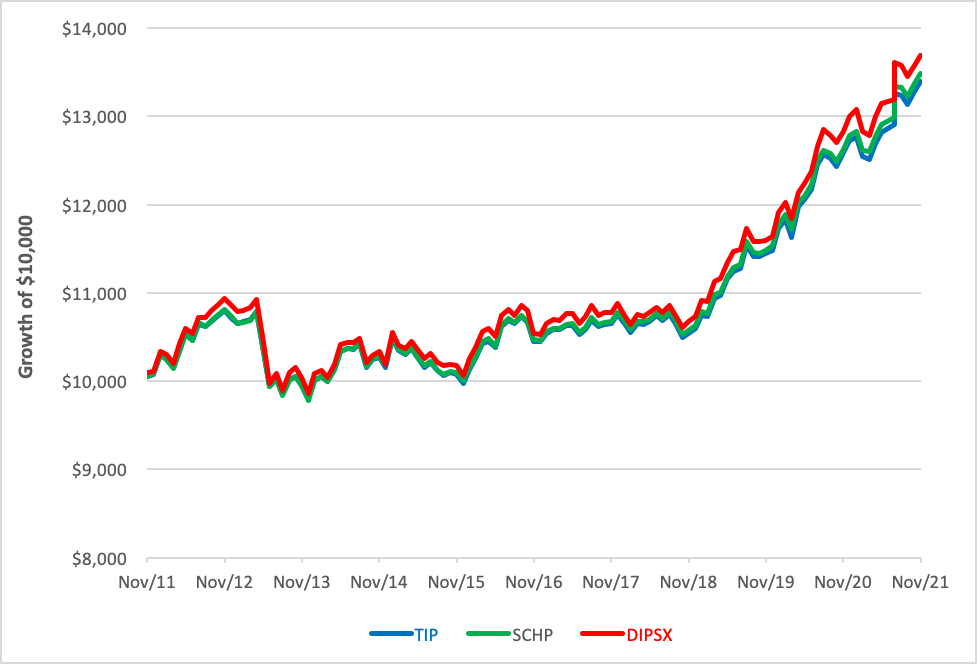

And now, with inflation rearing its ugly head over the investment landscape, investors and their advisors are shopping for ever-better tools to tame the beast. It’s fair to ask, then, if DFIP can continue to outperform its index-tracking competitors going forward. Prediction is always speculative, but we can take a page from the Dimensional playbook to look at the historic returns of DFIP’s sister fund DIPSX for clues about the potential for outperformance.

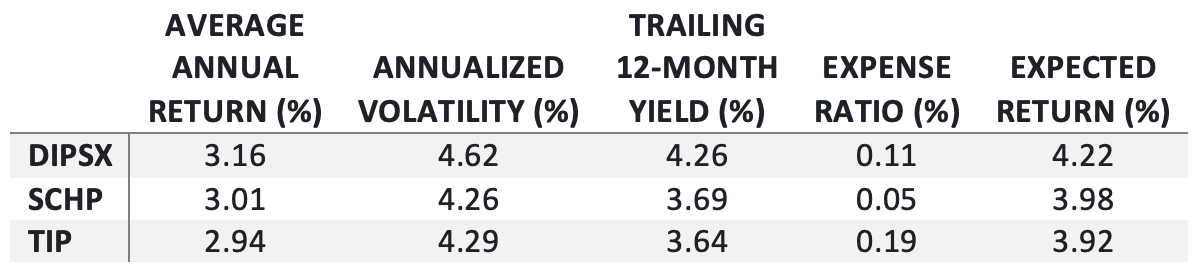

Over the past decade, DIPSX has outdone the TIP and SCHP index trackers’ compound average growth rates and trailing 12-month yields. More important, the Dimensional fund notched a significantly higher expected return than the passive products. Yes, DIPSX is modestly more volatile but judging from the fund’s information ratio, the active risk seems well justified by the portfolio’s consistency over time.

COMPARATIVE PERFORMANCE

(Based on Monthly Returns from November 2011 to November 2021)

There’s no guaranty, of course, that DFIP’s performance will match its sister’s, but Dimensional’s ability to capture premiums is fairly well established in this space.

“Risk management is a huge part of this process,” Crill said. “That’s the important aspect when you’re designing a portfolio. You want to balance these premiums against a number of risks, namely volatility and tracking error versus the market.”

Historically, the Dimensional approach has worked to keep its TIPS portfolio’s upside capture ratio in excess of its downside capture ratio. That’s created an edge that’s been sustained for years.

We’ll be keeping our eye on the relationship created by DFIP in the months to come to see if it keeps up with its sibling.

Brad Zigler is WealthManagement's alternative investments editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.