So what’s going on with interest rates? Well, that depends on what interest rates you care about. Since the top of the year, short rates have snugged up a bit, but at the long end of the yield curve, rates have dropped precipitously. When you were nursing your New Year’s hangover, the Treasury long bond yielded 2.33 percent. You’ll get 30 basis points less now.

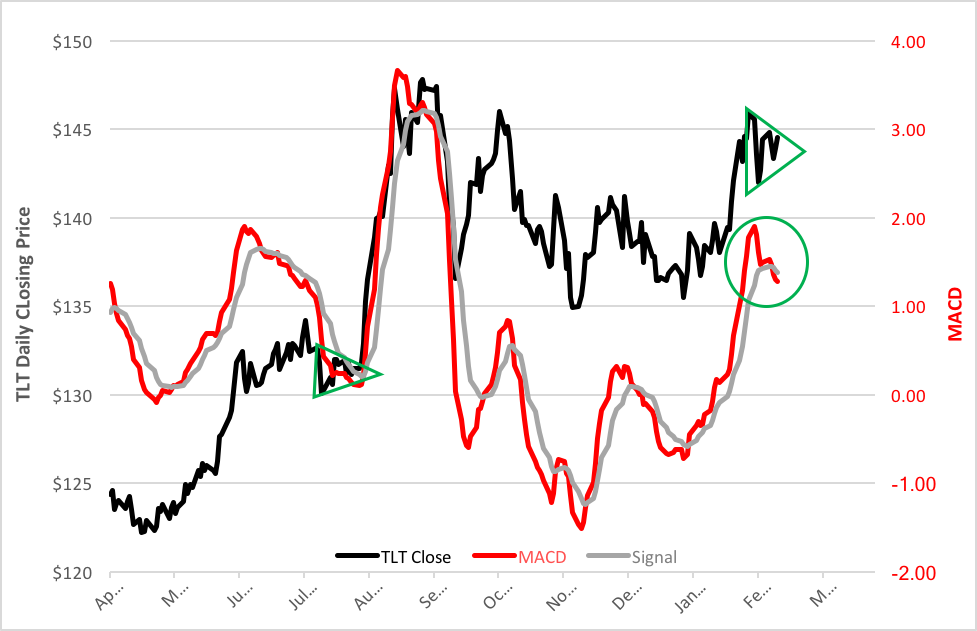

We might see a respite in the yield slide soon. Why? Take a look at the chart below. The black line tracks the daily closing price of the iShares 20+ Year Treasury Bond ETF (Nasdaq: TLT), a bellwether for the left side of the yield curve. The red and gray lines depict the Moving Average Convergence Divergence (MACD) Indicators. MACD (the red line) is a momentum gauge that distills the relationship of two moving averages of TLT’s price. It’s calculated by subtracting the ETF’s 26-day exponential moving average (EMA) from its 12-day EMA. A nine-day EMA of the MACD—the signal line, portrayed in gray—is plotted on top of the convergence-divergence indicator and functions as a prompt for buy/sell decisions. Buys are signaled when MACD crosses above the signal line while sells are triggered when MACD sinks below the signal line.

TLT Daily Chart

Recently, TLT has been trading in the congestion area marked by the green triangle in the chart’s upper left quadrant. This pattern usually presages dramatic breakouts. Evidence of the pattern’s predictive power can be seen in another green-triangle-scribed congestion area last summer which set up a $12 spike in TLT’s price. That translated to a 45-basis-point decline in long bond rates.

Now, however, a crossover of the MACD line suggests that the current consolidation phase most likely ends with TLT’s price breaking to the down side. Falling bond prices translate to buoyancy in yields and, in this case, steepening in the term structure.

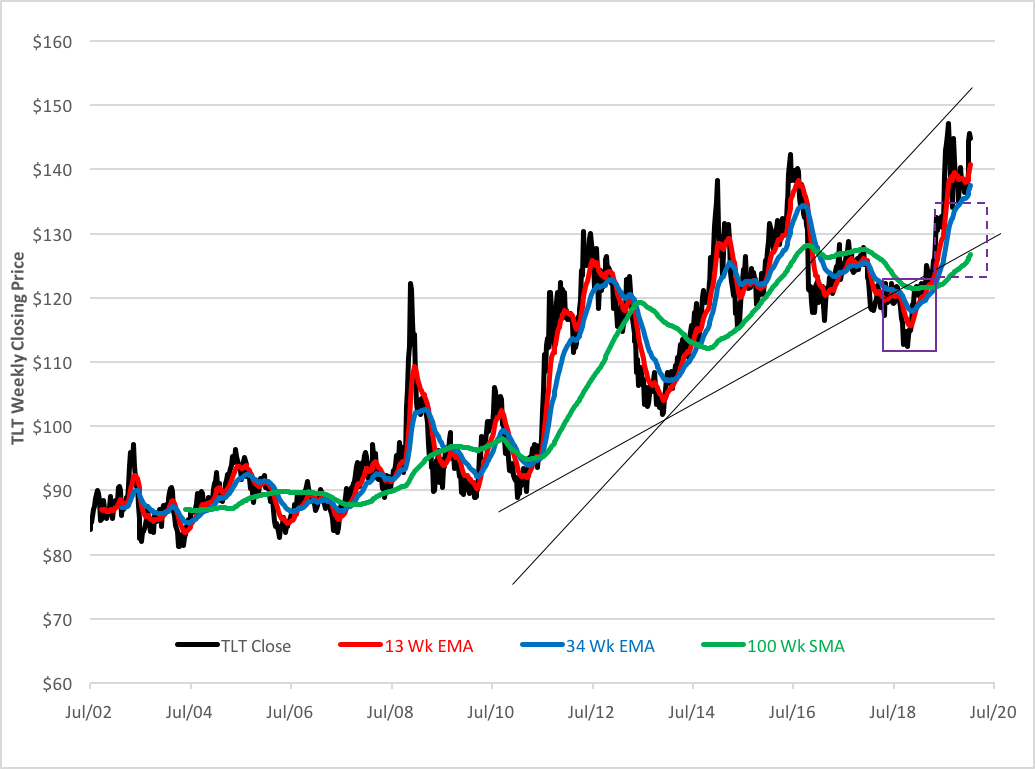

So, is this a seminal turning point in the bond market? Probably not. Given the technicals of the longer-term trend (see the weekly TLT chart below), it’s apt to be a buying opportunity within the existing uptrend.

TLT Weekly Chart

Accordingly, aggressive traders should be expected to place buy stops $4 under the current market.

Brad Zigler is WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.