You could be forgiven for feeling confused about the market’s future direction. A lot of advisors are scratching their heads wondering if they should lean into equities in the hope of a V-shaped recovery or instead play a more defensive game with bonds.

Some advisors, though, have opted to pursue both objectives with a single investment. Convertible bonds have historically provided equity exposure with higher yields and less drawdown risk than most stocks.

There seems to be no shortage of convertibles nowadays. New issuance has spiked in the wake of the coronavirus crisis. And it’s no wonder. Since investors seem willing to accept a lower coupon rate for the right to obtain equity in the future, corporate borrowing can be done on the cheap by floating converts instead of conventional bonds.

Opportunities avail in the secondary market as well. The volatility triggered by the pandemic pushed convert valuations out of shape, creating openings for savvy investors to scoop up discounted paper in anticipation of a rebound as fears abate.

That equity-like upside, coupled with converts’ benign response to rate increases, makes them attractive, but there are caveats. Converts are much more volatile than most conventional bonds of similar tenure and carry more credit risk.

It’s commonly asserted by the purveyors of convertible bond funds that a portfolio can be diversified by a dollop of these hybrid securities, but these claims warrant more than a grain of salt. Converts, because of their strong correlation to equities and their inherent volatility may not dampen portfolio risk enough to justify their costs.

Three exchange traded funds focus exclusively, more or less, on converts. The “less” is the paterfamilias, the SPDR Bloomberg Barclays Convertible Securities ETF (NYSE Arca: CWB). Launched in 2009, the CWB portfolio devotes 75% of its real estate to convertible bonds with the majority of the balance given over to preferred shares. CWB tracks a market value–weighted index of U.S. dollar-denominated converts with an outstanding par amount of at least $250 million. CWB’s annual expense ratio is 40 basis points.

A little less, um, less is the First Trust SSI Strategic Convertible Securities ETF (Nasdaq: FCVT) which presently allocates 79% of its portfolio to convertible bonds. Launched in 2015, FCVT is the only actively managed fund in the field. FCVT’s portfolio runners nominally invest in convertible securities with an original issue par value of at least $200 million, but, outside of that stricture, the fund’s managers have great latitude, even allowing them to acquire non-dollar-denominated paper. You’ll pay 95 basis points a year for the privilege of holding FCVT shares.

The standout in the troika is the iShares Convertible Bond ETF (Cboe BZX: ICVT). True to its name, this portfolio—or more properly, its underlying index—is geared solely to convertible bonds. Bonds take up 94% of the space in the portfolio. There’s simply no room for preferred shares in ICVT’s methodology. The fund’s index aims for U.S. dollar-denominated issues with outstanding par values of $250 million or more. ICVT’s expense ratio, at 20 basis points, is the most modestly priced convertible bond product. This iShares fund also debuted in 2015.

