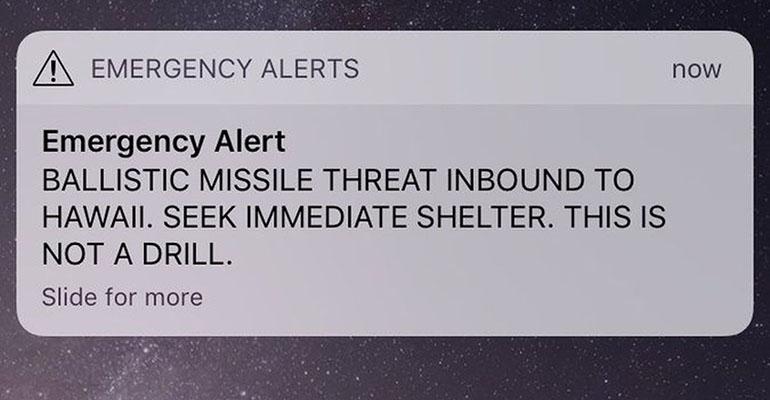

I just so happened to be in paradise (on the island of O’ahu in Hawaii) with my wife and son when the erroneous ballistic missile alert was issued back in January. We were on vacation. What luck!

I was utterly stunned when I read the 14-word ALL-CAPS message on my phone. It was a Saturday morning. My family had just finished breakfast. Everyone around me seemed strangely calm—perhaps stunned just like I was. Though I was extremely relieved to learn that the alert was just a horrible administrative mistake and nothing more, the financial professional in me could not escape the reckoning that my carefully crafted estate plan would have fallen short of its intended results.

Darrell Young and his family on vacation in Hawaii.

My Financial After-Thoughts

I realized that my financial/estate plan is incomplete and is not adequately shared with the people who may need to know how to put it into action.

Prior to these events, I was proud of the fact that I had put in place a financial/estate plan to protect my wife and son in the event of my untimely demise. Indeed, my wife knows where to find my documents. My insurance coverage is written with top-tier providers. My securities investments are performing very well—beating their benchmarks, anyway. I am current with my income taxes; I have no debts. Yet in this rare situation, my efforts felt void.

We often assume we will die alone and our loved ones will live on for many years. The ballistic missile threat completely nullified all of my carefully crafted arrangements.

1. Primarily, my plans are designed to protect my wife and son, but in this rare moment they both would have perished with me. What was to become of my:

- RIA practice and clients who had become dear friends?

- Real estate?

- Life insurance to cover my wife’s living expenses?

- College savings for my son?

- Social Security benefits?

- Most treasured effects such as the diamond ring on my wife’s finger?

2. Secondly, my plans are designed to protect my younger sister, but she just so happened to be here in Hawaii at the same time as me.

3. Although I have a fair idea of where I would like my assets to be distributed next, I have not formally designated tertiary beneficiaries.

4. I try to maintain a paperless existence; however, those I care about will not be able to easily access my files.

As a wealth manager, I try to lead my clients by example. The missile scare forced me to realize that the plans that I had carefully arranged would not have been sufficient. I have plenty of work to do. It’s likely that you and your clients do too.

Darrell Young is the Principal and Investment Adviser Representative at Poplar Global Wealth Management LLC.