Index-based ETFs continue to dominate the industry’s asset base, but actively managed ETFs have been gaining ground in recent years as some investors who have confidence in the stock or bond selections by an active management team want to access them in an ETF wrapper. We at CFRA think relatively new equity products from the top three providers could further drive investor interest in the transparent ETF approach to active management.

Actively managed ETFs comprise 2% of the $3.9 trillion in overall ETF assets, but last year these ETFs pulled in $28 billion of net inflows, quadruple what they gathered two years earlier. Indeed, while 2018 overall net inflows of $283 billion were nearly identical to the demand in 2016, the market share for active funds rose to approximately 10%. Demand was partially driven by active short-term bond products such as the $6.7 billion JPMorgan Ultra-Short Income (JPST) fund and the $12 billion PIMCO Enhanced Short Active (MINT) fund that were popular for their income and safety combination amid fears of rising interest rates.

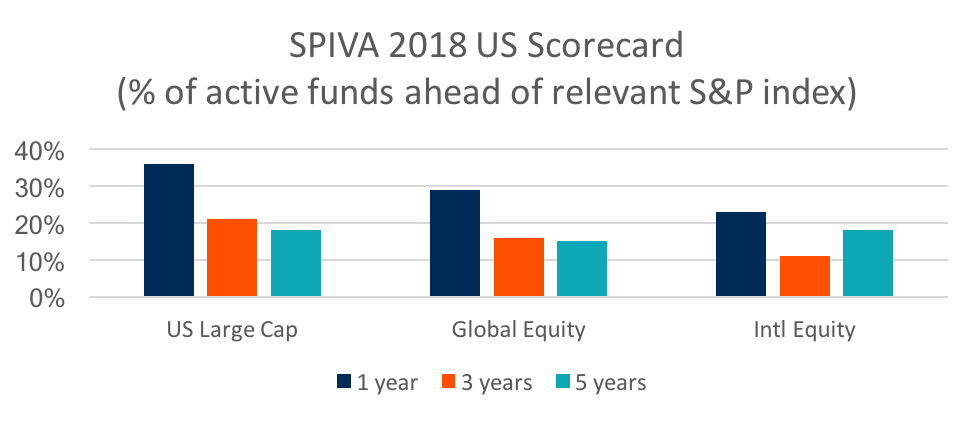

Actively managed equity mutual fund strategies have been pressured in recent years as more investors understood the challenges of consistently beating a low-cost index like the S&P 500 and sought out cheaper alternatives. Indeed, 21% of U.S. large-cap mutual funds outperformed the 500 in the three years that ended 2018, while just 16% of global equity mutual funds beat the S&P Global 1200 Index. However, active equity ETFs assets climbed 32% in the one-year period ended March 2019 to $12.8 billion.

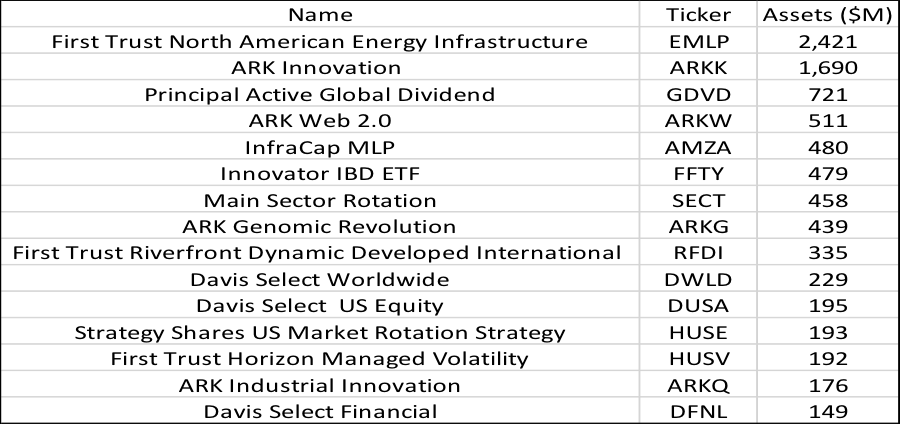

The largest actively managed equity ETF, First Trust North American Energy Infrastructure (EMLP), has $2.4 billion in assets. EMLP recently held a combination of energy and utility stocks, such as Enterprise Products Partners and Exelon, in contrast to some other solely MLP-focused ETFs. EMLP launched in 2012, charges a 0.95% expense ratio and has pulled in approximately $140 million in net inflows since the beginning of 2018.

First Trust also offers two other active equity ETFs among the 15 largest in the industry. First Trust Riverfront Dynamic Developed International (RFDI) and First Trust Horizon Managed Volatility (HUSV) both launched in 2016.

ARK Innovation (ARKK), the second largest actively managed equity ETF with $1.7 billion of net inflows, has swelled in size since the beginning of 2018 with $1.1 billion of net inflows. This concentrated ETF combines three themes—industrial innovation, genomics and technology trends such as cloud computing and mobile—across approximately 40 securities. Some of them, including Tesla and Twitter, are CFRA sell recommendations, which, along with a 0.75% expense ratio, negatively impacts our rating of the ETF. Though ARKK is up an impressive 39% on a three-year annualized total return basis as of May 4, an ETF’s historic track record is not incorporated in our research as we think a more forward-looking approach is a more appropriate way to select investments.

ARK Investment Management also offers three more of the industry’s 15 largest actively managed equity ETFs. ARK Web 2.0 (ARKW), ARK Genomic Revolution (ARKG 34 NR) and ARK Industrial Innovation (ARKQ) provide more targeted exposure to the above themes.

First Trust has a long ETF presence, but ARK burst onto the fund scene the past few years with ETF growth strategies. In contast, Davis Funds has a long mutual fund history with Davis New York Venture (NYVTX) launching 50 years ago. Yet, Davis rolled out the first three of its active equity ETFs, all among the current top-15-largest such funds, in early 2017.

Largest Actively Managed Equity ETFs

Davis Select Worldwide (DWLD) is the largest with approximately $230 million in assets. DWLD holds 32 stocks, including CFRA Buy–recommended Amazon.com and Alibaba. Beyond the U.S. and China, holdings from Switzerland and South Africa can be found inside. DWLD holds a largely similar set of stocks as the nearly 12-year-old mutual fund Davis Global Fund (DGFYX).

In early 2018, Vanguard launched a suite of actively managed single and multifactor-based strategies. We have high hopes for them. The most popular of these is the $85 million Vanguard US Multifactor (VFMF). Meanwhile, so far in 2019, BlackRock/iShares and SSGA, the number one and three ETF providers, respectively, have rolled out new actively managed equity ETFs. BlackRock US Equity Factor Rotation (DYNF) and SPDR SSGA US Sector Rotation (XLSR) are actively managed extensions of each firm’s popular single factor and sector ETF offerings. CFRA thinks the scale of these firms and their ability to market new funds could further drive investor interest in the industry’s broader active equity lineup.

CFRA is hosting a webinar on May 14 at 11 a.m. ET titled Understanding Actively Managed ETFs, with Dodd Kittsley, national director of Davis Advisors. To register in advance, please visit https://go.cfraresearch.com/Actively-Managed-ETFs.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.