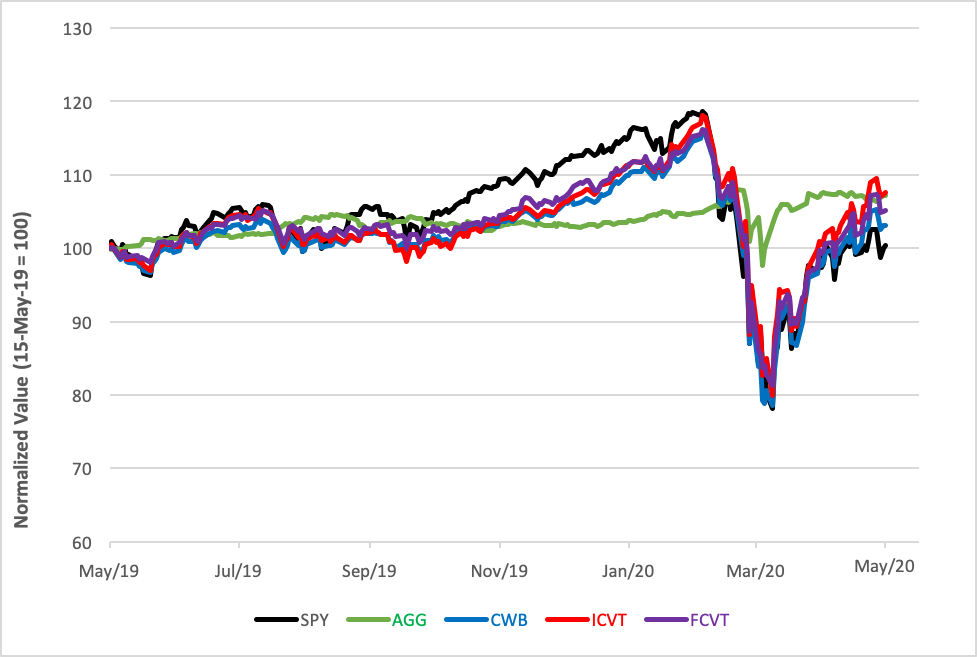

Over the past year, convertible securities ETFs have fared better than the broad equity market represented by the SPDR S&P 500 ETF (NYSE Arca: SPY) but clearly with volatilities exceeding the wide swath of fixed income securities proxied by the iShares Core U.S. Aggregate Bond Index ETF (NYSE Arca: AGG).

The upshot? Convertible securities ETFs earned some alpha over the past year. The ICVT index tracker racked up the best coefficient and the actively managed First Trust came in second.

Daily Performance of Convertible Securities ETFs

(May 2019-May 2020)

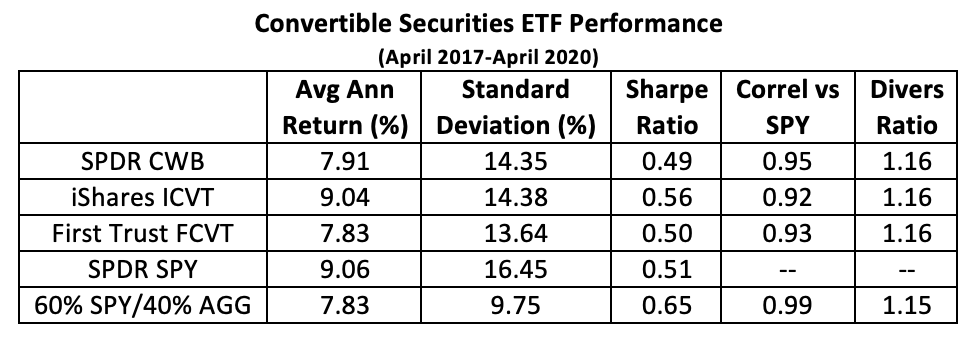

Over a longer stretch, though, converts funds’ performance record is mixed. The iShares portfolio betters SPY’s Sharpe ratio, while the other two products lag. ICVT’s average annual return approximates SPY’s but achieves it with less volatility than the blue-chip benchmark tracker.

Most telling, though, is the degree of diversification the convertible funds add to a portfolio. Put succinctly, it ain’t much. From the table, you can see the 1.15 diversification ratio of a balanced portfolio (60% SPY and 40% AGG). The ratio is the quotient of the weighted sum of the portfolio’s component standard deviations divided by the volatility of the aggregate portfolio. A ratio exceeding 1 indicates a diversification benefit derived from the combination.

If a 10% allocation to convertibles is carved out of the balanced portfolio’s equity side, the resultant diversification ratio, no matter which ETF is employed, comes in at 1.16, just a tick better than the 60/40 mix. That’s not been a good payback, most especially for the actively managed fund. FCVT’s hefty expense ratio doubles the portfolio cost. The balanced portfolio can be carried for 7.4 basis points annually. The price for the FCVT-enhanced portfolio is 16 basis points. Using the iShares fund, the case for augmentation is more compelling. Adding ICVT to the mix brings the annual carrying cost up just 1.1 basis points, pretty much a wash on a cost-to-benefit basis.

Of course, one can’t ignore the coupon income that can be obtained with converts. With an average maturity just short of four years and a weighted average coupon of 165 basis points, the ICVT fund, for example, offers a relatively high yield for a fixed income instrument in the current environment. For comparison, Treasurys of similar maturity are throwing off cash at a 25-basis-point clip now.

Bottom line? When listening to the blandishments of convertible securities fund hawkers, it pays to check under the hood and kick some tires to see exactly what you’re getting before driving capital into an allocation to this asset class.

Brad Zigler is WealthManagement's alternative investments editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.