(Bloomberg) -- The race for the first leveraged Bitcoin exchange-traded fund is heating up as applications land amid a surge in cryptocurrency prices.

Direxion on Monday filed for the Direxion Daily Bitcoin Strategy Bull 2X Shares ETF, which would look to double the performance of the S&P CME Bitcoin Futures Index each day. That follows a ProShares application on Friday for the ProShares UltraBitcoin Strategy ETF, which would seek similar types of returns as Direxion’s proposed fund.

And they both come on the heels of Volatility Shares’s petition in late March to launch a product that would every day deliver two times the performance of a Bitcoin futures index.

“That initial filing opened the floodgates again,” said Todd Sohn, ETF strategist at Strategas. “It’s such a potentially lucrative category that the first scent of a filing — and maybe approval (big IF) — that everyone wants in on it.”

Cryptocurrencies have staged a comeback from last year’s doldrums, with Bitcoin almost doubling to break above $30,000 this week from around $16,600 at the start of 2023. Plenty of reasons have been proposed for its eye-catching surge, including prospects for interest rates coming down soon that would pave the way for riskier assets to rally. Digital-asset fans have also said that recent turmoil in the banking sector may have pushed some investors toward crypto, seeing it as independent of the traditional-finance system. Still, the largest token is down more than 50% from its near-$69,000 high reached in 2021.

“This is market environment-dependent, meaning, what’s the best time to bring to market leverage plays on an asset? It’s when that asset is up and rising,” said ETF Think Tank’s Cinthia Murphy. “We see that in the thematic space a lot — themes that follow a timely trend. Bitcoin is having a strong 2023, up sharply, after a long time out of favor, so it makes sense that providers looking to offer levered access would consider doing so now.”

To be sure, regulators have been super-focused on the crypto industry, doling out aggressive actions in recent months, including a number of lawsuits. Some analysts say the chances are slim for a levered Bitcoin futures ETF to receive approval in such an environment.

“I just don’t see it happening,” said Athanasios Psarofagis at Bloomberg Intelligence. “They rejected them in the past.”

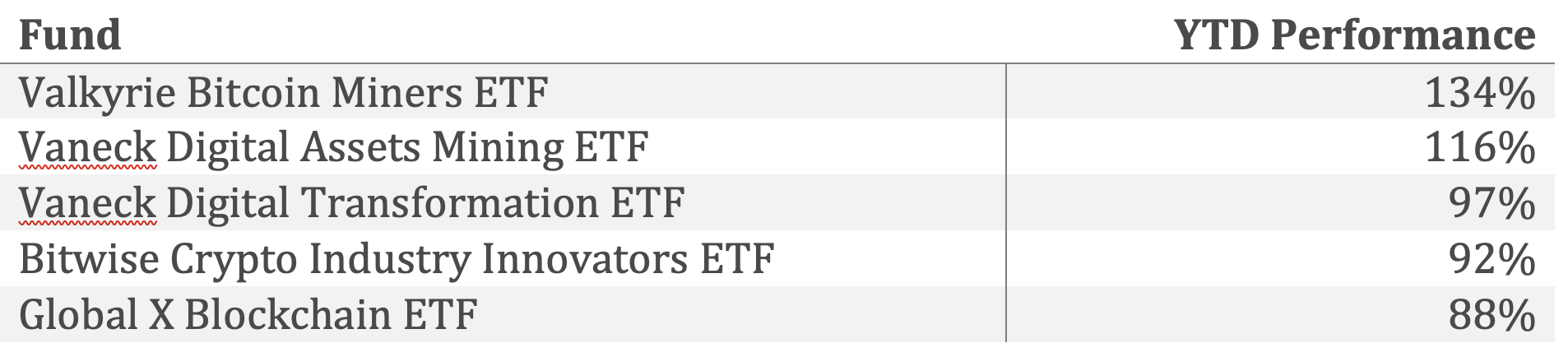

Yet the uptick in prices has placed crypto-focused ETFs atop the performance leaderboard year to date, with the five best-performing funds all centered around digital assets. The Valkyrie Bitcoin Miners ETF (WGMI) is up more than 130% so far in 2023, while the VanEck Digital Assets Mining ETF (DAM) has advanced 120%.

Still, there’s been little follow-through of investors putting money into these types of funds. WGMI has seen just a handful of days of inflows so far this year, which total just about $3.7 million. DAM has taken in less than $1 million of new money in 2023.

“The major decline in 2022, plus the black eyes from a handful of ‘key figures’ being taken out seems to have left demand on the sidelines,” Sohn said. “My guess is there’s still some retail who are really keen on the asset class. But if you are a major allocator, I’m not sure how many clients are going to love seeing these products within their allocations. Just based on the noise and negative headlines out there, right?”

--With assistance from Isabelle Lee.