The United States Tax Court’s long-awaited opinion on the matter of the Estate of Michael J. Jackson, Deceased, John G. Branca, Co-Executor and John McClain, Co-Executor v. Commissioner of Internal Revenue was finally released on May 3, 2021. The 271-page opinion was widely anticipated in the estate planning world for a variety of factors, including Jackson’s high profile, the amount of money at stake, the significant length of time between Jackson’s death and the opinion, and the significant differences of opinion between parties regarding the value of certain assets at issue.

Jackson, one of the preeminent stars in the history of pop music, passed away on June 25, 2009. Beginning in 1993, he endured a wave of negative publicity stemming primarily from allegations associated with the sexual abuse of various children. Jackson was never found guilty of these allegations, and though they significantly affected his ability to earn sponsorship and merchandising income, his music continued to sell relatively well. That said, despite some sustained fiscal success with his music, Jackson’s finances suffered as a result of the impact these accusations had on his public image, and he took on significant debt.

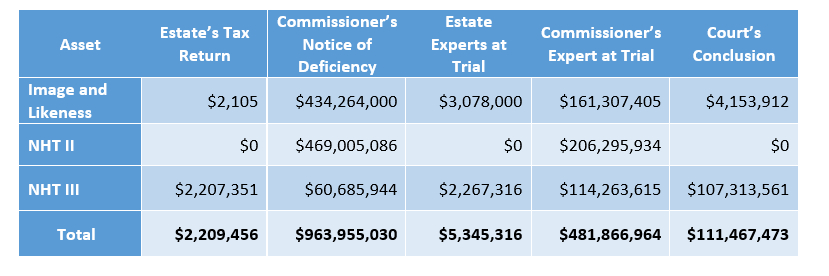

After his death, Jackson's Estate completed and submitted a U.S. tax return listing the value of Jackson’s various assets. After an audit of the Estate’s tax return, in May 2013 the Commissioner issued a notice of deficiency that adjusted the Estate’s reported values relating to a group of specific assets. The result of these adjustments led the Commissioner to conclude that the Estate has underpaid Jackson’s estate tax by approximately $500 million and that, as a result, the Estate had accrued penalties of nearly $200 million.

The Estate and the Commissioner ultimately settled most of the valuation disputes, apart from three assets which remained in contention:

- Jackson’s right of publicity (“Image and Likeness”);

- New Horizon Trust II (“NHT II”), which held Jackson’s 50% ownership interest in Sony/ATV, one of the largest music publishers in the world and which, among other things, owned a large catalog of copyrights, including those related to at least 175 songs by The Beatles; and

- New Horizon Trust III (“NHT III”), which held Jackson’s ownership interest in Mijac Music, a music-publishing catalog that owned copyrights to compositions that Jackson wrote or cowrote, as well as compositions by other songwriters.

The following table provides a summary of the various valuations proffered by the parties to the Dispute, along with the Court’s ultimate conclusions:

Ultimately, the Court concluded that the fair market value of the three assets at issue–all of which related to intellectual property–totaled $111,467,473. This conclusion will likely be construed as a win for the Estate of Michael Jackson, as this figure is a sharp decrease from the $481,866,954 valuation initially put forward by the IRS. However, the IRS didn't get completely beaten here (although this isn't a pretty result for them by any means).

As indicated in the table above, there were significant disagreements between parties regarding each of the three valuations. The Court’s value conclusions tended to align more with: 1) the Estate as it related to the valuations of Jackson’s image and likeness and NHT II; and 2) the Commissioner as it related to the valuation of NHT III.

Takeaways for Valuations Experts

The Court’s opinion related to the value of certain assets, primarily related to intellectual property, in the context of the Dispute provides many important reminders for valuations experts and may act as a guide to help experts perform valuations for trust and estate purposes in the future. More specifically, we believe that valuation experts can take away the following guidelines:

- The decision to rely upon historical financial data versus management projections when forecasting future cash flows should be determined on a case-by-case basis, determined by the facts and circumstances of each valuation. Particularly, in situations where the dynamics of an industry are changing, management forecasts may be more reliably than historical results.

- The Estate’s experts valued NHT II and NHT III on a C corporation basis. No adjustments were made to account for the different tax attributes associated with pass-through entity status. The Court found the assertion that the most likely buyer would be a C corporation to be unpersuasive, citing this point as the reason it rejected tax affecting. While the Court acknowledged the conceptual mismatch between applying a C corporation derived rate of return to pre-tax cash flows, by rejecting tax affecting, it accepted this flaw in its decision. Prior tax court decisions have also consistently rejected the concept of valuing pass-through entities like C corporations where no adjustment was made to account for the tax differences between these types of entities. By stating that the tax affecting issue is a fact-based exercise, the Court has apparently left some leeway for future decisions on this issue. Our view is that an analysis of the tax differentials between C corporations and pass-through entities would have provided the Estate’s experts more solid footing.

- The reliance on information that is known or knowable as of the valuation date continues to be a standard that valuation analysts must keep at the front of their minds as they make decisions regarding their chosen sources of information and the selection of inputs and assumptions presented in their valuations.

- The credibility of the valuation experts generally—along with their specific selection of assumptions and information sources, the accuracy of their calculations, and their verbal statements relating to those calculations—were influential in the context of the Court’s opinion. A lack of credibility by one expert can cause the Court to move away from reliance on that expert’s opinion toward the other’s party’s opinion.