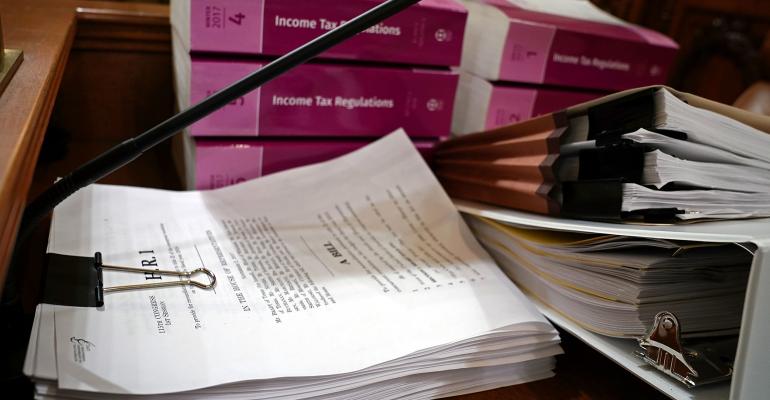

On Nov. 16, 2017, the House passed the Tax Cut and Jobs Act (the Act). As of this writing, it appears that professional fiduciaries will be thankful for some parts of this massive tax reform, but perhaps not thankful for other parts. The Senate passed its own version of the bill on Dec. 2, but reconciliation, passage and signing into law aren’t assured. Nevertheless, the Republicans and the President were determined to have tax reform become law before the New Year. Here’s what

All access premium subscription

Please Log in if you are currently a Trusts & Estates subscriber.

If you are interested in becoming a subscriber with unlimited article access, please select Subscription Options below.

Questions about your account or how to access content?

Contact: [email protected]